简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

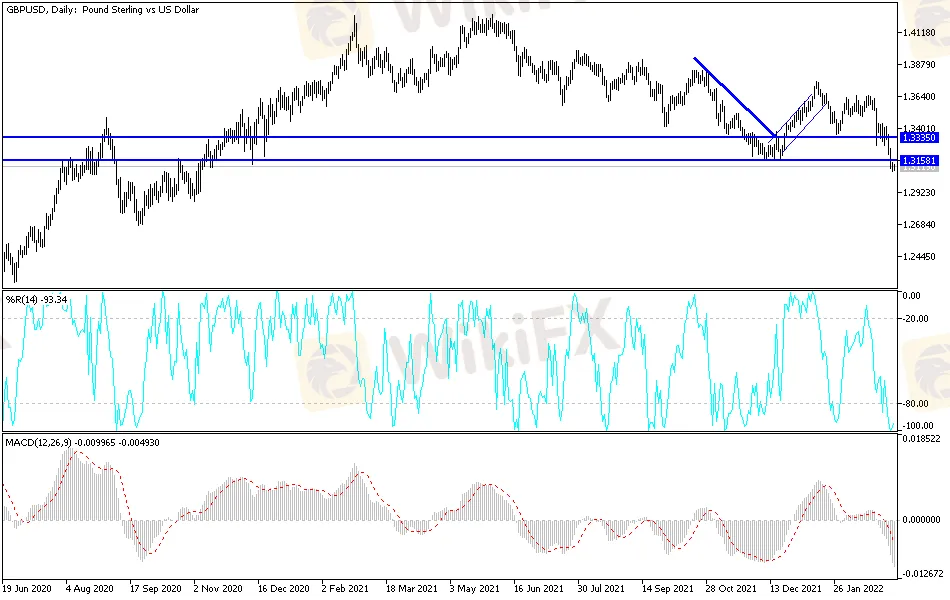

GBP/USD Technical Analysis: Bearish Momentum Remains

Abstract:Sterling remains vulnerable to further losses against the dollar if geopolitical tensions remain elevated. Investors are betting that the Federal Reserve will embark this month on a series of interest rate increases. Due to the current concern, the GBP/USD fell to its lowest level since November 2020 at 1.3081 before settling around the 1.3120 level at the time of writing. Analysts say that more losses are likely.

Investors are betting that the Federal Reserve will embark this month on a series of interest rate increases. Due to the current concern, the GBP/USD fell to its lowest level since November 2020 at 1.3081 before settling around the 1.3120 level at the time of writing. Analysts say that more losses are likely.

The dips in the British pound come despite the more upbeat investor tone on Tuesday. The shares were bought amid relief that Western countries do not appear bent on banning Russian energy and that Ukraine and Russia are preparing for more negotiations on Thursday. However, this market remains nervous, driven by headlines related to the war in Ukraine, which means that any weakness in the dollar is likely to be superficial.

The British pound is one of the worst performing currencies in the G10.

The invasion of the war caused a negative shock to the valuation of the pound sterling as it was the third worst performing currency in the G10 when it was examined over the past month. There will likely be further underperformance as the conflict continues. By contrast, the US dollar has been one of the main beneficiaries and will continue to outperform if investors continue to divest and lower global growth expectations.

Although Russia is a relatively small economy, it is an important supplier of basic commodities to the global economy. Disruptions in commodity supplies as a direct result of the war and as an indirect result of the sanctions have pushed up commodity prices since late February. Neighboring European countries are the victims of the war due to their increasing dependence on Russia for energy supplies: due to the conflict gas prices have risen to new highs this week and this will increase inflationary pressures on consumers in the Eurozone and the United Kingdom.

Meanwhile, oil prices rose at the start of the week in aggressive market conditions as traders fear a boycott or ban on Russian energy by the United States and the European Union

By selling the Euro and Sterling markets, markets are betting that the European Central Bank and the Bank of England will ease the speed at which they intend to raise interest rates, depriving their currencies of support against the US dollar. This is because the US is less exposed to conflict and markets are confident that the Fed will raise rates in March and will continue to do so throughout the remainder of the year.

According to the technical analysis of the pair: The general trend of the GBP/USD currency pair is still bearish and attempts to exit the current bearish channel will not succeed without moving above the 1.3335 resistance so far, the bears are still determined to break the psychological support 1.3000, especially if the Russian war continues and impose more of the international sanctions, which impede the efforts of global economic recovery.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

Why Should Women Join FX Market?

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator