简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Would you choose VT Markets for investment?

Abstract:In this article, WikiFX provides inquiry services in the forex field and evaluates the reliability of VT MARKETS based on the facts.

In this article, WikiFX provides inquiry services in the forex field and evaluates the reliability of VT MARKETS based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

Table of Contents

1. General Information of VT MARKETS

2. Regulatory Status

3. Special survey about VT MARKETS from WikiFX

4. Conclusion

To explore whether VT MARKETS is a scammer or not, we evaluated this broker from different aspects, such as regulatory status, field investigation, etc.

General Info of VT MARKETS

VT MARKETSs general info has been shown below:

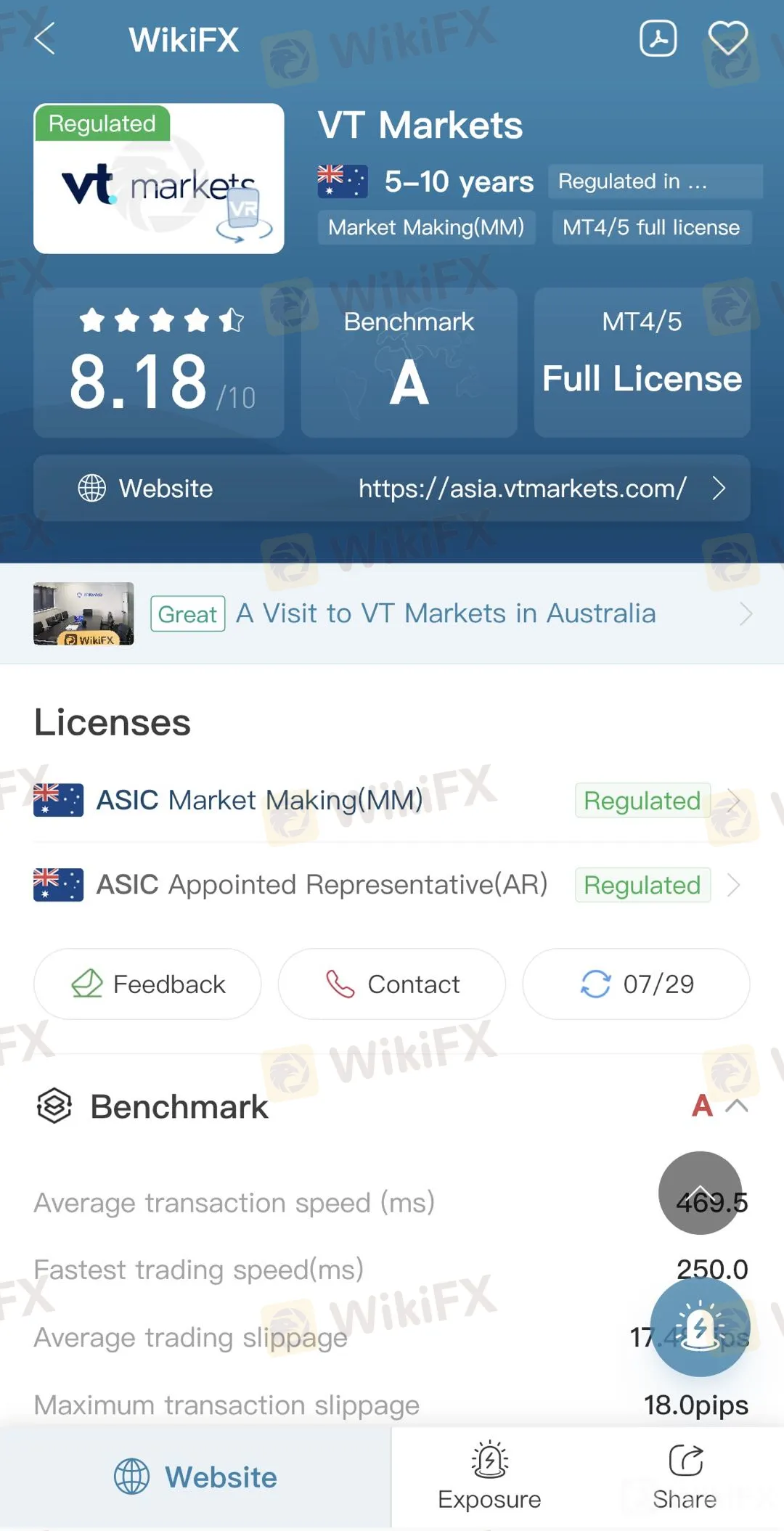

(source: WikiFX)

About VT MARKETS

VT Markets is an Australia-based subsidiary of VT Markets LLC (VIG), bringing more than 10 years of experience and expertise in global financial markets to offer easy and transparent market access and help its clients pursue their financial goals.

Trading Instruments

The marker range includes access to trading instruments, however, only CFDs and Forex. CFDs include Indices, Energy Soft Commodities, Precious Metals, US and HK Share CFDs. Cryptocurrencies also can be traded the same way as major currencies. Overall, the broker covers the most demanding markets to trade, however, popular asset classes like real stocks or ETFs are not available.

Account types

VT Markets offers two account types with STP and ECN execution models accordingly available through MT4 or MT5 platforms. Along with some diversification between the proposal, some differences between the pricing model may take place as well, so be sure to check the most suitable one for your need.

Leverage

Due to multiple regulations from various jurisdictions, VT Markets broker falls under particular regulatory restrictions which may apply differences between the offered leverage. Therefore, trading through the global/offshore entities of VT Markets you may enjoy high leverage levels up to 1:500 for major currency pairs. For the Australian clients the leverage remains the broker allows the following:

- 30:1 for forex

- 20:1 for stock index CFDs

Trading Platforms

VT Markets offers its traders the official MetaTrader mobile apps, allowing you to trade anywhere, anytime. EAs are allowed for all styles of automated traders. The ones who hold multiple accounts the integrated software tool Multi Account Manager (MAM) is the great and available solution, which lets placing of large orders in bulk with speed and no limitation. The VT Markets MetaQuotes WebTrader intuitive design is identical to the MetaTrader desktop version and enables access to your trading account without the need for the platform to be downloaded or installed on your computer

Deposit & Withdrawal

VT Markets clients having various options to fund a trading account, a number of ways including domestic bank transfers, international bank transfers, BPAY, Skrill, Neteller, Broker to Broker transfer, POLi, fasapay, and credit or debit card payments. VT Markets clients can also deposit with Bitcoin. Withdraw funds on VT Markets supporting various payment options and VT Markets does not charge internal fees for electronic deposits or withdrawals. Some additional methods may charge fees important to note with your payment provider in case any charges are waived for processing.

2. Regulatory Status

VT MARKETS is a regulated broker. It currently holds a Market Making(MM) license with License No. 428901 and an Appointed Representative(AR) license with License No. 001260828 from the Australia Securities & Investment Commission (ASIC).

(source: WikiFX)

Holding a license means that the broker is recognized and regulated by the regulatory authority, therefore your money is under the protection to some extent. Whether a forex brokerage firm holds a legitimate license or not is one of the important factors to evaluate the reliability of forex brokers.

3. Special survey about VT MARKETS from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments, etc |

| Risk Management index: the degree of asset security |

VT MARKETS has been given by WikiFX a decent rating of 8.18/10.

(source: WikiFX)

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make an on-site survey on VT MARKETS in November 2019 and successfully found their office.

(source: WikiFX)

4. Conclusion

It is no doubt that VT MARKETS is a regulated broker. If you are seeking a broker now, you may consider this broker since it has experience of more than 5 years, although some other brokers in the forex market are also as good as VT MARKETS. Or you can download the WikiFX APP to find the most trusted broker for yourself. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en).

Click on VT MARKETS's WikiFX page for details

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Can Forex Traders Learn from Ne Zha?

The animated blockbuster Ne Zha: Birth of the Demon Child tells the story of Ne Zha’s journey to defy fate and take control of his own destiny. Beyond being an inspiring tale filled with action and character growth, the film conveys profound life lessons - many of which resonate deeply with the world of forex trading.

The Dark Side of Social Media Investments: How a Manager Lost RM2.08 Million

A Malaysian company manager suffered financial losses amounting to RM2.08 million after becoming the victim of an investment scam promoted through Facebook.

Crypto-to-Cash Transfers Now Available for UK and Europe

Crypto-to-Cash transfers are now available for UK and Europe users through the eToro platform, enabling them to transfer crypto-assets to their wallets and convert them into cash for trading and investment.

Unlocking the Power of Algo Trading: Benefits and Limitation

Algorithmic trading merges speed, data, and automation—but can it outsmart human intuition and market chaos? Explore its power and pitfalls.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator