简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/AUD Price Outlook Bearish, Commodity Currencies to Strengthen

Abstract:EUR/AUD PRICE, NEWS AND ANALYSIS:

The outlook for EUR/AUD is bearish as commodity currencies such as the Australian Dollar benefit from the current global economic expansion after the contraction caused by the coronavirus pandemic.

Australia produces many of the raw materials like iron ore, copper and aluminum that will be in demand as economic growth picks up, and that should benefit AUD against currencies such as EUR, CHF and JPY.

As the global economy expands after the savage downturn caused by the Covid-19 pandemic, commodity currencies like the Australian Dollar are well placed to advance. In particular, the outlook for EUR/AUD is bearish as the pair has actually been strengthening since late February despite all the signs of an economic recovery.

As the chart below shows, EUR/AUD hit a recent low at 1.5253 on February 25 and has since climbed to just over 1.55. While there is trendline support currently around 1.5360, it would be no surprise if that level were challenged and eventually breached.

EUR/AUD PRICE CHART, DAILY TIMEFRAME (OCTOBER 1, 2020 – MAY 5, 2021)

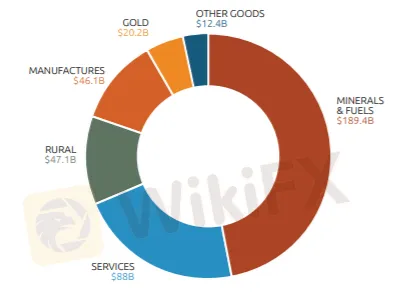

Australia is a major producer of raw materials such as iron ore, copper and aluminum that should all be in demand from industry as it picks up after the downturn. In fact, minerals and fuels accounted for 47% of its total exports according to the latest data.

Among these, iron ore is Australias major export, followed by natural gas and gold.

Taking iron ore as an example, the price has advanced by 94% in the past 15 months, reaching record highs as supply has been unable to keep pace with demand from China, where steel output has grown by 30% over the past five years.

IRON ORE PRICE CHART, DAILY TIMEFRAME (JANUARY 8, 2020 – MAY 5, 2021)

Similarly, the price of copper has more than doubled since its low back in March 2020 so it is remarkable that the Australian Dollar has not benefited more than it has. A drop in EUR/AUD would therefore be no surprise, prompting this bearish call on the cross and, by extension, strength in other commodity currencies such as CAD and NZD as well.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

Currency Calculator