简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

5 Things All Traders and Investors Need to “Own” in 2020

Abstract:It’s gonna be the year that you will be proud of yourself as a trader and investor. It’s gonna be the year you look back and say “I survived”. Or it’s gonna be the year that will break you and you’ll eventually give up on trading and investing.

1. The year 2020

It‘s gonna be the year that you will be proud of yourself as a trader and investor. It’s gonna be the year you look back and say “I survived”. Or it‘s gonna be the year that will break you and you’ll eventually give up on trading and investing.

Whichever version its gonna be, 2020 is definitely gonna be the year you remember.

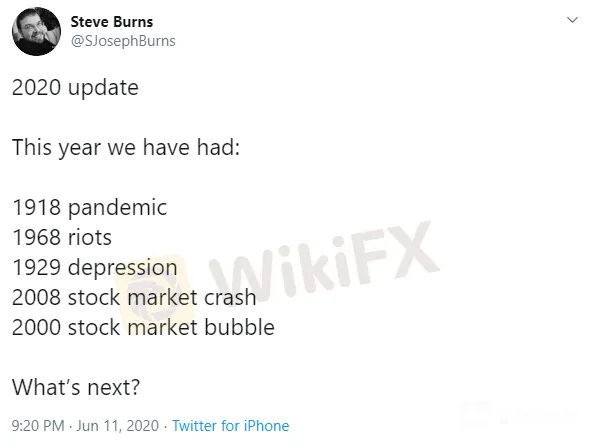

Steve Burns (@SJosephBurns) put it best -

Within the first half of 2020, so many things have happened.

I‘ve seen traders make amazing profits and return so far this year from the financial market. And I’ve also seen traders blow it all off within just two months trying to trade and invest in the market.

Let‘s face it, 2020 is definitely a unique year, let’s acknowledge it, and if you havent done so, OWN it too.

2020 is gonna be in your book of life (well, unless for some reason, you decided to cut it short, which I certainly hope not) so make the best use of it. Pick up the lessons taught, work on the areas that will strengthen you, grow out of this 2020, and be a stronger version of yourself.

This brings us to the next point -

2.Patience

I get it. All of us want things fast. Who wouldnt?

Especially in todays context, we are wired to seek out instant gratification.

We want to be able to trade and invest fast. We want to be able to profit from the market fast. We want to achieve our financial independence fast. And 2020 might be pulling you back.

But how many times have rushing helped and benefited you? Not many, if not none at all, I would believe.

“Without patience, we will learn less in life. We will see less. We will feel less. We will hear less. Ironically, rush and more usually mean less.” - Mother Teresa

Heres my latest performance for 2020 (as of 27th June), a net 0.66% capital growth for the first half of the year.

To be honest, I‘m getting a little impatient too. I was doing 43.04% gain last year and I wanted to up my game with a target of a 50% capital growth this year. But I’m nowhere near it. 2020 is just the year that whenever I buy, the price just goes down; and whenever I sell, the price just goes up.

Its really frustrating.

But I know there are things in the market that I have to always respect. And being patient is one of them.

As a trader and investor, always remember, “When you have a tough year, it‘s gonna end; when you have a really good year, it’s gonna end.” - Ray Barros

The question is that are you still gonna be in the market when the tough year ends or have you been knocked out entirely?

I‘m certainly not proud of my performance this year, but I take pride in managing my emotions and risk very well. And I’m proud of some of our traders in the community. I know some of them are killing it this month alone.

Trading and investing is a marathon and never a sprint. So pace yourself well.

And one of the key elements that is absolutely critical to your long term success, as mentioned by Marcus and Ray, is the discipline to manage your risk well.

3.Risk Management

You might feel that Im like an old man or a broken recorder, keep talking about risk management over and over again. But the truth is risk management is just so important.

Heres a recent case study on Wirecard, with the headlines “German payments firm Wirecard files for insolvency after revealing $2 billion accounting black hole.”

To give you a quick background on Wirecard, it is listed on Germany's prestigious DAX stock index, and was among the country's biggest 30 listed companies with a market valuation of US$28 billion.

Recently, the company revealed that 1.9 billion euros of cash on its balance sheet had gone missing, and has since filed for insolvency.

The stock price of Wirecard (WDI) has rallied over 6,620%, from €2.96 to €199.00 between 2008 to late 2018. Everything looks good. Even the financial numbers look solid. Not until the recent scandal. And the stock price just tanked more than 99%, bringing it down to €1.28 as of 26th June 2020.

It took more than 10 years for the stock to have an amazing run of 6,620%, and all it takes was less than 2 years for it to lose it all.

Putting this in the context of your portfolio. You might have a fantastic strategy that can return you a profit of 100% per year, but if you don‘t have a proper risk management plan to protect your capital and your profits, it’s only a matter of time before you lose it all.

This year, we are likely gonna see more and more companies closing down and filing for insolvency. Here are just some of the more popular companies that have closed down in 2020 -

1. GNC

2. Chuck E. Cheese

3. Hertz

4. Virgin Australia

Heres the full list of companies.

If someone comes to me and says risk management is not important, honestly there is no need for any more discussion. I‘ll simply walk away and I’m pretty sure he/she wouldnt be in the market anymore within the next 2 years.

And this brings us to the fourth point -

4.Focus

Bruce Lee has one of the best quotes on this,

“The successful warrior is the average man, with laser-like focus.”

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

How many times have you jumped from one strategy to another system, only to switch to another and another one? Or even jump from trading, to investing, to ecommerce, to drop shipping, to affiliate marketing, and eventually coming back to square one?

I‘m guilty of this in the past, and I’m pretty sure many traders went through this vicious cycle as well.

While it‘s important to find a method that suits your personality, be aware and not fall into the trap of searching for the holy grail. It doesn’t exist.

Focus on the right thing to work on. I always share this with fellow traders and investors - trading and investing is a skill. Focus on being a trader and investor. There is a difference between learning a trading strategy vs developing oneself to be a trader. Always focus on the latter.

If youve been following me for a while, or are part of our trading community, you know the difference, and why I keep emphasizing to focus on being a trader.

To stay focused is already challenging, with the addition of the constant bombardment of all the exaggerated “profits” and over-promised posts on social media nowadays, honestly makes it even more difficult to stay focused.

And that‘s why it’s so important to have the next point -

5.Discipline

Heres the hard truth -

You can have all the above, but without discipline, you have nothing.

Heres the formula for your trading and investing success.

Where S = [(PM x D) x (A+C)] - (MC x T)

If there is no discipline, D = 0, S is either gonna be 0 or worse, negative.

In times of such uncertainty and volatile periods in the market, its ever more important to have the discipline to follow your trade plan, the discipline to stay committed and have the right mindset, and the discipline to stick to your stringent risk management plan.

I admit it‘s not gonna be easy. That’s why I always believe in having a community of traders.

For me, my accountability to our community of traders is my constant reminder to always remain focused and disciplined. And in return, the community, the Mastermind Group is a platform for our community of traders to be supported throughout their trading and investing journey.

Find a partner or a trading community that is able to encourage, inspire and most important support you in your journey of trading and investing. Its also gonna make this process so much more fun and enjoyable.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Five Ways of Unconventional Thinking Demystify How Senior Traders Make Money

Lessons from experts who have traded forex for over 20 years.

Six Ways to Ruin Your Account

To speculate on the market usually means hard-earned profits but easy-suffered losses. There are various ways ruining your account, which can be sorted into the following types:

Reasons You Have to Learn Short-Term Trading

Long-term trading or short-term trading, investors can find the answer in the article.

Five Reminders for Traders

Investors who have just entered the investment field usually face a question: How do I analyze the foreign exchange market?

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

ATFX Enhances Trading Platform with BlackArrow Integration

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator