简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Ranking: The 10 Scam Brokers with the most traders’ complaints from July to September

Abstract:Exposure to scam brokers is always the priority of WikiFX, from July to September, WikiFX has received an overwhelming amount of exposures submitted by the traders. In today’s article, WikiFX lists 10 disrepute brokers by analyzing their target market, regulation status, type of exposure, and so on. Let's see what these brokers are.

The 10 Scam brokers have been listed below.

In this article, we will analyze these brokers based on four aspects: Target Markets, Regulation Status, Exposure, and Information on Twitter. The target Market is where the broker mainly runs its business. Regulation Status is to justify whether this broker is under the regulation of relevant authorities. A regulated broker is less likely to take your money away fraudulently as it is restricted by the law. When it comes to Exposure, in order to facilitate our targeted help, WikiFX divides complaints from investors into four types based on the victim's reason for complaining. They are withdrawal rejection, Scam, Slippery, and Others. And information on Twitter helps us understand a broker from the perspective of social media.

1. inception commercial limited

It is not the first time that inception commercial limited has been mentioned for its disrepute behavior. This broker is a no doubt scam broker. WikiFX has given this broker a very low rating of 1.06/10.

Target Market

On WikiFX's exposure page, we can see that the majority of complainants are from Hong Kong, China. It indicates that the dealer's main activities are in Hong Kong, China. There are also a small number of complaints from the United States.

Regulation Status

inception commercial limited lies that it has regulatory licenses all over the world. However, according to WikiFX, this broker is not regulated by any regulatory authorities. As an unregulated broker, inception commercial limited takes clients money away fraudulently and no one can hold it accountable.

Exposure

Within 3 months, WikiFX has received 106 complaints against this broker. In order to facilitate our targeted help, WikiFX divides complaints from investors into four types based on the victim's reason for complaining. They are withdrawal rejection, Scam, Slippery, and Others.

For this broker, the problem that the victims complained about the most is the withdrawal rejection.

Information on Twitter

On Twitter, all comments on Inception Commercial Limited are negative. Inception Commercial Limited announces that it is regulated by FINTRAC. But this broker had absconded with the money.

2. ITGFX

ITGFX is another scam broker on our list. WikiFX has received an overwhelming amount of complaints against this broker within 3 months. And we think this broker is getting involved in a Ponzi Scheme. WikiFX has given this broker a fairly low rating of 1.72/10.

Target Market

According to WikiFXs exposure database, the majority of victims are from Hong Kong, China. This means ITGFX is committed to doing business mainly in Hong Kong, China.

Regulation Status

This broker is not regulated, WikiFX considers this broker “Illegal”. Therefore, WikiFX has given this broker a low score of 1.72/10.

Exposure

The majority of the complaints we collected from the victims are related to “Unable to Withdraw”. It Sseems that blocking the withdrawal request is the typical trick that many scam brokers use.

Information on Twitter

According to Twitter messages, ITGFX falsely claimed that its system had been hacked, when it was actually running away with the money.

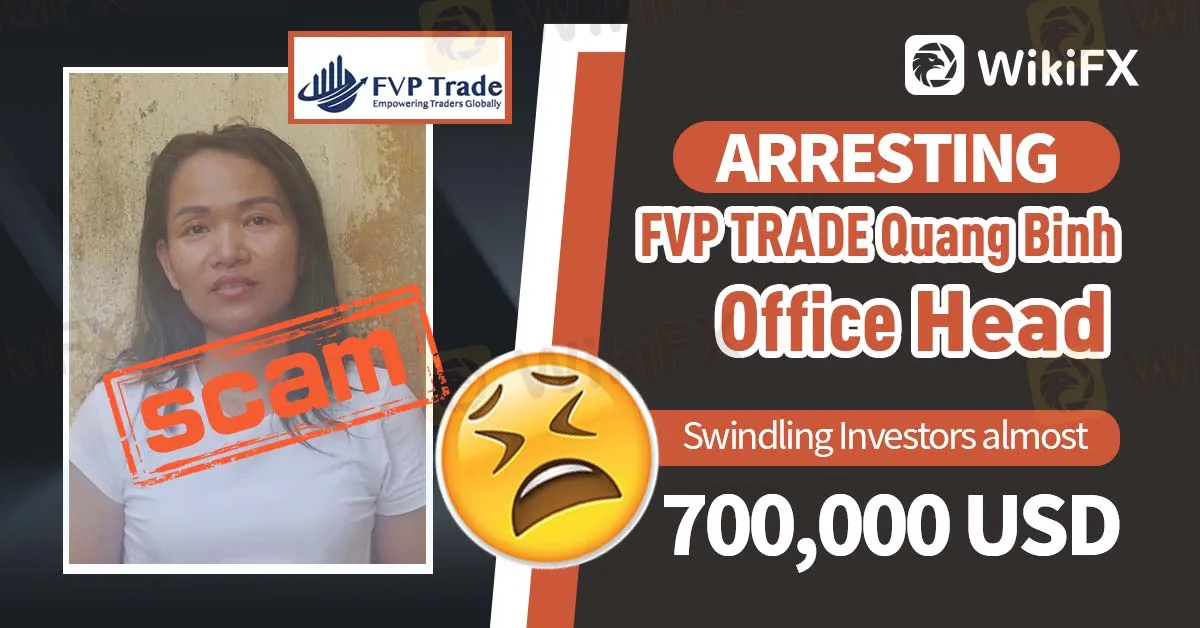

3. FVP Trade

In previous articles, FVP Trade is an online forex broker getting involved in a Ponzi Scheme. In the previous articles, we reported that this broker freezes clients accounts. We suspected this broker takes money away fraudulently. WikiFX has given this broker a fairly low score of 1.81/10.

Target Market

This Broker is primarily based in Hong Kong, as the vast majority of our exposure comes from that region. This indicates that FVP Trade has a large number of business activities in Hong Kong, and has caused dissatisfaction among many Hong Kong investors. FVP Trade also operates in Southeast Asia and North America.

Regulation Status

NFA (license number: 0536360) The regulatory status is abnormal, and the official regulatory status is Unauthorized.

This broker exceeds the business scope regulated by the United Kingdom FCA (license number: 956489).

Therefore, FVP Trade is not a regulated broker.

Exposure

The large number of complaints indicating that the broker is not allowing investors to withdraw has become very prominent. As we mentioned in an earlier post, the broker froze users' money. The number of complaints is predictable.

Information on Twitter

The information on Twitter about this broker is negative. Many victims still wait for FVP Trade to release their funds. For more information about this broker, please check the links below.

https://www.wikifx.com/en/newsdetail/202208042754308720.html

https://www.wikifx.com/en/newsdetail/202208088224392245.html

4. Lilium

Lilium, a trading name of LILIUM MARKETS LTD, is allegedly a financial company registered in the United Kingdom.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its trading assets, leverage, spreads, trading platforms, minimum deposit, etc. Lilium has been given by WikiFX a low rating of 1.43/10.

Target Market

The broker's main target market is also Hong Kong, China, where investors account for the vast majority of complaints.

Regulation Status

This broker is not regulated. The status of NFA and FCA licenses held by this broker is Unauthorized.

Exposure

The number of complaints received by WikiFX has reached 71 for this broker in the past 3 months. This broker has the problem of blocking clients withdrawal requests. In addition, Lilium also has other problems that angered clients, such as poor customer service.

Information on Twitter

LILIUM has been complained about by investors who are unable to withdraw their funds and are suspected to be on the verge of running away.

MultiBank Group Corporation has been operating since 2005 when its first company was registered in California (USA). WikiFX has given this broker a fairly low rating of 2.09/10.

Target Market

No surprise, this broker mainly runs its business in Hong Kong as well as we found out that the majority of complaints are from the victims in Hong Kong.

Regulation Status

This broker is not regulated by any regulatory authorities.

Exposure

The number of complaints received by WikiFX has reached 467 for this broker in the past 3 months. The main reason for these complaints is that this broker rejects clients withdrawal requests.

Information on Twitter

If you want to know more about this broker, we recommend you read the article via this link.

https://www.wikifx.com/en/newsdetail/202209154954705184.html

6. VOREX

VOREX is said to be established in Georgia in 2008, offerings its clients access to a series of financial markets, including Global Stocks, Cryptocurrency, Commodity Futures, and Forex VOREX provides its trading services to clients ranging from seasoned and novices to fund managers and institutional clients.

Target Market

The majority of the complaints come from Taiwan. There are also some complaints from Japan, Italy, the United States, Australia, and Hong Kong.

Regulation Status

This broker is not regulated. The regulatory status of AustraliaASIC (license number: 001296955) is abnormal, the official regulatory status is Revoked.

Exposure

The number of complaints received by WikiFX has reached 38 for this broker in the past 3 months. “Unable to withdraw” is the biggest problem that this broker has.

Information on Twitter

There is not much information about this broker on Twitter.

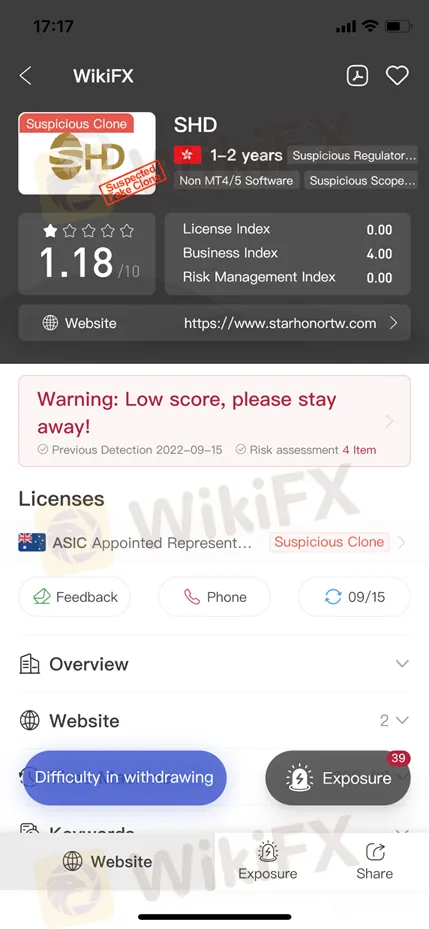

7. SHD

Established in 2000, Starhonor Development Limited is an online forex broker registered in Australia. This company opened its US branch in 2009 to provide brokerage services to clients. And in 2015, its business coverage expand to Shanghai, China. In 2019, Starhonor Development Limited developed an online trading platform, and in 2020, its Hong Kong office was set up.

Target Market

The target market of this broker is fragmented. This Broker is active in Europe, North America, Hong Kong, and Taiwan.

Regulation Status

This broker is not regulated. The AustraliaASIC regulatory (license number: 001293841) claimed by this broker is a suspicious clone.

Exposure

The number of complaints received by WikiFX has reached 40 for this broker in the past 3 months. Like other scam brokers, the major problem of this broker is blocking clients withdrawals.

Information on Twitter

There is not much information about this broker on Twitter.

8. TR

Since the official website of TR trading is currently inaccessible, we were only able to piece together a general picture of this company as a forex broker by gathering pertinent information from other websites

Target Market

From the above, we can see that TR is mainly running the business in Hong Kong.

Regulation Status

This broker is not regulated and has been considered a Ponzi Scheme.

Exposure

The number of complaints received by WikiFX has reached 212 for this broker in the past 3 months. Most of the investors complained that this broker refuses the withdrawal requests.

Information on Twitter

There is not much information related to this broker on Twitter.

9. WinterSnow Forex

WinterSnow Forex is an online forex and CFD broker getting involved in a Ponzi Scheme. Since its official website cannot be accessible for now, we were unable to obtain more information about its trading assets, minimum deposits, spreads and commissions, leverage, and more.

Target Market

This Broker does business worldwide. It tracks in North America, Europe, Southeast Asia.

Regulation Status

This broker is not regulated as it is a Ponzi Scheme.

Exposure

Recently we received a message that this broker freeze clients funds, causing a huge loss for the clients.

Information on Twitter

The information about this broker is negative on Twitter.

For more information about this broker, you can check the article via clicking the link below.

https://www.wikifx.com/en/newsdetail/202208111734949875.html

10. Seener Tech Limited

Seener Tech Limited is allegedly an online CFD broker that provides its clients with the industry-standard MT5 trading platform and low spreads on a variety of financial instruments.

Target Market

The majority of complaints we received is from Hong Kong.

Regulation Status

This broker is not regulated. WikiFX has marked this broker as “No License”.

Exposure

Many investors reported that this broker doesnt allow clients to withdraw.

Information on Twitter

The information about this broker on Twitter is negative.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

How Reliable Are AI Forex Trading Signals From Regulated Brokers?

Discover how reliable AI Forex trading signals are and why using a regulated broker boosts their effectiveness. Learn key factors to evaluate accuracy and enhance your trading.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

AI-Powered Strategies to Improve Profits in Forex Trading

Boost Forex profits with AI: predictive analytics, real-time automation, and smart risk management strategies for sharper trades and fewer losses.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator