简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.K. Retailers Posted Strongest Growth Since 2009 in September

Abstract:U.K. retail sales rose in September at their fastest annual pace since 2009 but tighter restrictions to control the surge in coronavirus could deliver a serious setback, an industry body warned.

U.K. retail sales rose in September at their fastest annual pace since 2009 but tighter restrictions to control the surge in coronavirus could deliver a serious setback, an industry body warned.

The British Retail Consortium said the 5.6% jump from a year earlier was driven by renewed stockpiling, early Christmas shopping and the reopening of schools boosting demand for clothing. Like-for-like sales jumped by 6.1%.

But fears are mounting that Britain could face more stringent curbs during the crucial run-up to Christmas if the spike in virus cases is not brought under control. On Monday, Prime Minister Boris Johnson announced that bars and pubs will close in the worst-hit parts of England from Wednesday.

“The industry is beginning to recover,” said BRC Chief Executive Helen Dickinson. “However, forced store or warehouse closures during any future lockdowns could put paid to this progress.”

The BRC also cautioned the pace of growth last month was inflated by a poor September last year, when spending was hit by fears about a no-deal Brexit. That prospect is facing Britian once again, with companies facing costs, tariffs and border disruptions on Jan. 1 unless Britain and the European Union can break the deadlock in talks over a new trade agreement.

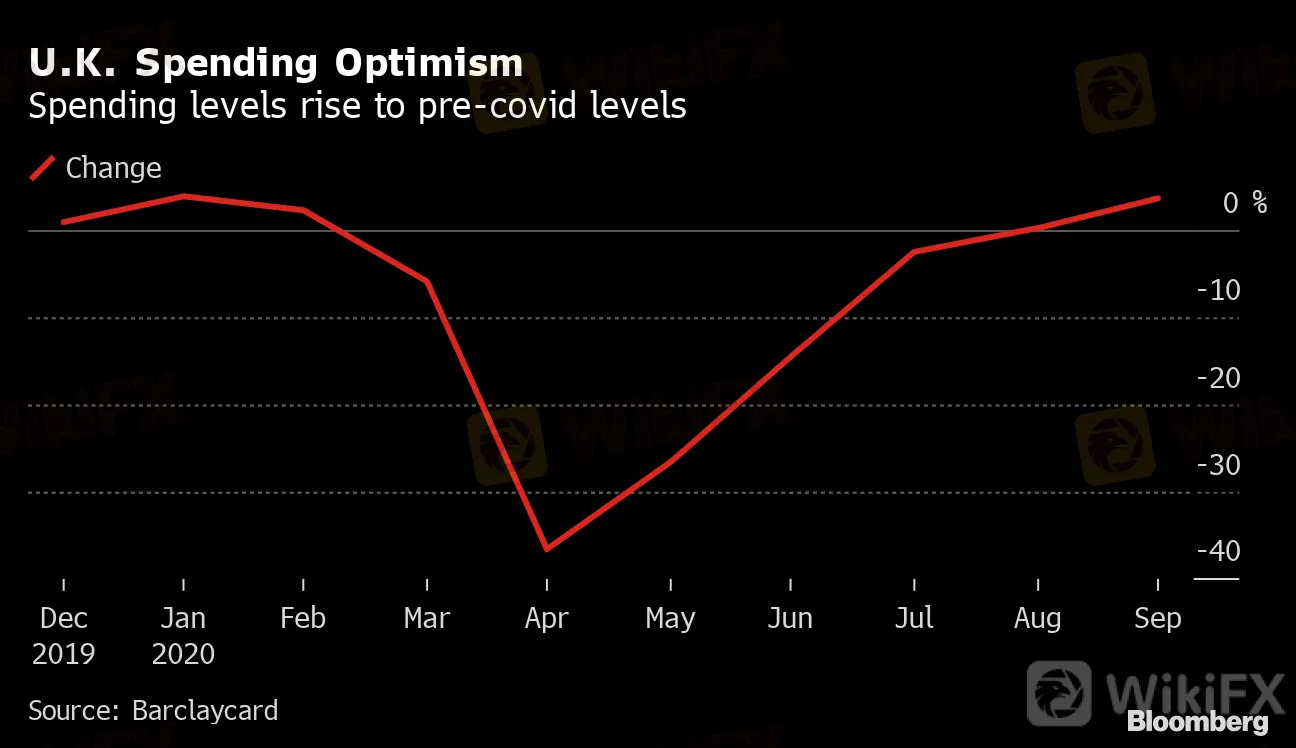

U.K. Spending Optimism

Spending levels rise to pre-covid levels

Source: Barclaycard

A buoyant September was also reported by Barclaycard, which said spending rose 2% on the year -- the best performance since before the pandemic struck.

Consumers fearing a new lockdown stocked up on essentials, pubs thrived and there was a surge in spending on home improvements as millions of Britons continued to stay away from the office.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

WikiFX Elites Club —— Fun Spring Camping in Malaysia Successfully Concluded!

Currency Calculator