简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

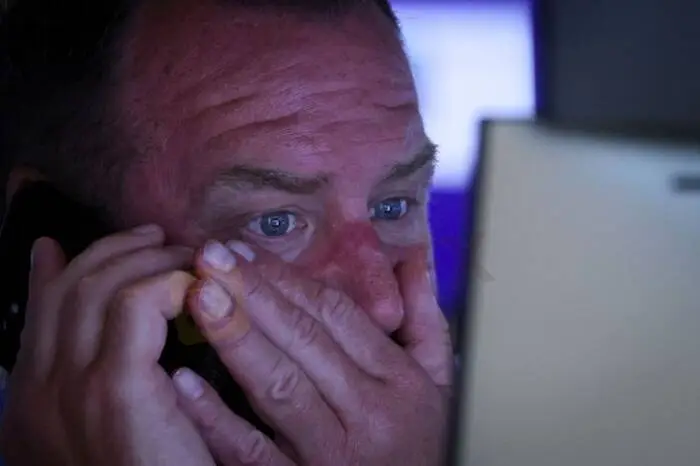

Marketmind: When bad news sounds good

Abstract:A look at the day ahead in markets from Anshuman Daga. After a strong set of mostly upbeat earnings reports from both sides of the Atlantic last week, stock bulls will now want macro data to disappoint.

While the Fed has hiked interest rates by 225 basis points points already this year as it fights the worst inflation in four decades, disappointing economic news could force it to slow down, providing relief to jittery markets.

The Fed, the White House and economists all say that the economy is not in recession based on broader measures of activity, but Treasury yields are pricing in bad news.

U.S. 10-year Treasury yields fell 33 basis points in July, marking the largest monthly decline since March 2020.

As August kicks off with manufacturing surveys from around the world, theres hope for the bond and stock bulls.

Asian equities started Monday on a weak note, with Chinas factory activity contracting unexpectedly in July as virus flare-ups cloud the outlook for demand.

Japans manufacturing activity also expanded at the weakest rate in 10 months in July.

The tepid growth outlook hit oil prices after they ended last month with their second straight monthly losses for the first time since 2020.

U.S. stock futures traded lower in Asia after both the S&P 500 and Nasdaq posted their biggest monthly percentage gains since 2020.

On the corporate front, banking titan HSBC sought to woo investors with a higher profitability target and bullish dividends outlook, while pushing back on a proposal by its top shareholder to split Europes biggest bank.

Meanwhile, U.S. House speaker Nancy Pelosi began her tour of four Asian countries but did not mention Taiwan amid intense speculation she might visit the self-ruled island claimed by China.

Key developments that should provide more direction to markets on Monday:

Economic data – July global PMI final – across the world, Germany June retail sales, US July ISM (manufacturing)

Major earnings: HSBC, AXA and Heineken

Chinas factory activity contracts unexpectedly in July as COVID flares up –

Evergrande offers sweetener for debt revamp as China property crisis worsens

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator