简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asian Open: Germany reconsider Russian oil embargo

Abstract:Germany’s defence minister called for fresh discussions with the EU on banning Russian gas imports.

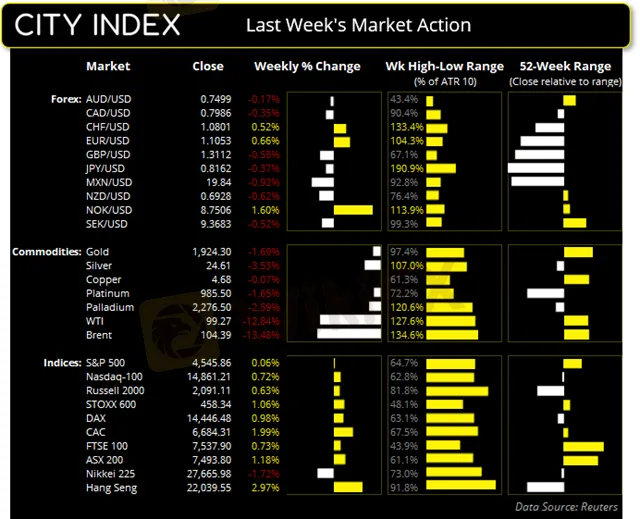

US Friday close:

The Dow Jones rose 139.87 points (0.4%) to close at 34,818.27

The S&P 500 rose 15.45 points (0.35%) to close at 4,545.86

The Nasdaq 100 rose 22.719 points (0.15%) to close at 14,861.21

Asian Indices:

Australias ASX 200 index closed at 7,493.80 on Friday

Japan's Nikkei 225 index closed at 27,665.98 on Friday

Hong Kong's Hang Seng index closed at 22,039.55 on Friday

China'sA50 Index closed at 14,009.59 on Friday

European Friday close:

UK's FTSE 100 index rose 22.22 points (0.3%) to close at 7537.9

Europe's Euro STOXX 50 index rose 16.16 points (0.41%) to close at 3918.68

Germany's DAX index rose 31.73 points (0.22%) to close at 14446.48

France's CAC 40 index rose 24.44 points (0.37%) to close at 6684.31

Wall Street posted minor gains last week after handing back the baulk of their initial gains over on Thursday, before recovering slightly into Fridays close. Bearish hammers formed on the Nasdaq, Dow Jones and S&P 500 on the weekly chart which shows exhaustion at the highs on this timeframe. That we saw a rise in volumes on Thursday yet they had remained below average during the supposed rally raises an alarm for bull. As does the fact the S&P500 failed to hold above 4600 and the Nasdaq failed to hold above 15,000.

Trading exchanges in mainland China and Hong Kong are closed today and tomorrow for the China Meng Festival.

Germany reconsider their stance on oil embargo

Commodities were broadly lower on Friday thanks to ongoing peace talks between Russia and Ukraine. The Thomson Reuters CRB index moved down to a 2-week low, brent futures stopped just shy of falling to $100 whilst brent closed at $99.27. However, we may see a reversal of some of these moves due to the weekend news flows.

Germany began indicating they may be willing to consider banning Russian gas in light of evidence of genocide in Ukraine. Their defence minister called for sanctions on Russia during a televised interview on Sunday, although the Economic Minister raid during a separate interview that whilst Germany was reducing its dependence on Russian oil, it could not wean itself off it right away. Separately, on Friday Germany have also said they may be able to ration power if the standoff continues.

ASX 200:

The ASX 200 rose for a third consecutive week but couldnt quite close the week above 7500, after a 2-day pullback heading into the weekend. It remains a ley level to monitor this week.

ASX 200: 7493.8 (-0.08%), 03 April 2022

Materials (1.33%) was the strongest sector and Telecomms (-1.46%) was the weakest

4 out of the 11 sectors closed higher

7 out of the 11 sectors closed lower

4 out of the 11 sectors outperformed the index

126 (63.00%) stocks advanced, 64 (32.00%) stocks declined

Outperformers:

+15.79% - Lake Resources NL (LKE.AX)

+11.64% - Core Lithium Ltd (CXO.AX)

+8.49% - Allkem Ltd (AKE.AX)

Underperformers:

-5.36% - Perseus Mining Ltd (PRU.AX)

-4.84% - IDP Education Ltd (IEL.AX)

-4.14% - Reece Ltd (REH.AX)

EUR and CHF were the strongest major last week, although it was a volatile ride for bulls and bears and their gains only accounted for around a third of their weekly range. This means trading conditions were also choppy for currencies, along with indices and commodities. USD/JPY hit our 123 target, but only after it pulled back to 121 which was just above our invalidation point. However, a 3-week bullish reversal pattern called a morning star formation has formed.

Quiet calendar in Asia today ahead of RBA tomorrow

The Australian dollar is the strongest major currency so far in 2022. The RBA hold their monetary policy meeting tomorrow and markets have priced in a 30% chance of a hike, down from 36% chance last week. Markets having now priced in a cash rate of 1% by September, with the first hike to come in June, the RBA continue to push back on such an aggressive trajectory with the war in Ukraine adding a “new source of uncertainty” and floods in NSW and VIC are less than ideal. Given the overall strength of the Australian economy and the fact that fear of nuclear war has lessened to that of a month ago we should be on guard for a slightly less dovish

RBA at tomorrows meeting.

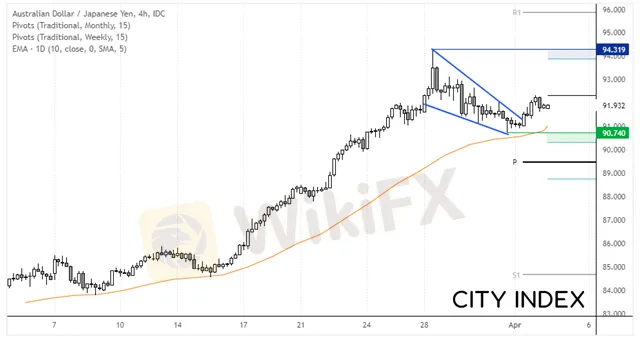

Bullish wedge in play on AUD/JPY

AUD/JPY formed a bullish engulfing candle on Friday after finding support at its 10-

day eMA on Thursday. It pulled back around -3.8% from last weeks high to low, so perhaps the corrective low is in place.

We can see on the hourly chart that prices have broken out of a falling wedge pattern, which projects a target at its 94.32 high. Prices are beneath the weekly pivot point so perhaps we‘ll see a pullback today, but as long as it is a low volatility retracement we’re keen to explore bullish setups whilst prices hold above the 10-day eMA (orange line). A break above 92.33 assumes bullish continuation and brings 94 into focus, near the weekly R1 pivot and last weeks high.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Libertex Review 2025: Live & Demo Accounts, Withdrawal to Explore

Founded in 2012, Libertex is a Cyprus-based online broker providing both investment and trading services. They offer access to over 350 instruments, including CFDs and real stocks. Libertex has become a popular choice among retail investors, largely due to its competitive trading costs, robust trading platform, a 100% welcome bonus for new clients (subject to certain deposit requirements and trading activity), and the availability of fractional shares. However, notably, Libertex does not currently offer copy trading functionality and its educational resources are somewhat limited.

JustMarkets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Established in 2012, JustMarkets (Formerly JustForex) is an online forex broker based in Cyprus and serves clients in over 160 countries. Featuring a low entry barrier, a 50% deposit bonus, and robust trading platforms -MT4 and MT5, JustMarkets has gained great popularity among retail investors in recent years. JustMarkets allows traders to trade over 260 CFD-based instruments, which is not an extensive range, yet on leverage up to 3000:1 to increase trading flexibility. To enhance the trading experience, both MT4 and MT5 are provided, along with JustMarkets Trading App, MetaTrader Mobile App, and MetaTrader WebTerminal. JustMarkets offers a 50% deposit bonus to boost traders' confidence. Opening an account is a fully online process, typically completed within one day.

CM Trading Review 2025: Accounts, Demo Account and Withdrawal to Explore

CM Trading is a South Africa-based online broker operating for 10 years, providing trading on Forex, Commodities, Indices, Stocks, and some Cryptos. Among many forex broker options in South Africa, CM Trading struggles to be the popular one due to its high costs for live accounts and wide spreads. Instead, it is considered an expensive broking. To open a live account, traders need to fund at least $299, less friendly to beginners. However, CM Trading compensates for this by offering large amounts of bonuses up to $150,000. Notably, CM Trading does not provide any popular copy trading solutions.

FBS Review 2025: Accounts, Withdrawals & Trading Platforms to Explore

FBS, more of an A-Book broking company, offers trading services through its three entities in Belize, Australia, and Europe, respectively. With the FBS platform, traders can get access to over 550 CFD-based instruments, including Forex, Indices, Energy, Stocks and Cryptocurrency through the FBS App and MetaTrader suite—MetaTrader 4 and MetaTrader 5. FBS's shining features, an extremely low entry barrier from $5 and its generous leverage up to 3000:1, attract active traders the most. competitor However, FBS does not provide tiered account options, only one live account offered for all investors, but opening an account here is quick and easy. FBS's copy trading solution—FBS Copytrade, while once available, isn't as user-friendly or prominently featured as those offered by competitors, closed in 2022, restricting beginners' access to simpler trading approaches.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

Why Should Women Join FX Market?

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator