简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Secret Behind Bearish Trend Reversals

Abstract:The Secret Behind Bearish Trend Reversals

Traders looking to enter the market are often sent off on a journey to discover the ‘holy grail’ of market entries. They study numerous theories; Japanese candlestick reversals, contrarian theory, oscillator divergence, wave theory, and others. Traders who are just starting out, put their trust in indicators and oscillators and rely on them make the decisions on when to place an order – and the more indicators/oscillators they discover, the more they add into their strategy.

The most neglected indicator/oscillator is price. That‘s right, price! Price is superior to any indicator and all others come second. It’s the only indicator that encompasses everything – economic factors, political and geographical. Novice traders often do not understand the importance of price and most of the time, they dont give it the attention it deserves.

The most effective market entry is trend reversal. After an ongoing trend towards one direction, the market eventually signals the end of that trend and begins a new one towards the opposite direction. In this article, well be focussing on a few of the most popular reversal patterns: head & shoulders, double top and triple top.

Head & Shoulders

Head & Shoulders have a reputation for being one of the most dependable reversal patterns. Its a pattern based on price movement and indicates the start of a new trend in one direction, after an ongoing trend in the other direction ends.

How to spot Head & Shoulders:

To have a reversal, an existing trend needs to exist, and head & shoulders is no different.

A prevailing uptrend (in this case) is made up of consequent higher tops and bottoms.

If volume is available, it signals alerts.

An upwards move to the Head often illustrates decreased volume (if available) and signals a warning.

The right Shoulder is lower than the Head and indicates a potential reversal.

A significant close below the neckline (with increased volume, if available) indicates the end of the uptrend and the start of a downtrend.

To calculate the minimum price target, project the height of the pattern to the necklines breakout point.

An existing trend (in this case an uptrend) is vital before you go looking for a reversal.

As with Head & Shoulders, the existing trend is marked by its consecutive higher tops and bottoms.

If volume is available, it signals alerts.

The upwards move to the resistance area indicates decreased volume (if available) and signals weakness to move higher.

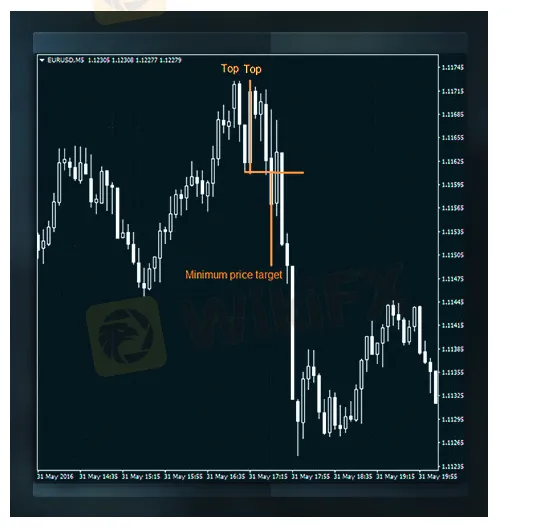

Equal (or almost equal) tops make up the resistance area.

A significant close below the bottom (with increased volume, if available) indicates the end of the uptrend and the start of a downtrend.

To calculate the minimum price target, project the height of the pattern to the breakout point.

An existing trend (in this case uptrend) is necessary.

The existing uptrend is defined by consecutive higher tops and bottoms.

If volume is available, it signals alerts.

The upwards move to the resistance area indicates decreased volume (if available) and signals weakness to move higher.

The tops are equal (or almost).

A significant close below the bottom (with increased volume, if available) indicates the end of the uptrend and the start of a downtrend.

To calculate the minimum price target, project the height of the pattern to the breakout point.

Triple Tops

Similar to the Head & Shoulders, the Triple Top is made up of three (almost) equal tops and a significant close below the support (bottom) of the formation. Its important to have a break below the bottom in order to have a valid Triple Tops. The three tops on their own are not enough!

How to spot Triple Tops:

Double Tops

During an uptrend, a top might surpass a previous top if the demand exceeds the supply. When that trend runs out of gas, it will start showing signs (signals) of weakness. If volume is available, then a decrease in it will be the first signal as it moves upwards. Another signal is if the last top fails to go higher than the previous one. A reversal is confirmed if prices break below the bottom/support area.

How to spot Double Tops:

Price rules supreme over oscillators and indicators. Price discounts for everything that affects the markets and reveals the crowds (traders) psychology. There are many bearish or bullish trend reversal patterns, and traders should pay more attention to them rather than experimenting solely with candlestick reversals and oscillator signals. Available volume in combination with oscillator analysis, can confirm reversal patterns with higher potential accuracy.

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator