简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD Rate Rebound Pulls RSI Out of Oversold Territory

Abstract:EUR/USD Rate Rebound Pulls RSI Out of Oversold Territory

EUR/USD trades to a fresh weekly high (1.1955) as Fed Chairman Jerome Powell strikes a dovish forward guidance in front of US lawmakers, and the exchange rate may stage a larger rebound over the remainder of the week as the Relative Strength Index (RSI) bounces back from oversold territory to indicate a textbook buy signal.

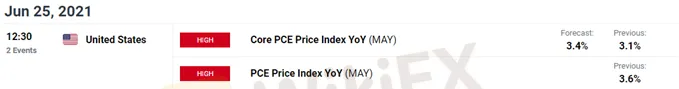

EUR/USD RATE REBOUND PULLS RSI OUT OF OVERSOLD TERRITORYEUR/USD may continue to retrace the decline following the Federal Reserve interest rate decision as it extends the series of higher highs and lows from the start of the week, but fresh data prints coming out of the US economy may rattle the recent rebound in the exchange rate as the Core Personal Consumption Expenditure (PCE) Price Index is expected to widen for the third consecutive month.

The Feds preferred gauge for inflation is projected to increase to 3.4% from 3.1% per annum in April, which would mark the highest reading since 1992, and persistent signs of stronger price growth may put pressure on the Federal Open Market Committee (FOMC) to adjust the forward guidance as the central bank now forecasts the economy to grow 7.0% in 2021.

In turn, the FOMC may start to discuss an exit strategy as officials continue to upgrade their economic outlook, but the recent testimony from Chairman Powell suggests the Fed is in no rush to switch gears as the central bank head tells US lawmakers that “inflation is expected to drop back toward our longer-run goal.”

In turn, Chairman Powell insists that “the Fed will do everything we can to support the economy for as long as it takes to complete the recovery,” and it seems as though the FOMC will stick to the same script at the next interest rate decision on July 28 as the central bank braces for a transitory rise in inflation.

Until then, EUR/USD may stage a larger rebound from the monthly low (1.1847) as it extends the bullish price series from the start of the week, but the recent shift in retail sentiment looks poised to persist as the exchange rate trades below the 200-Day SMA (1.1993) for the first time since April.

The IG Client Sentiment report shows 59.03% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.44 to 1.

The number of traders net-long is 9.31% higher than yesterday and 40.50% higher from last week, while the number of traders net-short is 8.86% lower than yesterday and 35.05% lower from last week. The jump in net-long position comes as EUR/USD extends the rebound from the monthly low (1.1847), while the sharp decline in net-short position has fueled the tilt in retail sentiment as 57.24% of traders were net-long the pair at the end of last week.

With that said, it remains to be seen if the decline from the January high (1.2350) will turn out to be a correction in the broader trend rather than a change in market behavior as EUR/USD attempts to retrace the decline following the Fed rate decision, and the exchange rate may stage a larger rebound over the remainder of the week as the Relative Strength Index (RSI) bounces back from oversold territory to indicate a textbook buy signal.

EUR/USD RATE DAILY CHART

Source: Trading View

EUR/USD trades below the 200-Day SMA (1.993) for the first time since April, with the depreciation in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the first time since February 2020.

The RSI continues to track the downward trend established earlier this year as the advance from the March low (1.1704) fails to produce a test of the January high (1.2350), but recent developments in the oscillator points to a near-term rebound in EUR/USD as it climbs back above 30 to indicate a textbook buy signal.

Lack of momentum to close below the 1.1860 (61.8% expansion) region has produced a series of higher highs and lows in EUR/USD, but need a closing price above the Fibonacci overlap around 1.1920 (78.6% expansion) to 1.1970 (23.6% expansion) to bring the 1.2010 (100% expansion) region on the radar.

Next area of interest comes in in around 1.2080 (78.6% retracement) followed by the 1.2140 (50% retracement) to 1.2170 (78.6% expansion) region.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator