简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is RCG MARKETS a dependable broker?

Abstract:Is RCG Markets worthy to invest in? For more information about RCG Markets and their offer please check the following WikiFX review.

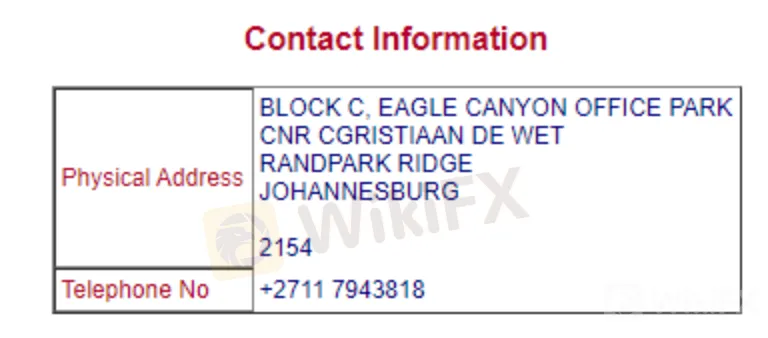

RCG Markets (rcgmarkets.com) has been attracting the attention of investors recently. It claims to be a forex broker based and regulated in South Africa. It advertises a broad product range, a choice of four account types, and a market-leading trading software.

The question is whether the broker is really safe to trade with and will such an offer suffice your needs? For more information about RCG Markets and their offer please check the following WikiFX review.

First let's search “RCG Markets” on WikiFX to take a look at the details page. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/1493567572.html), RCG Markets is licensed by the South African financial regulator, the Financial Sector Conduct Authority (FSCA). However, the broker exceeds the business scope regulated by FSCA (license number: 49769), and it has been given by WikiFX a low rating of 3.34/10. WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

WikiFX did check in the online registry and can confirm that the company behind the brand, RCG Markets (Pty) Ltd., is licensed by the Financial Sector Conduct Authority (FSCA) in South Africa.

Although the trading environment in South Africa is safer and better than those in offshore zones like Seychelles, Marshall Islands or Saint Vincent and the Grenadines, it cannot be compared to the regulatory regimes in the EU, UK, and Australia.

For example, South African brokers aren‘t required to keep their clients’ funds in segregated accounts, nor to provide negative balance protection. They do not have to comply with any restrictions on leverage or trading bonuses, participate in compensation schemes, nor report on open and closed trades.

In other words, a license with the FSCA is better than nothing, but it doesnt have much value, especially if you are not a South African resident.

WikiFX also paid a visit to the broker's website to find out more. RCG Markets provides access to the Metatrader 4 platform – that is quite good, as MT4 is revered as the industry standard when it comes to trading software. It has earned that title with powerful automated features, a clean interface and much more.

However, the brokers demo web MT4 gave us a EUR/USD spread of 2 pips fixed, which is not that good of a spread. Most legit brokers provide spreads of less than 1.5 pips and some go even below 1.0 pips for this pair.

What's more, there is also something to be said about the leverage that RCG Markets offers – 1:2000 on RCG Classic Account, 1:1000 on both RCG ECN Account and RCG RAW, and 1:500 on RCG BONUS 30.

This might be a bit much for retail traders. Most regulatory bodies have banned the provision of such leverage as too risky for them, but the FSCA is not one of them. Also, sometimes high leverage can be the case you are dealing with an unlicensed broker – not here, obviously, but seeing such amounts in the wild warrants caution!

WikiFX also did some research on the brokers activity on social media. As of August 4th, 2022, RCG Markets does have official accounts on major social websites - Facebook & Instagram, and it is updating posts on these two sites.

Many investors on social media speak highly of RCG Markets:

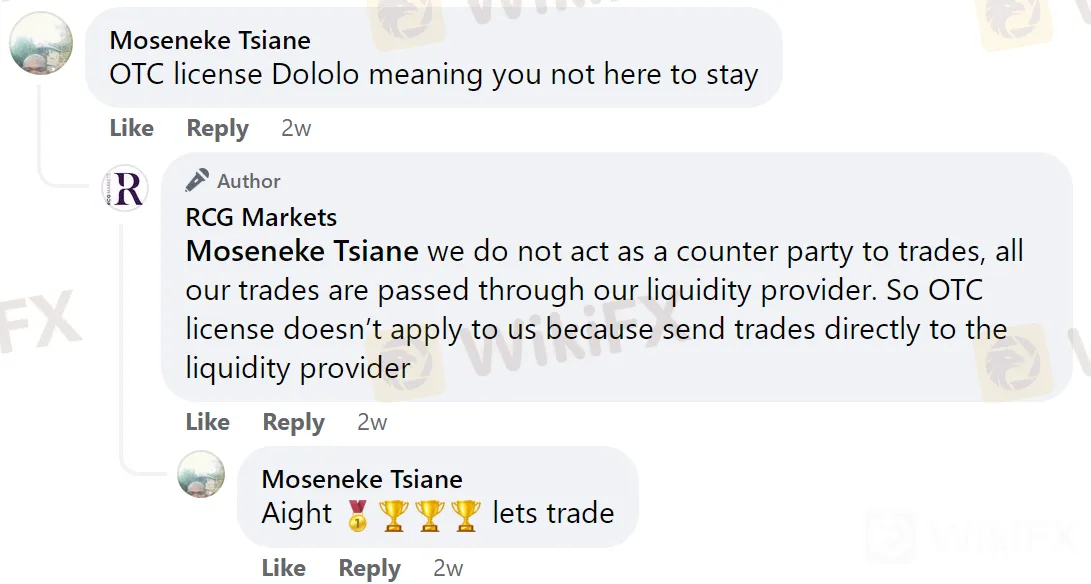

The broker responds to questions from traders in time:

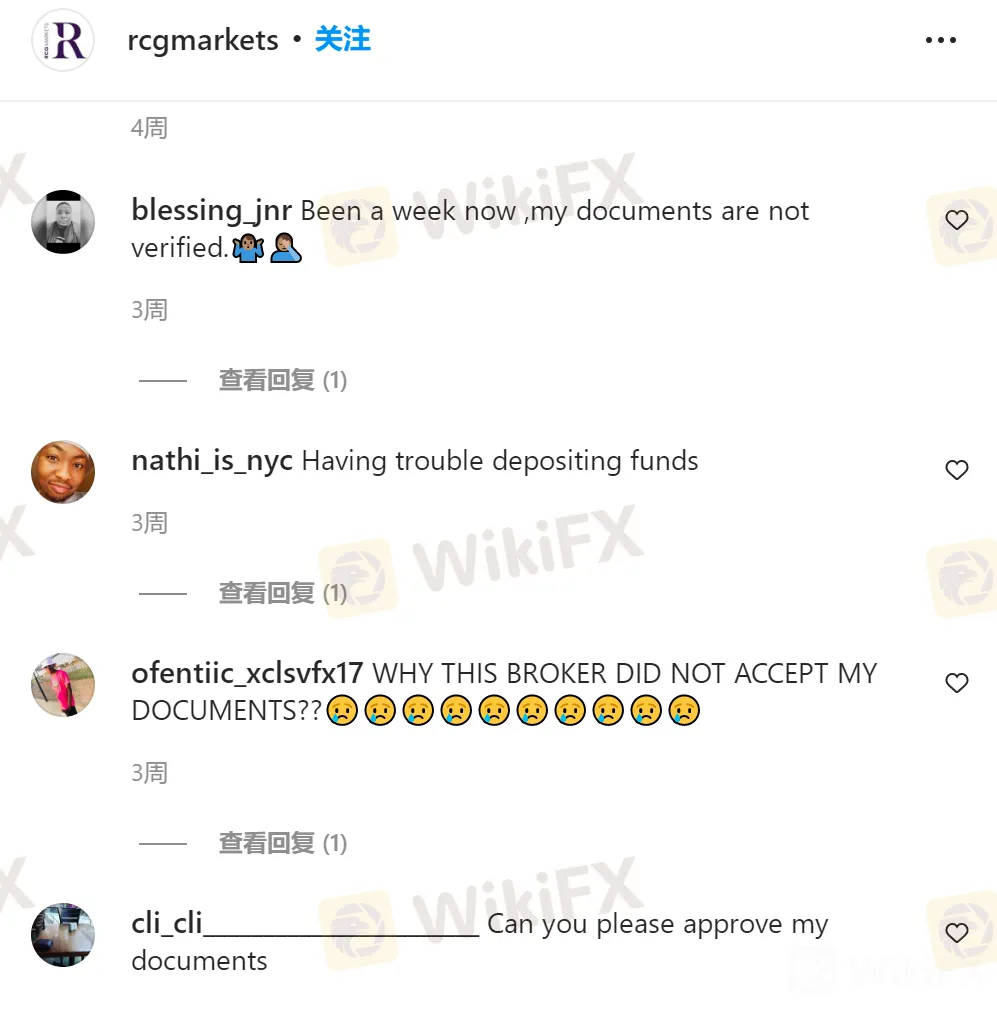

However, some investors complain that the broker is slow at verifying accounts & documents and that they have trouble depositing funds:

In conclusion, in spite of the fact that RCG Markets is regulated by the South African FSCA and that the broker seems to have some popularity on social media, it does not mean that it is absolutely safe for investors to trade with the broker. Traders should think carefully and cautiously before deciding whether to choose RCG Markets for investment or not.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

The worlds of social media and decentralized finance (DeFi) have converged under a new banner—SocialFi. Short for “Social Finance,” SocialFi leverages blockchain technology to reward user engagement, giving individuals direct control over their data and interactions. While SocialFi has primarily emerged in the context of content creation and crypto communities, its principles could soon revolutionize the forex market by reshaping how traders share insights and monetize social influence.

Do This ONE Thing to Transform Your Trading Performance Forever

The story is all too familiar. You start trading with high hopes, make some quick profits, and feel like you've finally cracked the code. But then, just as fast as your gains came, they disappear. Your account balance dwindles, and soon you’re left wondering what went wrong. Worse still, fear and confusion creep in, making every new trade a stressful gamble rather than a calculated decision. If this cycle sounds familiar, you’re not alone.

This FREE App Is Helping Millions Avoid Financial Scams

Fraudulent brokers, Ponzi schemes, and deceptive trading platforms are on the rise, making it increasingly difficult to distinguish between legitimate and illicit financial services. Fortunately, there’s a powerful, free tool designed to help users identify and avoid scams before it’s too late—WikiFX.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator