简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex Trading hours for Nigerian Traders

Abstract:The Nigerian Forex traders have got an added advantage to participate in the Forex market in the two dominant trading sessions such as the London and New York sessions. This is because the Nigerian time zone readily aligns with these two time zones. Nigerians can therefore trade the market comfortably from 6:00am in the morning (or even earlier for those willing to join the Asian session) till 10:00pm at night which is when the New York session ends and the market itself at this point closes for the day across the three different time zones. Often, we experience a one hour break before the market reopens again for the Asian session. The next resumption for trading for Nigerians who are willing to sacrifice their night sleep is from 11:00am which marks the beginning of the Asian session.

By: Damian Okonkwo

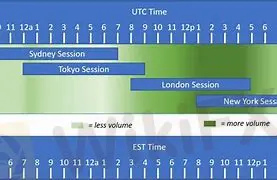

The Forex Market is open for trading 24 hours a day, 5 days a week and 20 - 22 days a month. There are however three dominant sessions in the Forex market. We which shall consider below.

The three dominant trading sessions.

There are basically three dominant trading sessions for trading the Forex Market known as:

A. London Session

B. New York session

C. Tokyo and Sydney (Asian session)

The London Session begins at 7am Nigerian time which is 6:00am EST. The one hour difference is because Nigeria is one hour ahead of time EST time zone. The London session is often seen as the busiest time in the market as it comprises all the European Union countries and most African countries participating in the market at the same time. Thus it could be is said that the greatest number of traders are often present at this point. The Nigerian time equally overlaps with the New York session too.

The next session after the London time is the New York time comprising all the United States, Canada and North America. This session usually begins at 11:00am Nigerian time. During this session.

The greatest trading volumes and market movement is often witnessed within this interval when the London market and New York market overlap. Often occurring from 11:00am to about 6:00pm Nigerian time.

The final session is the Tokyo and Sydney session (ASIAN session) occurring from 11:00am to about 11:00 am Nigerian time. The Asian market is a very volatile moment often for GOLD and Silver as these continent are the greatest dealers on these commodities.

Finally, expert traders consider 10AM EST to be the best time for trading as this is the period when the London market and then New York market interact with the Asian traders just exiting the market at this point. Hence, we often experienced the greatest market movement during this time, offering a very good opportunity for quick profit making.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

Swissquote Review 2025: Live and Demo Account to Explore

Swissquote is a unique online broker with a solid banking background in Switzerland. As a forex-focused platform, it provides one of the most respective range in the industry, over 80 currency pairs in major, minor and exotic. Notably, Swissquote offers different trading conditions for traders from Switzerland, Europe, Middle East, Hong Kong, South Africa, and other regions, and traders at Swissquote can enjoy the benefit of trading with its well-regulated brand and entities. Besides, Swissquote offers excellent research offerings along with its product offerings.

Webull: A Comprehensive Review from Accounts to Withdrawal 2025

Webull Financial stands as a digital trading platform founded in 2017, offering commission-free trading across multiple asset classes including stocks, options, ETFs, cryptocurrencies, and forex. The platform targets primarily intermediate traders seeking a balance of analytical tools and straightforward execution capabilities. While Webull provides robust charting tools and an intuitive mobile experience, its forex offering remains at industry average levels with certain limitations in currency pair selection compared to some other forex brokers.

Quotex Review 2025:Live & Demo Accounts, Withdrawal to Explore

Quotex is an online trading platform specializing in digital options, offering access to various assets, including currencies, commodities, and cryptocurrencies. It operates with a proprietary web-based platform. The platform's user interface, while basic, is generally functional, and the availability of numerous short-term trading options may appeal to those seeking rapid trading opportunities. While it presents a user-friendly interface and a low minimum deposit, it's important to note that the regulatory landscape surrounding Quotex involves offshore registration, which may present different levels of investor protection compared to more strictly regulated financial jurisdictions.

WikiFX Broker

Latest News

TriumphFX: The Persistent Forex Scam Draining Millions from Malaysians

2025 SkyLine Guide Thailand Opening Ceremony: Jointly Witnessing New Skyline in a New Chapter

Safety Alert: FCA Discloses These 11 Unlicensed Financial Websites

Unbelievable! Trump to 'Sell US Green Cards'?

Massive Crypto Scam in Philippines: Education Pioneer Wealth Society Exposed

GQFX Trading Review 2025: Read Before You Trade

WikiFX Community Ramadan Charity Creator Program

Arab Trading Market Stunned by this Scam! Know about it & Beware

Skype announces it will close in May

DOJ Investigates LIBRA Memecoin Scam: $87M Lost by Investors

Currency Calculator