简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Beat Inflation with Investments in 2021?

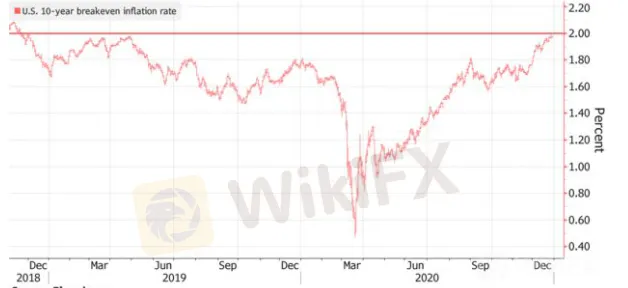

Abstract:Bloomberg data shows that the break-even inflation rate - a measure that draws on inflation-linked expectations - has hit a record high.

WikiFX Strategy (5 Jan.) - Bloomberg data shows that the break-even inflation rate - a measure that draws on inflation-linked expectations - has hit a record high. Since the US election has ended and the relief bill has been passed, inflation trends could be crucial to market performance in 2021 amid the vaccine hopes and the Fed's loosening policy.

Each day get a money-making strategy on WikiFX (bit.ly/wikifxIN)

Now that we've expected future inflation, how to beat it with investments accordingly?

Commodity investing could be one of the best options. Copper, iron ore and soybeans have risen to their highest levels in more than six years, says BlackRock analyst Evy Hambro. Recovering global economic growth and the possibility of higher inflation should be supportive for prices.

Investing with ETFs in a broad basket of commodities is also a good choice, which includes SPDR Gold Trust (the largest gold ETF in the world), USO (an oil ETF), etc.

Potential investments also include commodity currencies that are strongly linked with commodity prices, such as AUD, NZD and CAD. These currencies will embrace a rebound once seeing the economic recovery and the inflation rise.

Another method fighting against inflation is purchasing cyclical stocks (oil, natural gas, coal, steel, non-ferrous metals, etc.)

The US 10-year break-even inflation rates

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How to Pick a Stock?

Basic Best Practices for New Investors: So you've finally decided to start investing. And you know the cardinal rule of the smart investor: A portfolio should be diversified across multiple sectors.

Rich VS Poor Mindset - How to Think Like a Billionaire

No Matter How Much Money You Have, If you truly want to join the ranks of the super rich, you'll need to start thinking like you're already one of them.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator