简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Coinbase Effect Means Average 91% Token Price Gain in 5 Days

Abstract:WikiFX | Free Encyclopedia in The Finance & Forex Industry Find market trend, trading signals, broker ranking, scam alert, expert advisor and more!

In cryptocurrency markets they call it the “Coinbase effect” – the theory that up-and-coming digital tokens like cardano tend to experience a quick price pop after theyre listed on the big U.S. exchange Coinbase.

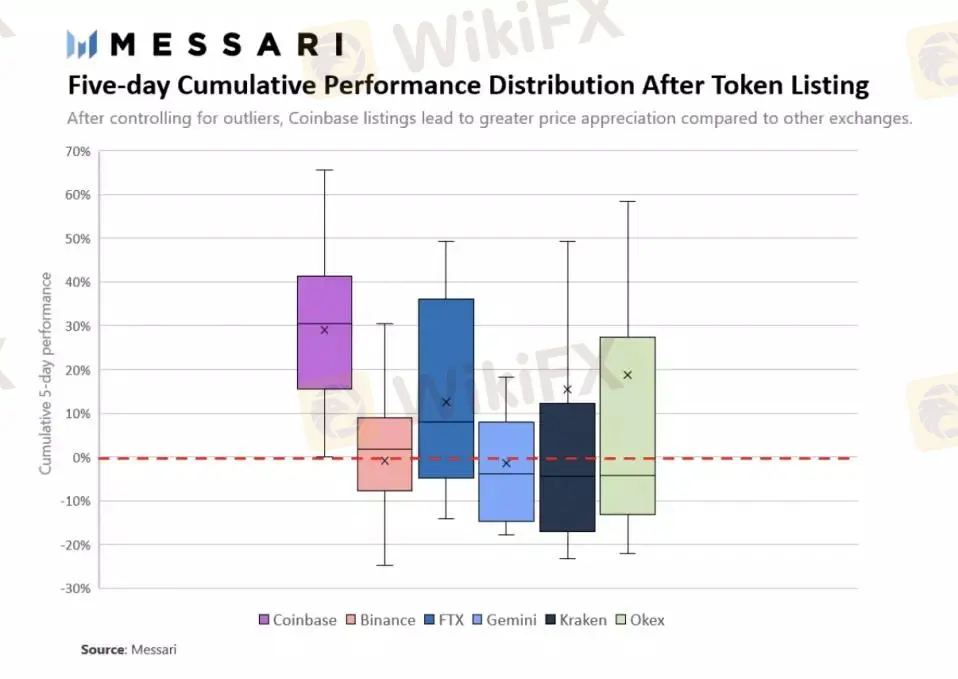

The phenomenon has been exhaustively researched and chronicled, and it happened recently after the digital-token cardano (ADA) listed on Coinbase. But now the cryptocurrency analysis firm Messari has conducted a fresh study looking at the price pops of tokens on Coinbase during their first five days of trading, compared with the impact of listings on other big digital-market venues including Binance, FTX, OKEx, Kraken and the Winklevosses Gemini.

The conclusion? The Coinbase effect is quite real.

“Coinbase listings have the highest average return standing at 91%, but also have the widest distribution of ranging from -32% to 645%,” wrote Roberto Talamas, analyst at Messari, a cryptocurrency research firm in newsletter post titled “The Crypto Exchange Pump Phenomenon.”

Recent Coinbase listings include cardano along with ankr (ANKR), curve DAO token (CRV) and storj (STORJ). Filecoin (FIL) is up sixfold since it appeared on the San Francisco-based exchange in December.

Cardano, for its part, jumped 36% in two days on the rival Kraken exchange when Coinbase announced March 16 it planned to list the token, though some of those gains reversed on March 18 when trading actually started on Coinbase. (Messaris analysis looked at the token performance during the first five days following the listing, rather than from the date of the announcement.)

Messari then scrubbed the data to eliminate “outlier” data points – price reactions seen as so extreme that they might create an unrealistic picture of the effect.

“Outliers experienced tremendous returns after their listing announcements, drastically skewing the average towards the right side of the distribution.”

“Among these outliers, District0x (a platform to create decentralized marketplaces and communities) and Civic (an identity verification solution) saw their price increase 645% and 493% respectively,” wrote Talamas.

Even after controlling for the outliers, Coinbase still had the highest post-listing price response compared with other big exchanges.

-----------------------------

WikiFX, a free encyclopedia in the Finance & Forex Industry! Now you can find best forex broker ranking on WikiFX APP and 100 free VPS waiting for you to receive!

╔═══════════════════════╗

Website: https://bit.ly/wikifxIN

APP for Android: https://bit.ly/3kyRwgw

APP for iOS: https://bit.ly/wikifxapp-ios

╚═══════════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

CPT Markets Secures UAE SCA License for FX and CFDs Services

What do Users say about "Titan Capital" on Trustpilot?

Beware: Another Victim Of Finalto Clone Scam

Currency Calculator