简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: Beware of Winnex-Prime Markets!!!

Abstract:The British regulator FCA issued a warning against Winnex-Prime Markets on September 6th!!!

Investors who are still trading forex at Winnex-prime Markets had better quit trading ASAP!!! Investors who have been deceived by this broker please contact WikiFX to help you recover your funds!!!

To make things straight from the very beginning, on our next screenshot you may check the recent warning on September 6th issued against Winnex-prime Markets (winnex-primemarkets.online) by the Financial Conduct Authority (FCA) in the UK. Take a look (source: https://www.fca.org.uk/news/warnings/winnex-primemarkets-online):

FCA believes that Winnex-prime Markets may be providing financial services or products in the UK without its authorization. Winnex-prime Markets is not authorized by FCA and is targeting people in the UK. Clients will not have access to the Financial Ombudsman Service or be protected by the Financial Services Compensation Scheme (FSCS), so you are unlikely to get your money back if things go wrong!

WikiFX also paid a visit to the broker‘s official website to learn more. Winnex-prime Markets claims to be based in the UK – one of the top locations for forex trading. The country’s financial authority, the FCA, is one of the strictest and most well-respected in the world. However, Winnex-prime Markets is an officially exposed scam! It was blacklisted by the FCA, confirming its unauthorized, meaning that all services advertised by Winnex-prime Markets are practically illegal!

According to the home page, Winnex-Prime Markets is a multi regulated broker, holding licenses from the FCA, ASIC, and the FSCA in South Africa.

The FCA license is obviously a lie, as has been discussed above. WikiFX made the effort to check the registers of ASIC and FSCA, but in vain – no company or broker by the name of Winnex-Prime Markets was to be found there:

Then we read the following on the footer of the website: “This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.”, which is basically a smart way for Winnex-Prime Markets to say that it is not regulated anywhere. Moreover, it is in direct oppositions to the previous regulatory statements. And so, there is no doubt that Winnex-Prime Markets is unlicensed and a risk to all! Do not invest here!

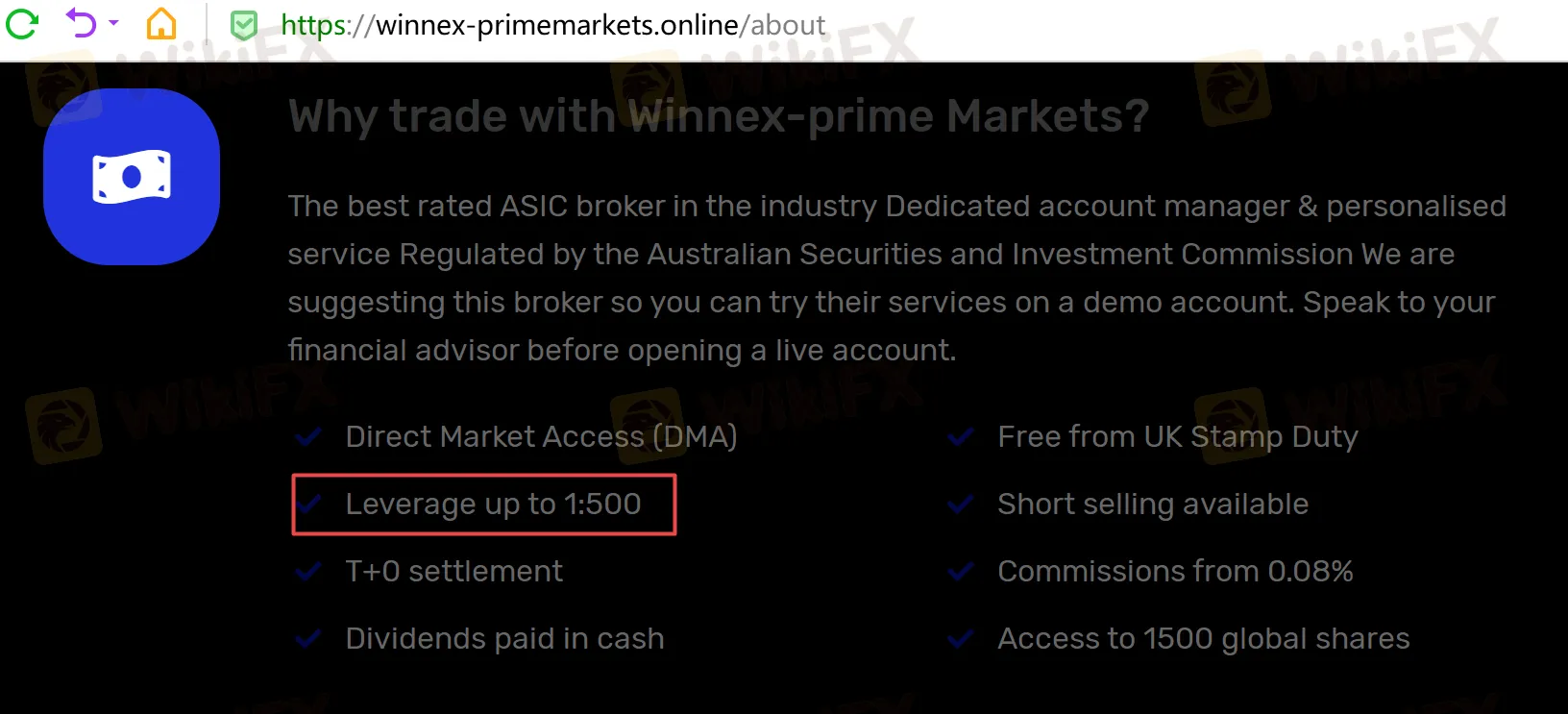

Furthermore, the leverage the broker claims, one of up to 1:500 is too much for the retail client. The Australian regulator ASIC has limited the leverage available to retail clients to up to 1:30. Despite this, Winnex-Prime Markets offers them amounts of up to 1:500, which means it cannot be ASIC-compliant.

As far as the minimum deposit with Winnex-Prime Markets is concerned, the firm sets that to $250, which is incredibly high. Legitimate brokers nowadays instead open accounts for no more than $10 – the so-called micro account. The reason scammers have high deposits, however, is because they wish to get their hands on all of the money you will throw their way! Therefore, a high entry cost could be a scam sign as well.

Now let's search “Winnex-Prime Markets” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/1646318978.html), Winnex-Prime Markets currently has no valid regulatory license and the score is rather negative - only 0.99/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

In a nutshell, it's not wise to invest in Winnex-Prime Markets. The so-called brokerage is nothing more than an outright scam, which is in the spotlight of a recent investigation by the British financial authorities, who have already blacklisted the website for targeting UK customers without proper authorization.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

How Reliable Are AI Forex Trading Signals From Regulated Brokers?

Discover how reliable AI Forex trading signals are and why using a regulated broker boosts their effectiveness. Learn key factors to evaluate accuracy and enhance your trading.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator