简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Sunak Hands $6.2 Billion to U.K. Firms Facing Lockdown Recession

Abstract:Chancellor of the Exchequer Rishi Sunak announced 4.6 billion pounds ($6.2 billion) of emergency support to help U.K. businesses survive a third lockdown that threatens to plunge the economy into a sharp double-dip recession.

Chancellor of the Exchequer Rishi Sunak announced 4.6 billion pounds ($6.2 billion) of emergency support to help U.K. businesses survive a third lockdown that threatens to plunge the economy into a sharp double-dip recession.

Retail, hospitality and leisure businesses will be entitled to one-off grants of as much as 9,000 pounds to tide them over until the spring, the U.K. finance minister said in a statement Tuesday. Thats on top of existing funds of as much as 3,000 pounds per month for those required to shut their doors because of coronavirus restrictions.

“This will help businesses to get through the months ahead -- and crucially it will help sustain jobs, so workers can be ready to return when they are able to reopen,” Sunak said. In a video message on Twitter, he said the budget in early March will “set out the next stage in our economic response.”

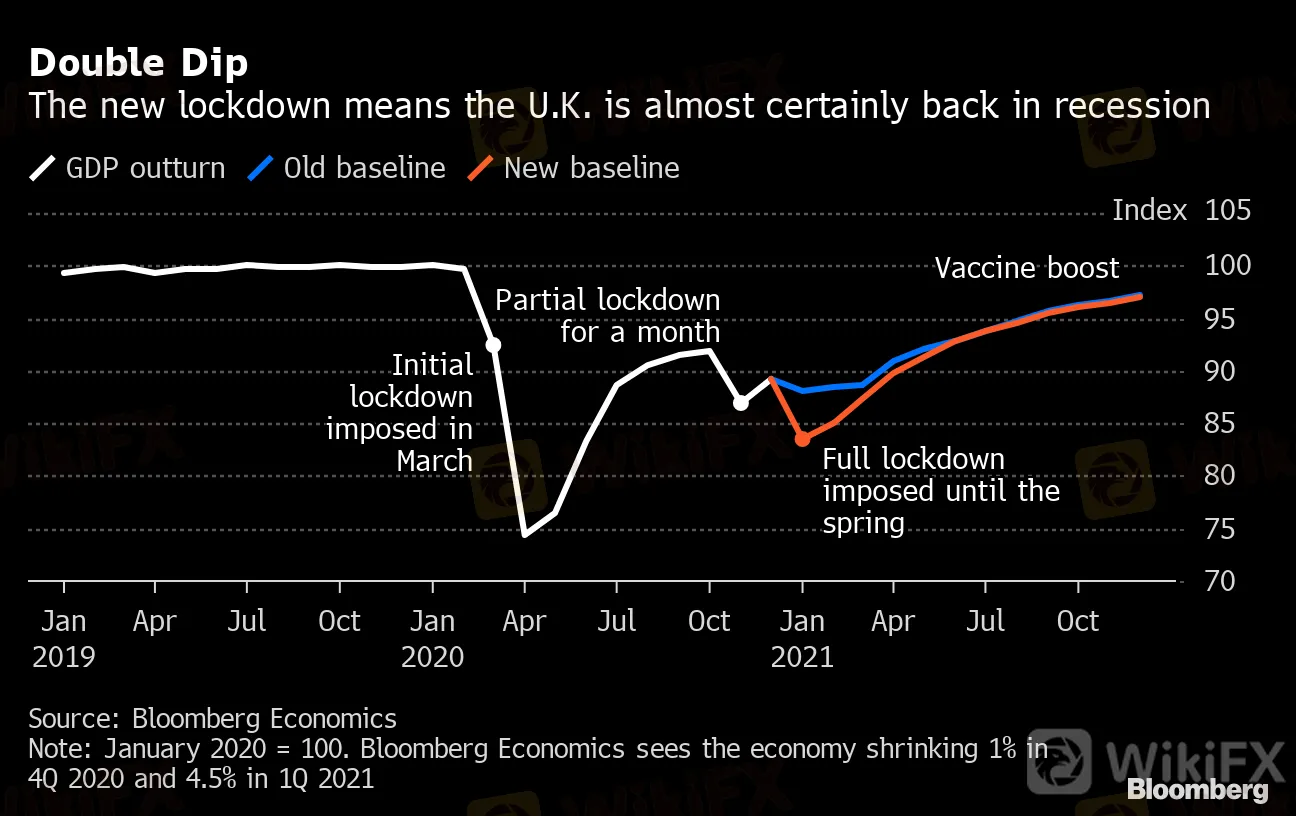

Double Dip

The new lockdown means the U.K. is almost certainly back in recession

Source: Bloomberg Economics

Note: January 2020 = 100. Bloomberg Economics sees the economy shrinking 1% in 4Q 2020 and 4.5% in 1Q 2021

Business groups said the government hasn‘t gone far enough to protect companies and workers from the slump. Mike Cherry, chair of the Federation of Small Businesses, saying for many, the grants “won’t be enough for businesses who are already under the cosh and on the brink.” Kate Nicholls, chief executive officer of the UKHospitality group said Sunaks aid represents “only a sticking plaster for immediate ills.”

“It is not enough to even cover the costs of many businesses and certainly will not underpin longer-term business viability for our sector,” she said in a statement. She called for an extension to the business rates holiday, which currently runs until the end of the tax year in April, as well as an extension to reduced value added tax rates for the industry.

The latest measures add to the 280 billion pounds it has cost the Treasury to tackle the virus and support firms and workers through the pandemic. Closing schools and more businesses will sharpen an economic slump in the first quarter, delaying a recovery from the worst recession in three centuries.

Restrictions will be in place in England until at least Feb. 15, and Prime Minister Boris Johnson has said he hopes a mass vaccination program will mean the government can relax some of the rules in the spring.

“The next few weeks are going to be difficult,” Sunak said. “But the end is in sight. We are vaccinating more and more people every day.”

The Treasury estimated the money will help 600,000 business properties nationwide. Sunak also made a further 594 million pounds of discretionary funding available to businesses in sectors other than hospitality and leisure that are also impacted by the coronavirus lockdown.

The Scottish, Welsh and Northern Ireland governments were apportioned 375 million pounds, 227 million pounds and 127 million pounds respectively to spend on the grants.

The additional aid comes after business groups demanded more support in the wake of new coronavirus restrictions announced by Johnson late Monday.

War Footing

The pandemic has pushed government spending to its highest since 1944

Source: Office for Budget Responsibility

This hit to the economy will be worse than the one in November since schools are closed this time. Bloomberg Economics now sees a 4.5% contraction in the first quarter. JPMorgan Chase & Co. on Tuesday cut its forecast for the first quarter, saying it now expects a 2.5% contraction, compared with a near stagnation previously.

“This is bad,” Ludovic Subran, chief economist at Allianz SE said in a Bloomberg Television interview. “The U.K. is a service economy, so it‘s all about shutting down services, and it’s bad because things like schools are a big part of GDP -- also because they play a role in how much parents are able to work.”

In addition to the extra fiscal support, the lockdown may also prompt the Bank of England to provide more support, either through quickening the pace of its bond-purchase program, or taking more drastic measures such as cutting interest rates below zero for the first time.

The damage from the latest lockdown probably wont be as deep as the record 18.8% contraction in the second quarter of last year. JPMorgan says business and households are now better prepared to adjust to lockdown conditions.

As things stand, the governments main support program for workers -- the furlough plan paying 80% of wages to those whose employer was forced to close -- is due to expire at the end of April. Support for the self-employed also will run through April, while business loan programs are due to close to new entrants at the end of March.

Following Sunaks announcement, the Confederation of British Industry on Tuesday called for furlough to be extended until June

“”With the vaccine rollout now underway, and increasing mass rapid testing, there really is a brighter future within reach,“ said the CBIs cheif economist Rain Newton-Smith. ”Maintaining steadfast support for firms during this painful period will help ensure the recovery is delayed for as short a time as possible.

— With assistance by Stuart Biggs, and Andrew Atkinson

(Updates with reaction from business groups.)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator