简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast

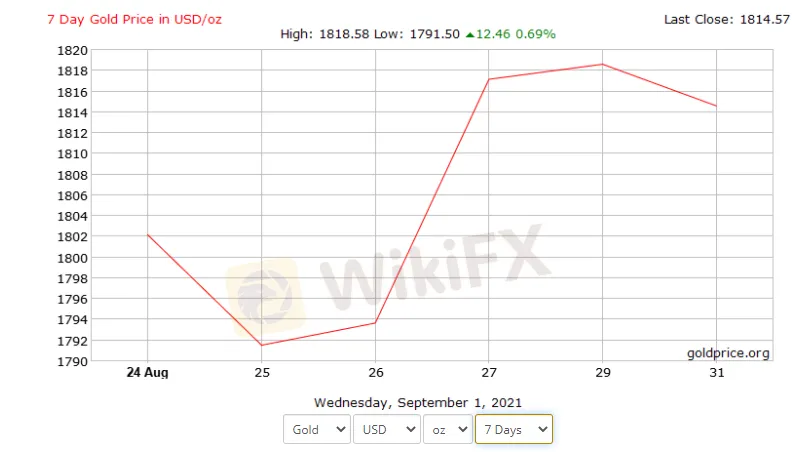

Abstract:XAU/USD attempts to reclaim $1,820 on dollar weakness.

Gold prices attempt to cross beyond $1,820 and record some gains following the previous session‘s consolidative move. The prices seem to be stabilizing now to make a consolidative move in a trading band. The yellow metal is rangebound amid continuing debate over Fed’s monetary policy. A lower USD valuation, which makes the precious metal less expansive for the other currencies holders continues to support gold prices. The softer US ADP data weighed on the greenback. The lower US benchmark Treasury yields also supported gold prices as it enhances the appeal of the non-yielding asset. Concerns over the delta coronavirus crisis reduce investor confidence and risk appetite that eventually supported corrective pullback in gold prices. Investors now turn their attention to the Nonfarm payroll data on Friday for an update on US labour market conditions.

The price of gold is trading at $1,813.88 and between a low of $1,813.33 and a high of $1,814.21.

The US dollar dropped after the ADP National Employment Report showed private payrolls rose by 374,000 in August, up from 326,000 in July but well short of the 613,000 forecasts.

There are now even more expectations for a disappointing jobs number this week which pushes back the case for a taper no sooner than December.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The U.S. dollar index and U.S. Treasury yields rebounded at the same time; gold fell by more than 1%!

The initial value of the US S&P Global Manufacturing PMI in August was 48, which was lower than expected and the lowest in 8 months; the service PMI was 55.2, which exceeded the expected 54. The number of initial jobless claims in the week ending August 17 was 232,000, slightly higher than expected, and the previous value was revised from 227,000 to 228,000. Existing home sales in July increased for the first time in five months. The PMI data was lower than expected, which was bad for the US eco

The U.S. dollar index returned to the 103 mark; gold once plunged nearly $40 from its intraday high!

The monthly rate of retail sales in the United States in July was 1%, far exceeding expectations; the number of initial claims last week was slightly lower than expected, falling to the lowest level since July; traders cut their expectations of a rate cut by the Federal Reserve, and interest rate futures priced that the Federal Reserve would reduce the rate cut to 93 basis points this year. The probability of a 50 basis point rate cut in September fell to 27%. The data broke the expectation of a

Gold Price Stimulates by Geopolitical Tension

Gold prices experienced their largest gain in three weeks, driven by escalating tensions in the Middle East and the easing of the U.S. dollar as markets await the crucial CPI reading due on Wednesday. Gold has surged to an all-time high above $2,460, as uncertainties surrounding developments in both the Middle East and Eastern Europe persist push the demand for safe-haven assets higher.

Types of gold: How to build a gold investment plan

As investors seek stability and diversification in their portfolios, especially in uncertain economic periods, gold stands out as one of the best options. How many types of gold exist? Before diving into golden investments, it's crucial to grasp the various forms that gold can take.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

IMF Adds Bitcoin and Digital Assets to Global Economic Statistics for the First Time

Tariff Deadline Looms on April 2: Where Will the Market Go?

Forex Explained in 60 Seconds: How It Works & Who Profits

Currency Calculator