简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Futures Technical Analysis

Abstract:Gold futures are edging lower early Monday.

Gold futures are edging lower early Monday after giving back more than half of its gains the previous session on U.S. Federal Reserve chief Jerome Powells comments that inflation could ease next year and the central bank was on track to start tapering its stimulus.

On Friday, gold futures rallied to their highest level since September 7 before trimming gains on Fed Chairman Jerome Powells comments on tapering. The price action suggests weak sellers were taken out on the move since there is little evidence of new buying.

Buyers are being cautious which means they arent likely to chase the market higher. During the current rally, they seem to be more inclined to buy dips.

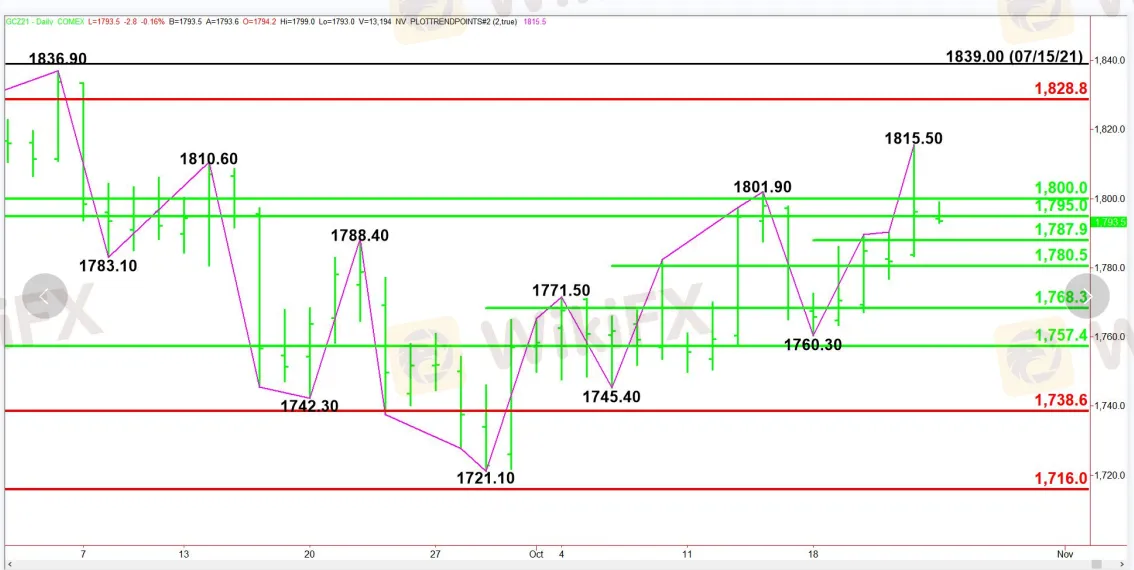

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart. A trade through $1815.50 will signal a resumption of the uptrend. A move through $1760.30 will change the main trend to down.

Gold is currently trading inside a pair of 50% levels at $1795.00 and $1800.00. This area is controlling the near-term direction of the market.

On the upside, resistance is a long-term 50% level at $1800.00 and a long-term Fibonacci level at $1828.80.

On the downside, the nearest support is a series of 50% levels at $1795.00, $1787.90 and $1780.50. These levels are followed by $1768.30 and $1747.40.

Daily Swing Chart Technical Forecast

The direction of the December Comex gold market early Monday is likely to be determined by trader reaction to $1795.00.

Bullish Scenario

A sustained move over $1795.00 will indicate the presence of buyers. The first upside target is $1800.00.

Taking out $1800.00 with strong volume could trigger an acceleration to the upside with $1815.50 the next potential target.

Bearish Scenario

A sustained move under $1795.00 will signal the presence of sellers. This could trigger a break into $1787.90. Buyers could come in on the first test of this level. If it fails then look for the selling to possibly extend into the next 50% level at $1780.50.

The 50% level at $1780.50 is a potential trigger point for an acceleration into another 50% level at $1768.30.

- END -

Market dynamics, global insight, daily analysis - All in WikiFX.Download and enjoy it now!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The U.S. dollar index and U.S. Treasury yields rebounded at the same time; gold fell by more than 1%!

The initial value of the US S&P Global Manufacturing PMI in August was 48, which was lower than expected and the lowest in 8 months; the service PMI was 55.2, which exceeded the expected 54. The number of initial jobless claims in the week ending August 17 was 232,000, slightly higher than expected, and the previous value was revised from 227,000 to 228,000. Existing home sales in July increased for the first time in five months. The PMI data was lower than expected, which was bad for the US eco

The U.S. dollar index returned to the 103 mark; gold once plunged nearly $40 from its intraday high!

The monthly rate of retail sales in the United States in July was 1%, far exceeding expectations; the number of initial claims last week was slightly lower than expected, falling to the lowest level since July; traders cut their expectations of a rate cut by the Federal Reserve, and interest rate futures priced that the Federal Reserve would reduce the rate cut to 93 basis points this year. The probability of a 50 basis point rate cut in September fell to 27%. The data broke the expectation of a

Gold Price Stimulates by Geopolitical Tension

Gold prices experienced their largest gain in three weeks, driven by escalating tensions in the Middle East and the easing of the U.S. dollar as markets await the crucial CPI reading due on Wednesday. Gold has surged to an all-time high above $2,460, as uncertainties surrounding developments in both the Middle East and Eastern Europe persist push the demand for safe-haven assets higher.

Types of gold: How to build a gold investment plan

As investors seek stability and diversification in their portfolios, especially in uncertain economic periods, gold stands out as one of the best options. How many types of gold exist? Before diving into golden investments, it's crucial to grasp the various forms that gold can take.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

Become a Full-Time FX Trader in 6 Simple Steps

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator