简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Institutions turn to DeFi with over $260 billion in TVL as Bitcoin demand weakens

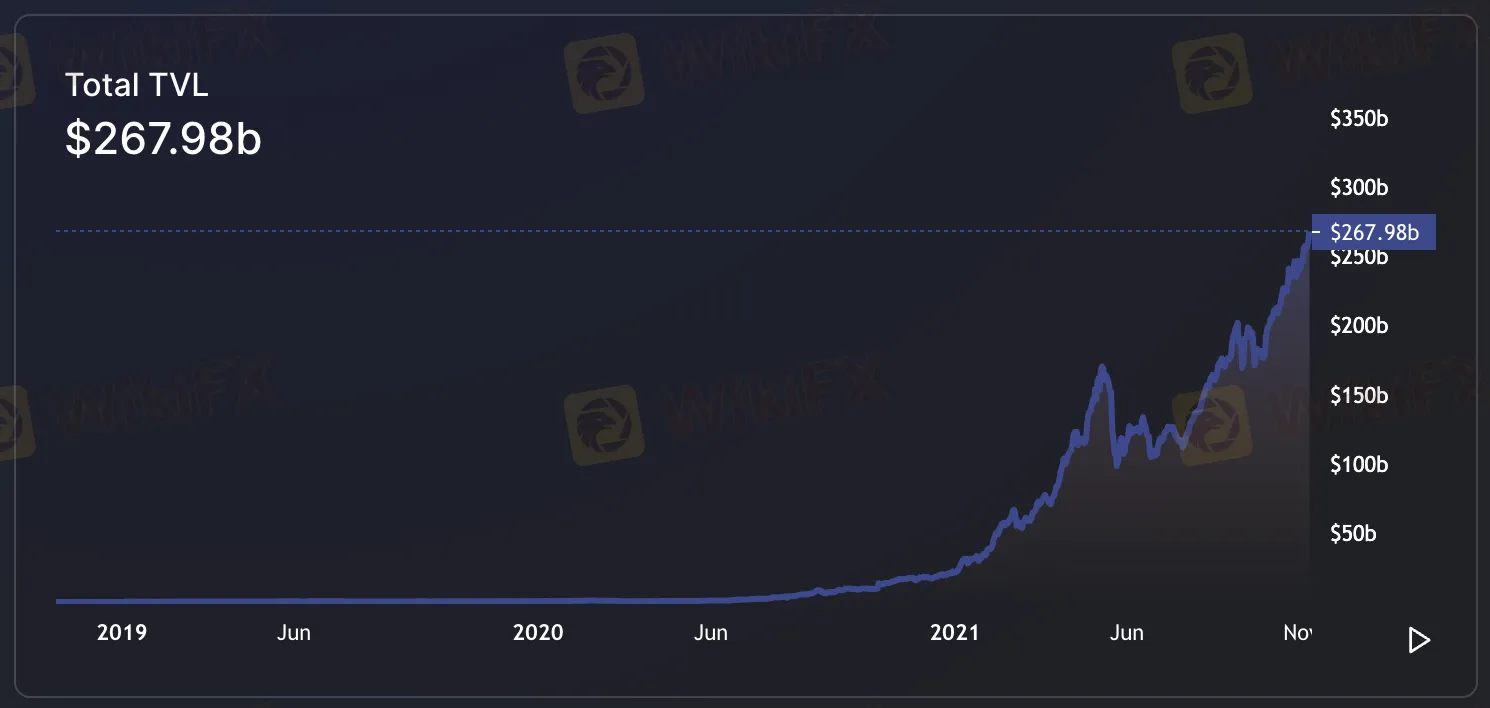

Abstract:The total value locked among DeFi protocols has reached an all-time high at $267 billion.

Institutions turn to DeFi with over $260 billion in TVL as Bitcoin demand weakens

The total value locked among DeFi protocols has reached an all-time high at $267 billion.

A growing number of institutions have been dabbling in the DeFi space as a recent report noted a greater appetite in ETH used to borrow and lend across Dapps.

The demand for Bitcoin has trended downward in Q3 as there was a lack of opportunities for traders.

Decentralized finance has resumed its growth recently as the cryptocurrency market proceeded with rallies in the past few weeks, with a total value locked (TVL) reaching an all-time high at $267 billion. According to a recent report, Bitcoin demand has slowed down in the third quarter due to the lack of opportunities for traders to profit.

DeFi expands as Bitcoin lacks behind

Following the tremendous Bitcoin rally in October, the TVL in DeFi surpassed $260 billion, according to DeFillama. Protocols that support the DeFi ecosystem, including Ethereum, Solana, and Avalanche have also seen a considerable climb in their prices. Solana recently reached a record high at $260.

Daily transactions have also soared on the DeFi protocols, including PancakeSwap, which runs on the Binance Smart Chain. The network witnessed a rise in active users to above 600,000, with the number of active addresses on the protocol soaring to 2 million.

According to the Q3 report by Genesis, the number of institutions entering the DeFi industry has been growing. There has been an increase in appetite for Ether from large companies to borrow and lend across various decentralized applications (Dapps).

This could also be due to a “significant structural change” in the cryptocurrency market, as retail exchanges started to deleverage. During the second quarter of 2021, several digital asset exchanges limited their leverage offerings, including Binance which reduced its levels to a maximum of 20x for accounts that have been opened for less than a month.

Genesis further highlighted a decline in the weighting of Bitcoin in its overall portfolio due to the lack of BTC-denominated trading opportunities. While interest in the leading cryptocurrency witnessed a downturn, emerging Layer-1 protocols including Solana have witnessed a boost in demand, serving as natural liquidity pairs for DeFi yield opportunities.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator