简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Swings with Enduring Buoyancy

Abstract:Gold prices are sustaining the consolidation now, but may see a wedge/triangle pattern this month.

WikiFX News (5 Sept) - Gold prices are sustaining the consolidation now, but may see a wedge/triangle pattern this month.

The FED Governor Lael Brainard stressed that a flexible average inflation targeting means the inflation may be achieved moderately above 2% for a time, indicating that gold may be more attractive as the Federal Open Market Committee (FOMC) may stick to the status quo at the monetary policy meeting on September .

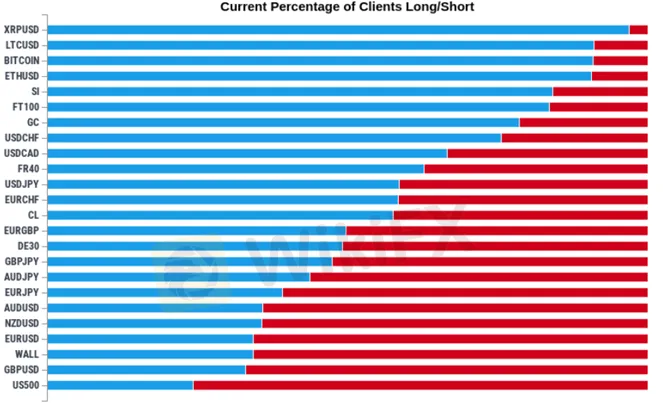

At the same time, markets may continue the current trends with bulls for the U.S. dollar increasing in this month. According to the IG Client Sentiment report, retail traders hold net-long USD/CHF, USD/CAD and USD/JPY, while the crowd remains net-short AUD/USD, NZD/USD, EUR/USD and GBP/USD. The ongoing tilt in retail sentiment may continue to coincide with the bullish behavior in gold as the dollar index is verging below the key support zone.

The Relative Strength Index (RSI) requires close attention as it appears to have bottomed out in August. However, the bullish outlook will only greet it when both a breach above 70 and a overbought territory are achieved. This indicator may help to validate the wedge/triangle formation.

Until then, gold prices may continue to face range bound conditions. In future tradings, a closing price above the Fibonacci overlap of $1,971-1,985 is necessary for bringing the $2025 region back on the radar.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: IG Client Sentiment Report

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Market Technically Analysis

The trend of gold on the daily chart is in line with technical requirements.

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Price (XAU/USD) Struggling to Break Meaningfully Higher

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Q3 Fundamental Forecast: Outlook Deteriorates for Gold Prices

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

Gold Price Forecast: XAU/USD has a good chance to regain the $1900 level – TDS

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Currency Calculator