简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Warning: The FCA Flags HobitalFxTrade as a Fraud

Abstract:An unregulated forex broker will not follow the industry's practices, and thus investors are likely to lose their money.

HobitalFxTrade (HobitalFxTrade.com) is a completely unknown website claims to be “one of largest forex brand”. Additionally, it is claiming to offer a trusted and secure trading platform. But fact-checking confirms that the company is a scam website that has already attracted the attention of the FCA.

An unlicensed UK-based company

HobitalFxTrade claims it is one of the world's leading Forex CFD provider and is providing fair and transparent Forex trading to active traders, but actually it has no authorization to do so.

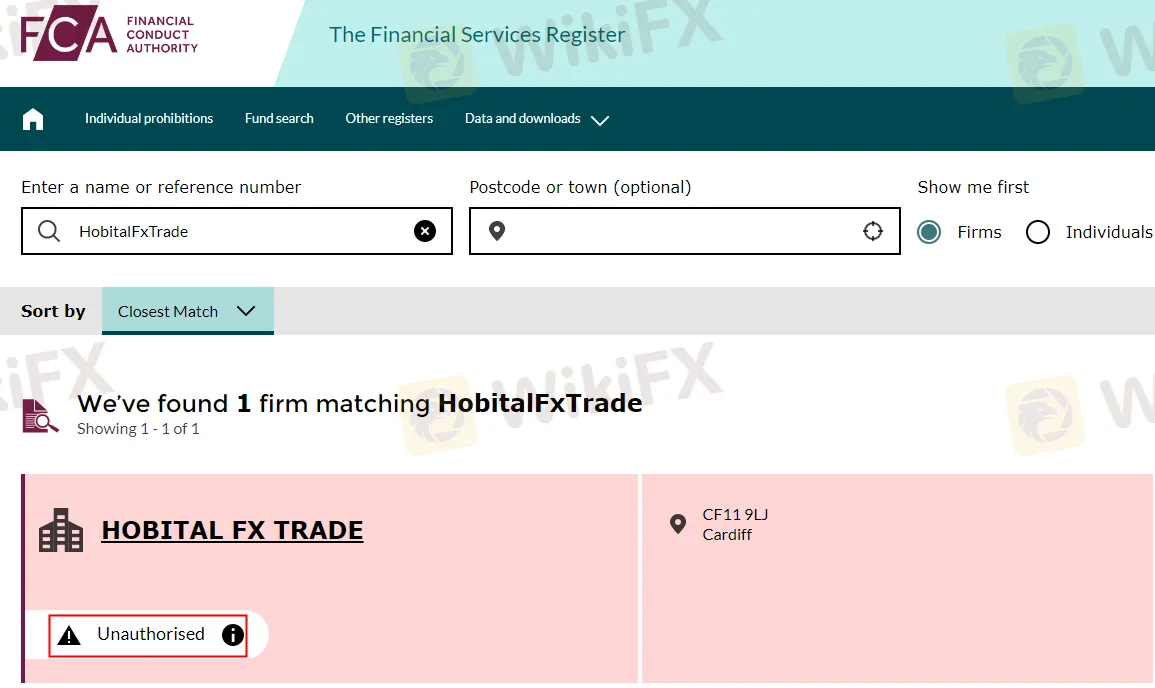

It presents no regulatory information. Headquartered in the UK, the entity must be registered and regulated by the FCA. But no result matched with HobitalFxTrade was found on the regulator. Instead, we only found an unauthorised record.

The FCA flags HobitalFxTrade as a scam

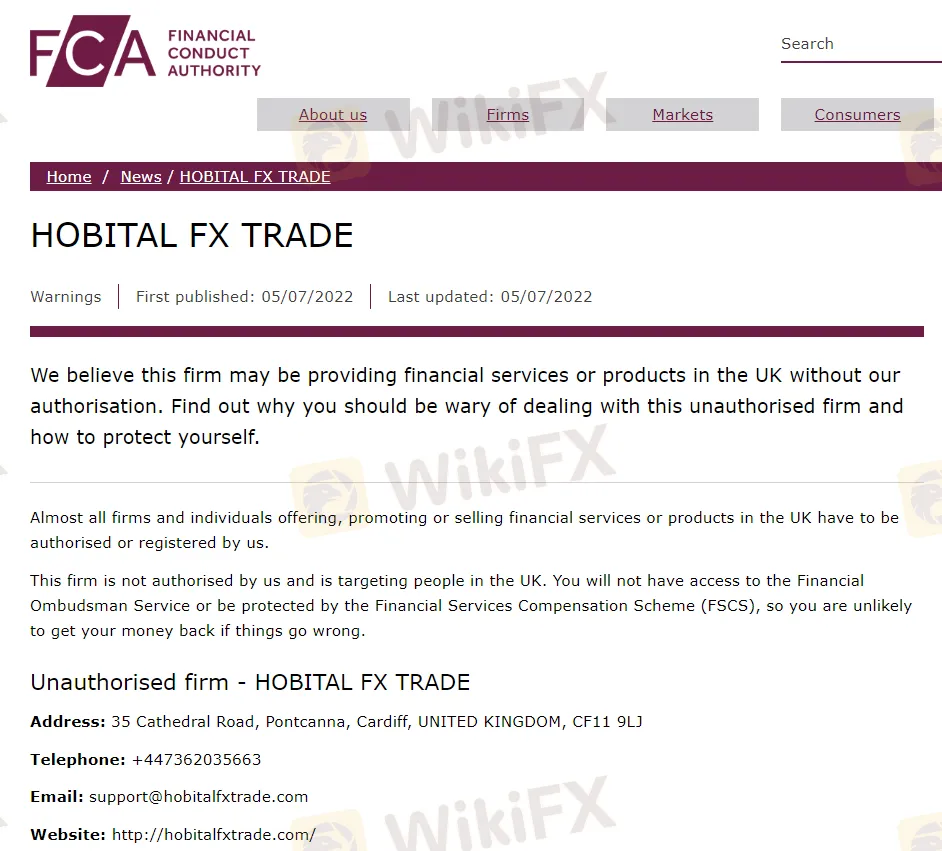

On 5 July 2022, the financial watchdog added HobitalFxTrade to its alert list, saying that this firm is not authorised by it and is targeting people in the UK.

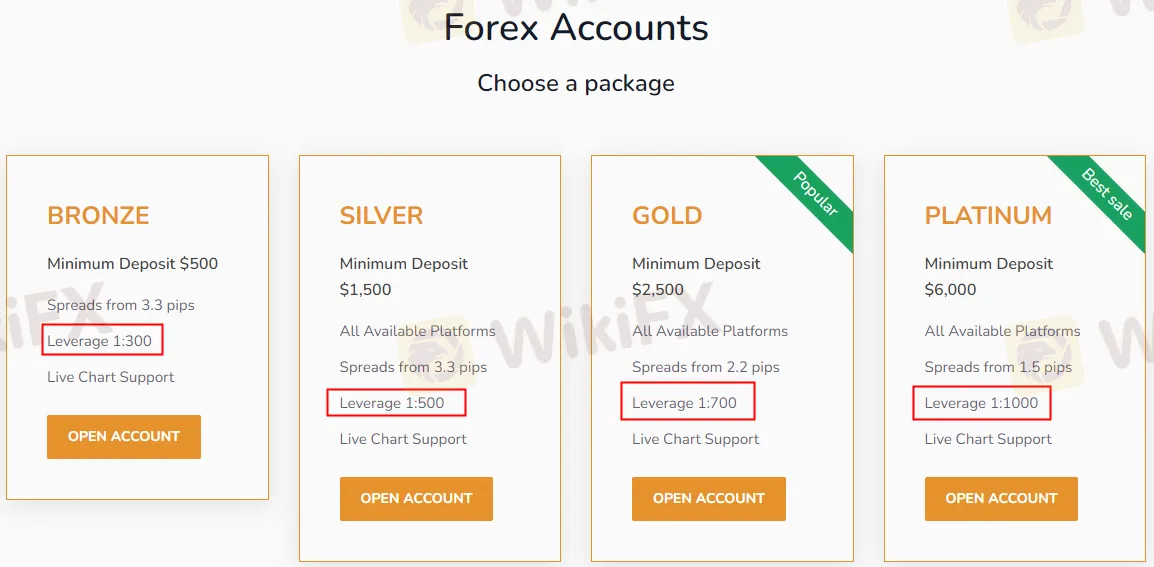

Forex accounts with leverage up to 1:1000

As you can see, HobitalFxTrade provides four types of forex trading accounts, with leverage ranging between 1:300 and 1:1000. According to the laws and rules of the UK financial authority, it is not possible for a UK-regulated broker to have such risky levels of leverage.

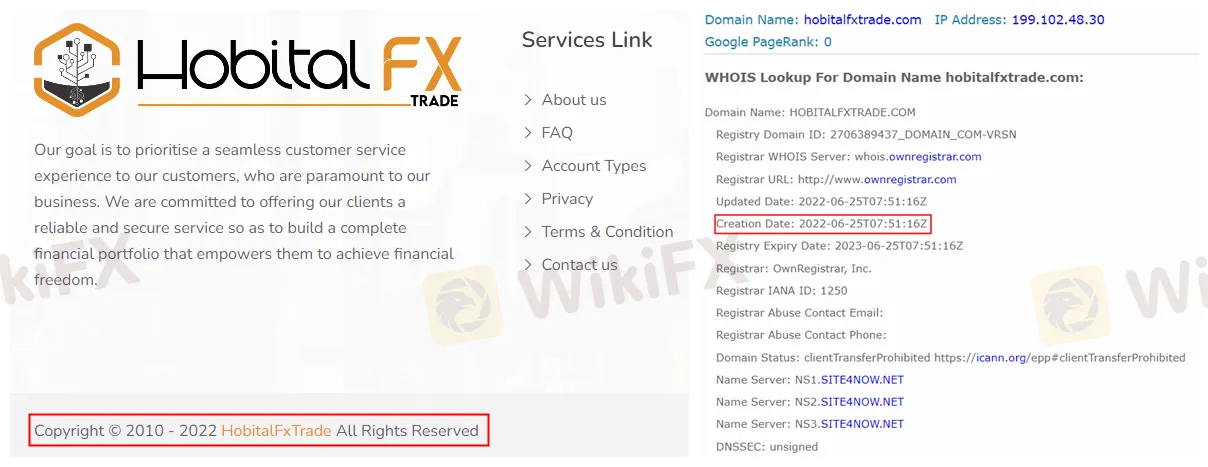

Misleading copyright info

Its page footer shows Copyright © 2010 - 2022 HobitalFxTrade All Rights Reserved, but its domain (https://hobitalfxtrade.com/) was actually created just a few days ago. It is obviously a sign of a scam.

An unregulated broker is clearly not authorized to operate in any regulated country.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Shocking! Trump to Double Tariffs on Canada!

Trump announced a tariff hike on Canadian steel and aluminum to 50%, shaking the markets. The Canadian stock market took a hit, the Canadian dollar plummeted, and U.S. steel and aluminum stocks surged, triggering strong reactions from all sides.

Good News for Nigeria's Stock Market: Big Gains for Investors!

Nigeria’s stock market kicked off the trading week with strong momentum, boosting investor assets by ₦52 billion. Market confidence is high, creating a rare investment boom!

Olymp Trade Review 2025: Is It Safe to Trade With?

Founded in 2014, Olymp Trade has been operating for over a decade, expanding its services and user base considerably, now offering focused trading in fixed-time trades (previously known as binary options in some regions) and Forex. Specifically, Olymp Trade operates two trading modes: fixed-time trades and forex mode. Fixed-time trades refer to trades with predetermined expiration times, where traders predict market movement directions. Payouts typically range from 70-90% of the investment amount. Forex Mode is a more traditional forex trading approach with variable leverage (up to 1:500 for experienced traders). At the same time, it allows for more sophisticated trading strategies with customisable take-profit and stop-loss orders.

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Gain gold trading insights as US CPI nears. Will $2,900 hold or break? Prepare with tariff and geopolitical factors in focus.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Currency Calculator