简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Not Gold But This Metal Will Save Trader During Covid-19

Abstract:Prior to the analysis, the fact that the author is a Trend Trader should be taken into account. This trend trading method is of the longest-term trading strategies which related to identifying and trading in the overall direction of market, usually until reversal occurs.

Symbol: Silver XAG/USD

Price: 17.700

Prior to the analysis, the fact that the author is a Trend Trader should be taken into account. This trend trading method is of the longest-term trading strategies which related to identifying and trading in the overall direction of market, usually until reversal occurs. Trailing stops will often be used to protect the account profits. The analysis firstly based on fundamental analysis, then specified trading positions based on technical analysis and use statistical probability to calculate the probability of price increases and risks.

We shall start with a number of reviews of the market history and the important milestones of the metal silver to see why we all should care for this.

In 1973, Hunt brothers – sons of the oil billionaire Haroldson Lafayette Hunt Jr began to acquire silver market.

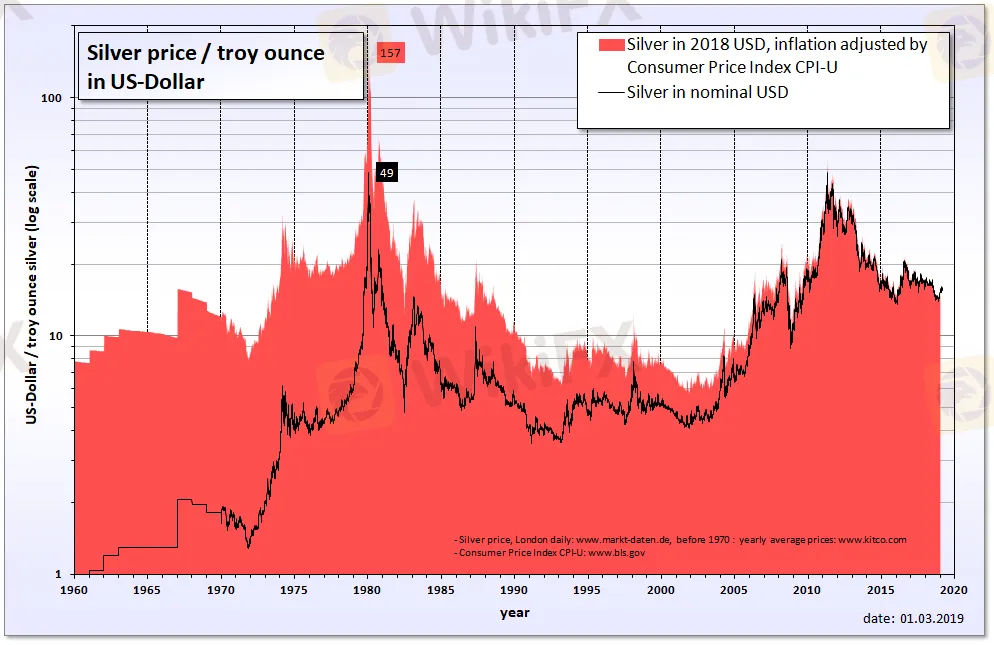

On January 18th, 1980 Silver price reached the highest level ever, nearly $50/oz, which is also the period when the Soviet Union invaded Afghanistan. Silver prices fell about $15 later that year.

In February, 1985 the Hunt brothers were charged “with manipulating and attempting to manipulate the prices of silver futures contracts and silver bullion during 1979 and 1980” by the United States Commodity Futures Trading Commission (CFTC) (the US government raised deposit rates and trading restrictions) and fined $ 134 million in compensation for a Peruvian mineral company. The Hunt brothers then declared bankruptcy. And there is also a legendary investor who has also entered this market however people only know him mostly through the stock market – no one rather than Warren Buffett.

Warren Buffett also invested in Silver during 1997 - 1998, he bought 130 million oz. silver, which is equivalent to 4,043 tons. It generated a pre-tax profit of more than $ 97 million for their Berkshire Hathaway Group, Buffett revealed in a letter to shareholders in 1997. Berkshire CEO described the purchase of more than 4,000 tons of silver as “back in the past” because he had also invested in the metal in the 1960s. In 1997, Buffett once again bet on silver when he predicted the shrinking reserves and the process of “issuing more money” that the central banks was proceeding will push this metals price up.

Subsequently in the 2008 the historic event of financial crisis with the Fed's QE bailout packages pushed silver to $49.5/oz, the highest level since 1980. And then silver had a long slide in the price until today.

Silver has had a 3,300-day decline chain until the time the author wrote this analysis. And silver's chances are being strengthened as the primary metal – gold has achieved an 80% recovery from its peak in 2011 ,while silver is still down 65% from its own.

Chance for silver in 2020-2021?

I. Fundamental analysis:

1. USD-index

USD index is weak right now with FED's very strong USD issuance rate to the market and the 2,000 billion bailout package will make the market flooded with money. Not only Fed, currently ECB (European Central Bank) has also pumped relief packages across Europe with the amount up to 600 billion Euros. At the same time, figures from the IMF show that more than 60 countries and territories have lowered interest rates and pumped more money to support the economy. There are a number of countries that have had to lower their rates 3 times continuously to support the economy since January 1, 2020.

A typical example of pumping money out, central banks often have to reserve and buy gold or precious metals to balance part of the balance sheet to avoid inflation and liquidity risks. Gold is currently being preferred, so the price of gold increases very fast and the trend is firmed. Silver is the second priority so the price hasn't changed too much.

One thing to notice is that the price of metal depends greatly on USD exchange rate. If USD appreciates, gold prices will decrease and vice versa. So in March, 2020 when the USD-index peaked at 103.6, the silver price was pushed down to $11.10. If Fed's fiscal easing programs continue to work, the price of USD is likely to continue falling to the lower zone and this will be a breakout opportunity for silver price.

When gold price rises high enough and then when individuals - investment funds - hedge funds - financial institutions choose to buy silver instead of the primary gold because the profit rate of silver will be higher and the low risk ratio since the price area has not increased, the shock decline rate will be less risky than gold.

2. Silver mining output

GFMS (World Silver Survey Agency)

· 3 largest silver mining countries in the world are: Mexico, Peru and China

· In the period from 2013 to 2019, gold price remained at the bottom with the price not increasing too much, reducing the motivation for expanding silver mining, the silver industry has not been nearly developed in the past 5 years since 2014, the silver supply has not changed too much. So any “big boy” in the financial market will focus on speculation in silver will make price rise very quickly and sharply.

“Global demand for silver has increased by 4% in the past year, the first increase since 2015, due to a sharp increase in consumption in India and a drop in supply, causing a shortage.” Johann Wiebe, Refinitiv expert, said that in 2019, the world consumed 1,033.5 million ounces of silver, up from 998.4 million ounces in 2017. The reason is that the increase in gold price makes Indian consumers produce the tendency of using silver to replace. Silver consumption in India last year increased 16% to 76.5 million ounces, along with consumption in the US has increased demand for silver jewelry worldwide by 4% last year to 212.5 million ounces.

II. Technical analysis

1. Time frame

· Monthly: Currently, the price is in a quite safe area when it is above MA200 and M50. Right here we see two MA50 and 200 lines intersecting each other. It shows that the stability of this price range is quite high and also the average price that the market accepts without too much risk when the MA50 has reduced its slope and moved sideways. This is obviously a quite important signal of a long bull market if the price established a solid foundation at this important support zone.

· Weekly: In this time frame, two moving averages have formed the Golden Cross pattern when the MA50 crossed above the MA200 after a fairly long period below the MA200. The Golden Cross model is a very important model in the financial market as the 50-week short-term average of prices surpasses the previous 200-week average price signaling a very long uptrend.

The weekly Golden Cross model of gold has increased by 45% after the MA50 surpassed the MA200 and has not shown any signs of reversing.

· Daily: We temporarily ignore the black swan event caused by Covid 19 epidemic has made XAG price plunge to the $11.8 region

The previous XAG had important resistance zone at 18.50 - 19.00. The support area is quite good, but the latest XAG has just been tested at 17.00, here are two price points to notice during the trading process.

MA: XAG is in the process of Strong Bullish, completely surpassing important EMA and SMA.

The common indicators and price alarms like RSI STOCH or MACD both show Buying signals for XAG. It is quite clear now that XAG time frames are heading for a long-term uptrend and even the Daily zone has given Buy points through MA lines and technical indicators.

III. Summary

Fundamental analysis shows an opportunity for the price of XAG and the trend of XAG price is also in an increasing process with the important setups from price model to indicators. However, if this is the start of a price rising process, it will take a long time for the price to completely exit a bear market that has existed for many years. You will need to wait patiently and once the market goes up it will always rise without any doubts. This entire analyzing process helps to hold the Long position, which the author mentioned at the beginning of the article regarding Trend Trading method.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Let’s Talk About Derivatives: Advantages of Trading Futures Over Options

What are Derivative Contracts in Simple Terms?

Taking Your Trading to the Next Level with MetaTrader 5 (MT5)

Dollars Markets boasts having the two platforms of MetaTrader 4 (MT4) and MetaTrader 5 (MT5); however, there is much confusion between the two platforms. Is the new platform really all that new? How is it in any way better than the tried, tested, and trusted ‘Old Reliable’ MT4? All these questions will be answered, and perhaps you will find the right platform for you.

Copy Trading: How It Works?

Successful trading is a challenging route that needs a trader to develop specific abilities, do comprehensive market analysis, and keep up with financial news.

Characteristics Beneficial to Obtaining Long-term Profits!

Instead of challenging competence, forex trading is a test of personalities.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator