简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Mexico Central Bank Cuts Key Rate for What May Be Last Time

Abstract:Mexicos central bank cut its key interest rate to a four-year low with one board member seeking a smaller reduction than the rest amid expectations that the current easing cycle is ending as inflation reemerges.

LISTEN TO ARTICLE

2:34

SHARE THIS ARTICLE

Share

Tweet

Post

Mexicos central bank cut its key interest rate to a four-year low with one board member seeking a smaller reduction than the rest amid expectations that the current easing cycle is ending as inflation reemerges.

Banco de Mexico, led by Governor Alejandro Diaz de Leon, lowered borrowing costs by a half point to 4.5%, in line with 22 of 24 estimates in a Bloomberg survey. One of five board members at the bank voted for a quarter-point cut, in line with forecasts from two of the 24 economists in the poll.

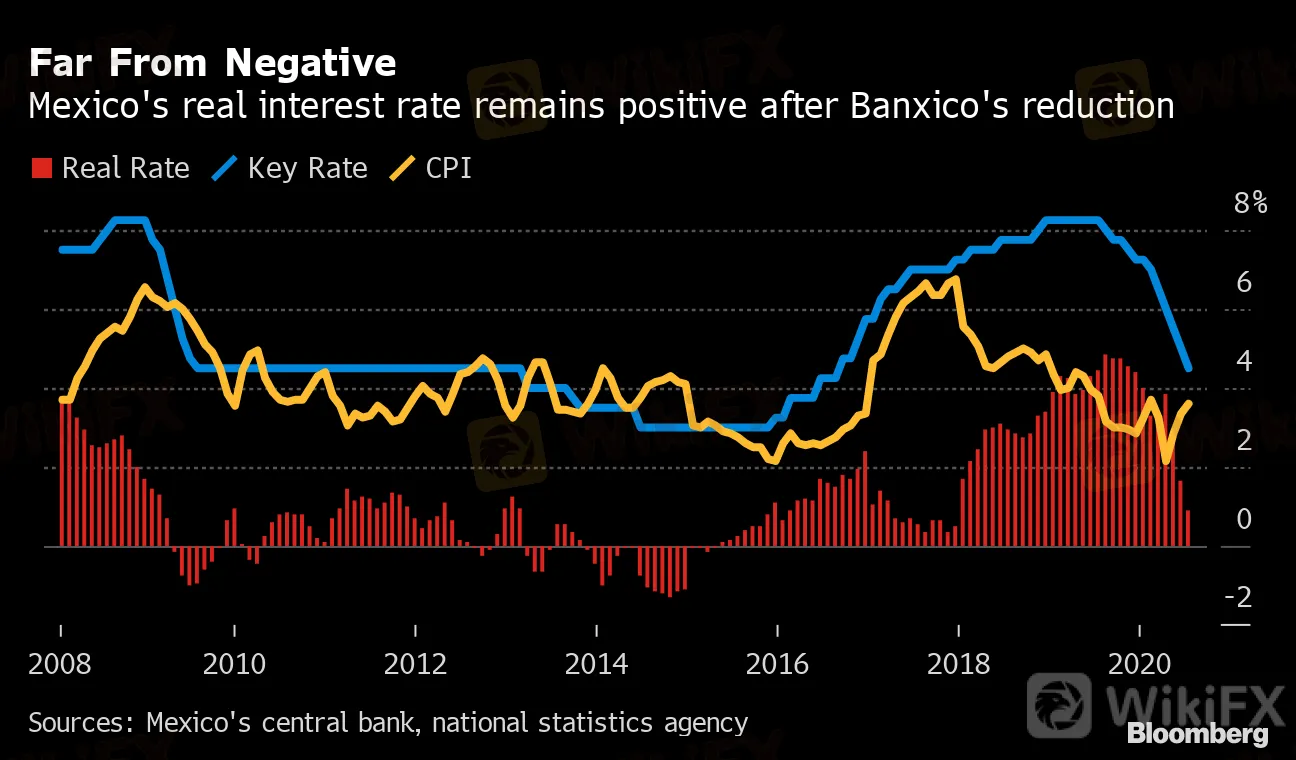

Far From Negative

Mexico's real interest rate remains positive after Banxico's reduction

Sources: Mexico's central bank, national statistics agency

Policy makers are caught between the recent pick-up in inflation and what economists expect will be the worst economic contraction in nearly a century as the coronavirus pandemic saps demand. That‘s led to some difference of opinion between economists, who see this as the easing finale, and investors, who think there’s room for one more rate cut.

Analysts surveyed by Citibanamex before the decision expected the central bank to hold rates at 4.5% through the end of next year. Swap rates showed traders scaled back bets on further easing, but still forecast a quarter-point reduction following this weeks decision.

The central bank itself included language about how the coronavirus may impact its future decisions.

“Going forward, the space available will depend on the evolution of factors that impact on inflation perspectives and expectations, including the effects the pandemic may have on both,” the central bank stated in the communique accompanying its decision.

‘Room for Maneuver’

That language appears to leave the door open to further cuts, even if just slightly, said Carlos Capistran, a New York-based economist at Bank of America.

“The split decision and the new sentence regarding the available room for maneuver means that the door is not wide open, but only barely so, given the inflation outlook,” Capistran said. “I think future decisions will very much depend on whatever happens to inflation. Given my inflation forecasts, I think it will be difficult for Banxico to move down further.”

Capistran bucked the consensus and had forecast that the central bank would cut borrowing costs by only a quarter point Thursday.

The bank has already lowered rates 10 times over the past year from 8.25%, the longest easing streak at least since Mexico formally adopted an operating interest rate target in 2008.

Despite some variation, there‘s growing consensus that the end of rate cuts is near after Mexico posted the biggest cost-of-living increase in eight months amid a surge in energy prices. July’s price jump brought annual inflation to 3.62%, above the 3% midpoint of the central banks target range.

(Updates with comments from rate decision statement starting in fourth paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator