简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Are Bearish and Bullish Markets?

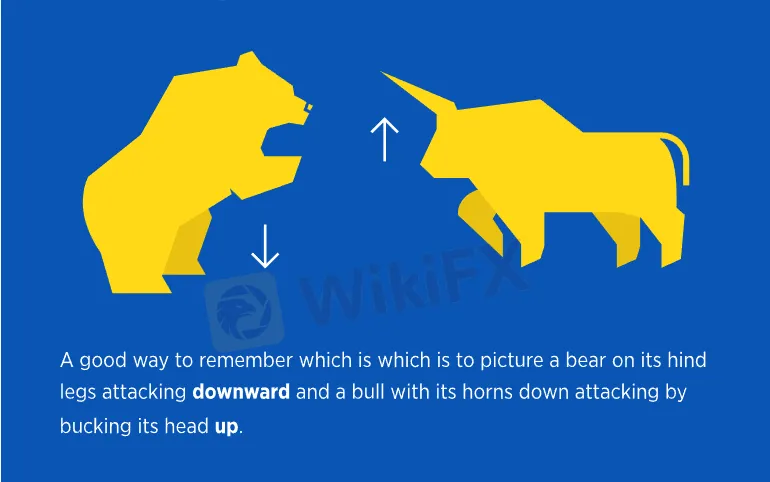

Abstract:Simply put, a bear market is one in which prices are heading down and a bull market is used to describe conditions in which prices are rising.

When the bulls reign in the market, people are looking to invest money; confidence is high and the acceptance of risk generally goes up.

This leads to rises in various markets – particularly in stock markets, but also in FX currencies such as the Australian dollar (AUD), Canadian dollar (CAD), New Zealand dollar (NZD), and emerging market currencies. Conversely, bull markets typically lead to a decline in safe-haven currencies such as the Japanese yen, the Swiss franc (CHF) and, in some cases, the U.S. dollar.

The U.S. dollar (USD) and Japanese yen (JPY) are safe-haven currencies and tend to strengthen in a bear market as riskier instruments are sold off and safe-haven currencies are in demand.

Why Does It Matter to You?

One of the key benefits of forex trading is the opportunity it offers traders in both bull and bear markets. This is because forex trading is always done in pairs, when one currency is weakening the other is strengthening thereby allowing you to take advantage of rising and falling markets.

Bull and bear markets are important to pay attention to as they can determine currency market trends. By being aware of market trends, can help you to make the best decisions of how to manage risk and gain a better understanding of when it is best to enter and exit your trades.

In a bull market, traders are looking to enter the market when prices are rising so that they can sell once they believe the market has reached its peak.What Happens in a Bear Market?

Bearish markets follow a downward trend as investors sell riskier assets such as stocks and less-liquid currencies such as those from emerging markets.

In a bear market, traders are looking to enter the market when prices are falling so that they can buy once they believe that market has reached its peak.

The U.S. dollar (USD) and Japanese yen (JPY) are safe-haven currencies and tend to strengthen in a bear market as riskier instruments are sold off and safe-haven currencies are in demand.

Why Does It Matter to You?

One of the key benefits of forex trading is the opportunity it offers traders in both bull and bear markets. This is because forex trading is always done in pairs, when one currency is weakening the other is strengthening thereby allowing you to take advantage of rising and falling markets.

Bull and bear markets are important to pay attention to as they can determine currency market trends. By being aware of market trends, can help you to make the best decisions of how to manage risk and gain a better understanding of when it is best to enter and exit your trades.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Anti-Scam Groups Urge Tougher Action on Fraudsters in UK

Anti-scam groups demand tougher police action on fraudsters as UK fraud rates surge 19%, targeting millions in a penalty-free crime spree exposed by a $35m scam leak.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator