简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Outlook: USD/JPY Eyes BoJ as Yield Volatility Hastens

Abstract:US Dollar Outlook: USD/JPY Eyes BoJ as Yield Volatility Hastens

USD/JPY PRICE OUTLOOK: US DOLLAR SUPPORTED BY SURGING TREASURY YIELDS, MULTI-YEAR TRENDLINE IN FOCUS AHEAD OF BOJ ANNOUNCEMENT

US Dollar strengthened broadly on Thursday and erased losses from the prior session

Treasury yields exploded higher with the ten-year piercing 1.75% despite a dovish Fed

USD/JPY price action contends with a critical technical level ahead of the BoJ decision

Several traders were caught offside on Thursday as the US Dollar whipsawed back higher alongside surging Treasury yields. The ten-year Treasury yield, for example, briefly spiked above 1.75% intraday and provided a meaningful boost to US interest rate differentials. This helped the broader DXY Index reverse prior session losses sparked by another dovish FOMC update.

USD/JPY was little changed, however, as the major currency pair stagnates at a huge level of resistance around the 109.00-handle. The Dollar-Yen has started to lack direction with buying pressures clashing with a multi-year bearish trendline. This negatively sloped trendline extends through the June 2015, August 2015, and February 2020 swing highs.

USD/JPY PRICE CHART: MONTHLY TIME FRAME (FEB 2014 TO MAR 2021)

USD/JPY price action also contends with technical resistance posed by the 38.2% Fibonacci retracement level highlighted on the chart above. Honing in on a shorter time frame with daily candlesticks, we can see how well the Dollar-Yen is respecting this bearish trendline as more lower highs begin to form. Though there could be potential for an overshoot above this obstacle near the 109.00-price level, particularly in light of surging Treasury yields, the upper Bollinger Band might reject attempts to push higher and cause USD/JPY to pivot back lower.

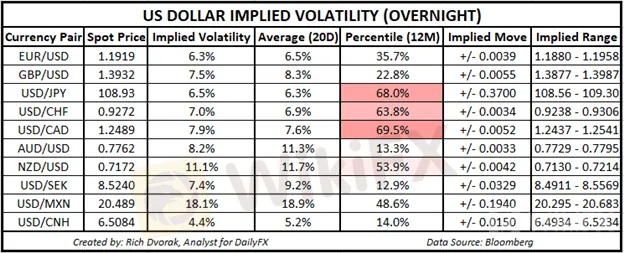

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

Looking to the DailyFX Economic Calendar, we find that high-impact event risk posed by the upcoming Bank of Japan rate decision is on tap for Fridays trading session. USD/JPY overnight implied volatility appears relatively subdued, however, considering that the Bank of Japan is expected to release findings from their latest monetary policy review. If tweaks are made to BoJ monetary policy, such as widening its YCC band, it could catalyze some serious volatility in the Yen and potentially send USD/JPY snapping lower.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Currency Calculator