简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/CAD Rate Reverses Ahead of January Low to Defend 2022 Opening Range

Abstract:USD/CAD halts the series of series of lower highs and lows from the previous week after depreciating for nine consecutive sessions, and the exchange rate appears to be defending the opening range for 2022 as it reverses ahead of the January low (1.2450).

CANADIAN DOLLAR TALKING POINTS

USD/CAD RATE REVERSES AHEAD OF JANUARY LOW TO DEFEND 2022 OPENING RANGE

USD/CAD extends the rebound from the monthly low (1.2465) as the Greenback appreciates against all of its major counterparts, and the exchange rate may track the yearly range over the coming months as both the Federal Reserve and Bank of Canada (BoC) plan to further normalize monetary policy in 2022.

It seems as though the Federal Open Market Committee (FOMC) will adjust its exit strategy as Chairman Jerome Powell acknowledges that the central bank could “move more aggressively by raising the federal funds rate by more than 25 basis points,” and it remains to be seen if the BoC will do the same as Deputy GovernorSharon Kozicki insists that “the timing and pace of further increases in the policy rate, and the start of QT (quantitative tightening), will be guided by the Banks ongoing assessment of the economy and its commitment to achieving the 2% inflation target.”

Deputy Governor Kozicki went onto say that “the pace and magnitude of interest rate increases and the start of QT to be active parts of our deliberations at our next decision in April” while speaking at the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference, and it seems as though the BoC will unveil a more detailed exit strategy as “the Bank will use its monetary policy tools to return inflation to the 2% target and to keep inflation expectations well anchored.”

Until then, USD/CAD may continue to retrace the decline from the monthly high (1.2901) as it defends the opening range for 2022, but the tilt in retail sentiment looks poised to persist as retail traders have been net-long the pair for most of the month.

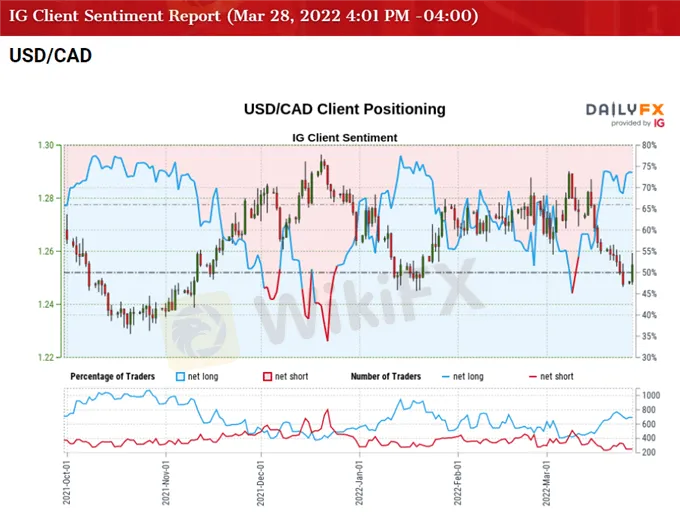

The IG Client Sentiment report shows 73.18% of traders are currently net-long USD/CAD, with the ratio of traders long to short standing at 2.73 to 1.

The number of traders net-long is 3.26% lower than yesterday and 5.54% lower from last week, while the number of traders net-short is 1.21% higher than yesterday and 13.19% lower from last week. The decline in net-long position comes as USD/CAD marks the longest stretch of decline since 2016, while the drop in net-short interest has fueled the tilt in retail sentiment as 65.85% of traders were net-long the pair last week.

With that said, USD/CAD may continue to extend the rebound from the monthly low (1.2465) as it snaps the series of lower highs and lows from last week, and the exchange rate may further retrace the decline from the yearly high (1.2901) as it defends the opening range for 2022.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator