简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

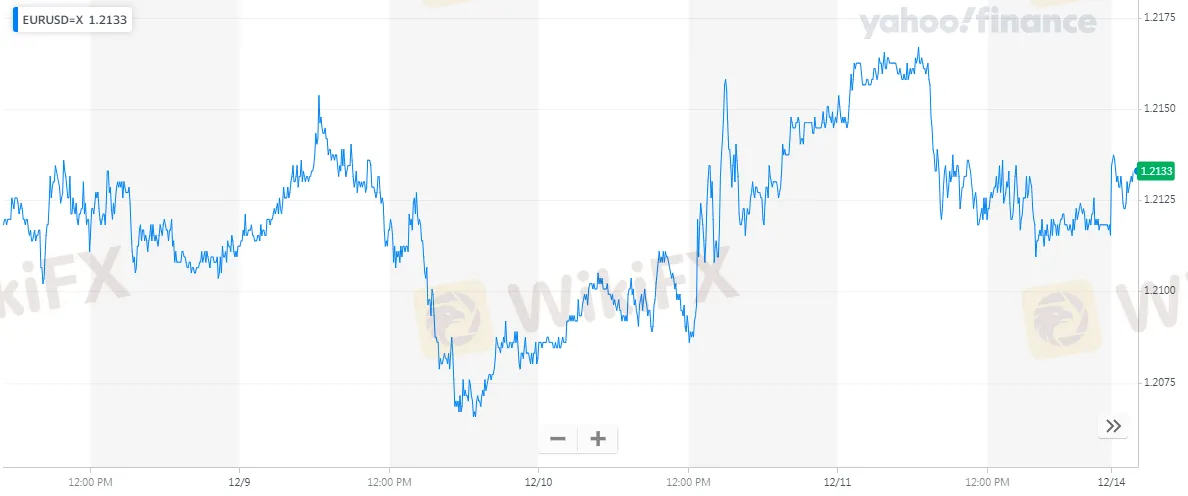

EUR/USD Updates: Swing traders should note over extended weekly conditions

Abstract:EUR/USD rallied some 2% since the prior resistance at the end of November on US dollar weakness. The greenback had attempted a correction but was capped in the DXY at the 10-day moving average and is threatens a break below 90.50 again.

EUR/USD rallied some 2% since the prior resistance at the end of November on US dollar weakness. The greenback had attempted a correction but was capped in the DXY at the 10-day moving average and is threatens a break below 90.50 again.

However, the euro is in stretched conditions from a longer-term perspective which would be expected to limit the upside potential for the time being.

Zooming in to the weekly chart, we can see that there could even be scope for a run to the 61.8% Fibo which meets the 21-week moving average and a thicker pool of liquidity.

From the daily chart, a test of the marked support would result in an M-formation and likely see a bid back to the prior support, turned resistance.

It will be from there which could offer the next downside extension to the 61.8% Fibo or a prolonged period of consolidation.

In the shorter term, bulls could look for an opportunity from the 38.2% to target the M-formation's neckline.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator