简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Enforcement Directorate raids JSPL premises for 'forex rule violation'

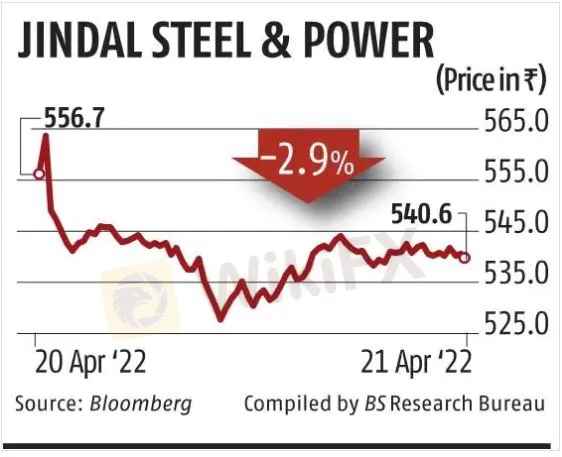

Abstract:Jindal Steel shares plunged 6 per cent to a three-week low in their biggest fall since mid-March

The Enforcement Directorate (ED) on Thursday carried out searches at multiple premises of Jindal Steel and Power Ltd (JSPL) and also places linked to its chairman, Naveen Jindal, for possible violations of forex rules, said officials of the agency.

“There are two-three separate cases going on under the Foreign Exchange Management Act (FEMA). Some are related to its (JSPL‘s) owner/promoter’s bank accounts overseas,” an official privy to the case told Business Standard.

Sleuths searched locations in Delhi and Gurugram. They will cover some more places and the searches will continue for a day or two, an official said.

Digital records, laptops, and documents have been taken into possession for scrutiny, another person said.

Sources said the federal agency had inputs from a financial intelligence unit about accounts opened abroad and also some bits of information related to a recent transaction, a source said, without giving detail.

A statement by a spokesperson for JSPL to the exchanges read: We would like to bring to your notice that our office premises in Delhi and Gurugram have been visited today by the officials from ED for seeking business related information, which is being provided to them.

“We would like to reiterate here that the Company has an exemplary track record of corporate governance and disclosing the required information to the regulator and will continue to do so.”

JSPL, along with Tata Steel, JSW Steel, SAIL, and Nippon Steel India, is a key steel manufacturer in India.

Jindal Steel shares plunged 6 per cent to a three-week low in their biggest fall since mid-March.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Twin Scam Alert: Broker Capitals is a New Domain of Finex Stock

This week, the Italy financial regulator CONSOB issued a warning against an unlicensed broker named Broker Capitals. When we clicked on Broker Capitals' website, its logo, trade name, and design seemed familiar to us.

Berkshire CEO-designate Abel sells stake in energy company he led for $870 million

Berkshire Hathaway Inc said on Saturday that Vice Chairman Greg Abel, who is next in line to succeed billionaire Warren Buffett as chief executive, sold his 1% stake in the company’s Berkshire Hathaway Energy unit for $870 million.

Paying particular heed to payrolls

A look at the day ahead in markets from Alun John

Dollar extends gains against yen as big Fed hike bets ramp up

The dollar extended it best rally against the yen since mid-June on Monday, buoyed by higher Treasury yields after blockbuster U.S. jobs data lifted expectations for more aggressive Federal Reserve policy tightening.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

ED Exposed US Warned Crypto Scam ”Bit Connect”

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

Currency Calculator