简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Outlook Mired by Fall in Longer-Dated US Treasury Yields

Abstract:US DOLLAR TALKING POINTS

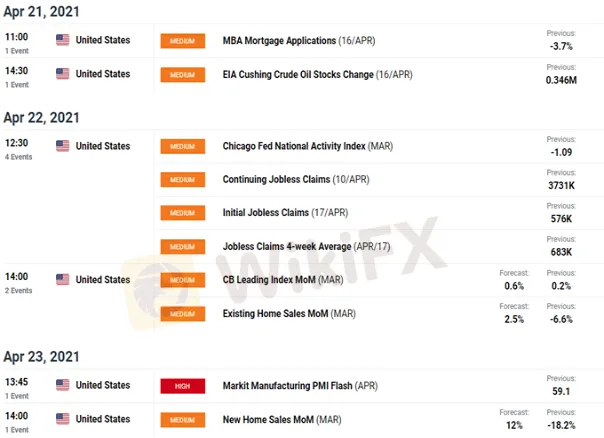

The US Dollar Index (DXY) has been stuck under the 200-Day SMA (92.21) as the 10-Year Treasury yield slips to a fresh monthly low (1.53%), and recent market dynamics may keep the Greenback under pressure as the economic docket remains fairly light ahead of the Federal interest rate decision on April 28.

Fundamental Forecast for US Dollar: Bearish

The US Dollar Index (DXY) extends the decline from the start of April

despite the 9.8% rise in US Retail Sales, and the data prints on tap for the week ahead may do little to influence the Greenback as the Federal Open Market Committee (FOMC) appears to be on track to retain the current path for monetary policy.

The depreciation in the US Dollar comes as Fed officials emphasize a dovish forward guidance, and recent remarks from Vice Chair Richard Clarida suggest the central bank is on a preset course as the permanent voting member on the FOMC insists that “policy will not tighten solely because the unemployment rate has fallen below any particular econometric estimate of its long-run natural level.”

It seems as though the FOMC will continue to utilize its emergency tools even though the US economy adds 916K jobs in March, and a further decline in Treasury yields may keep the Dollar under pressure as the central bank stays on track to “”increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.

However, signs of a stronger recovery may put pressure on the FOMC to change its tone as the Atlanta Fed‘s ’GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 8.3 percent on April 16, and it remains to be seen if Chairman Jerome Powell and Co. will alter the forward guidance in 2021 as the central bank attempts to achieve above-target inflation.

Until then, recent market dynamics may continue sway the US Dollar as the economic docket remains fairly light ahead of the next Fed rate decision, and DXY may continue to hold below the 200-Day SMA (92.21) amid the ongoing weakness in longer-dated US Treasury yields.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator