简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: FCA Issued a Warning Against SMI TRADE !!!

Abstract:SMI TRADE was officially exposed as a scam by the British regulator FCA, which issued a warning against the brokerage. Blacklisted brokers are fraudulent and should be avoided no matter what!

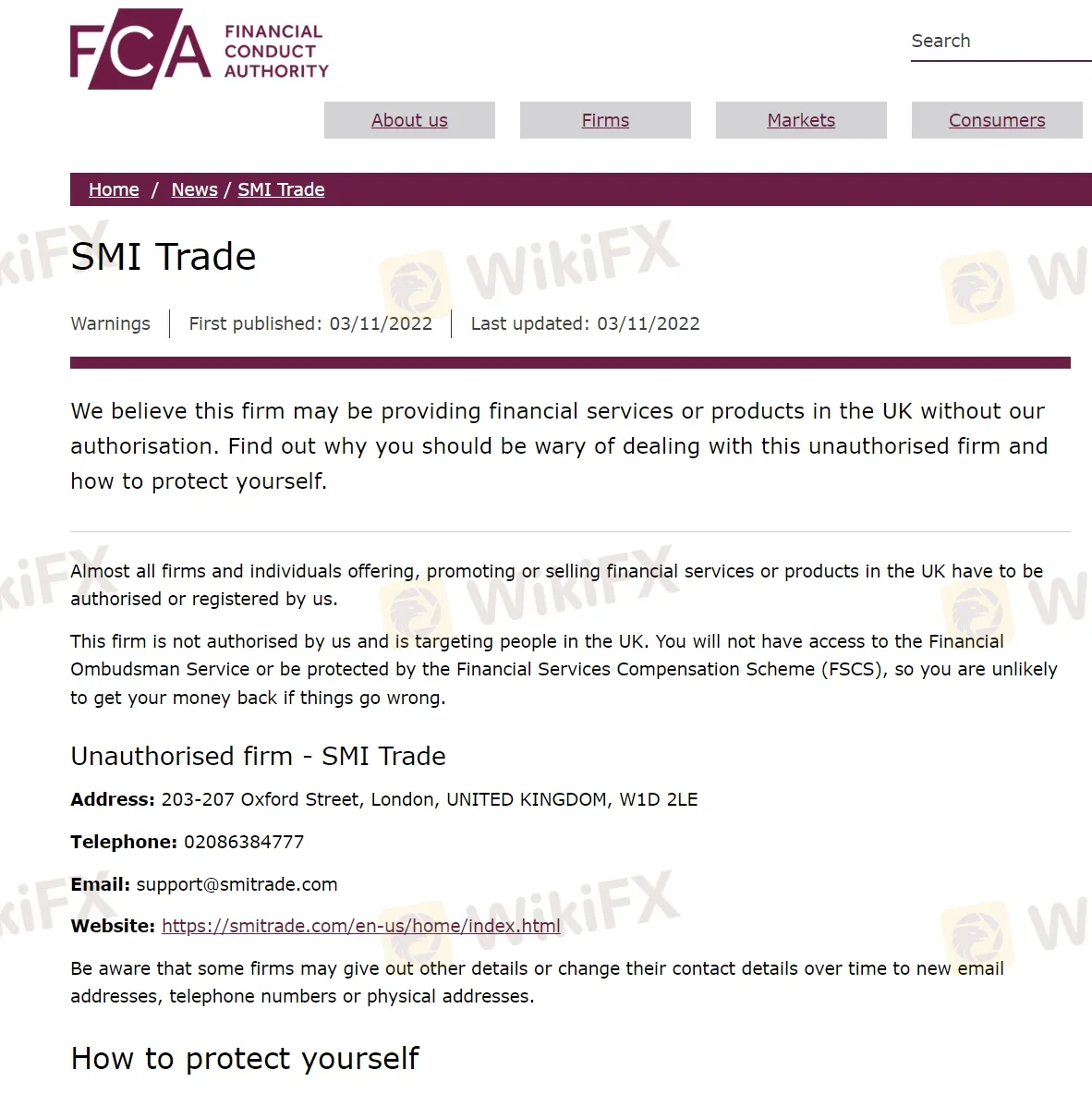

SMI TRADE has come to the attention of the Financial Conduct Authority in the UK, which warned on November 3th that SMI TRADE was not licensed but was providing financial services to the public in the UK. You can see the warning in the screenshot below.

“ This firm is not authorised by us but still was providing financial services to the public in the UK, the FCA says adding that you will not have access to the Financial Ombudsman Service or be protected by the Financial Services Compensation Scheme (FSCS), so you are unlikely to get your money back if things go wrong”.

The FCAs warnings prove with almost absolute certainty that a company is running some sort of scam – so refrain from enterprises that have received the negative attention of reputable financial authorities like the FCA. The only way to be sure that your investment is in good hands and that you would be treated fairly and in accordance with all laws would be to turn to a licensed, legitimate broker.

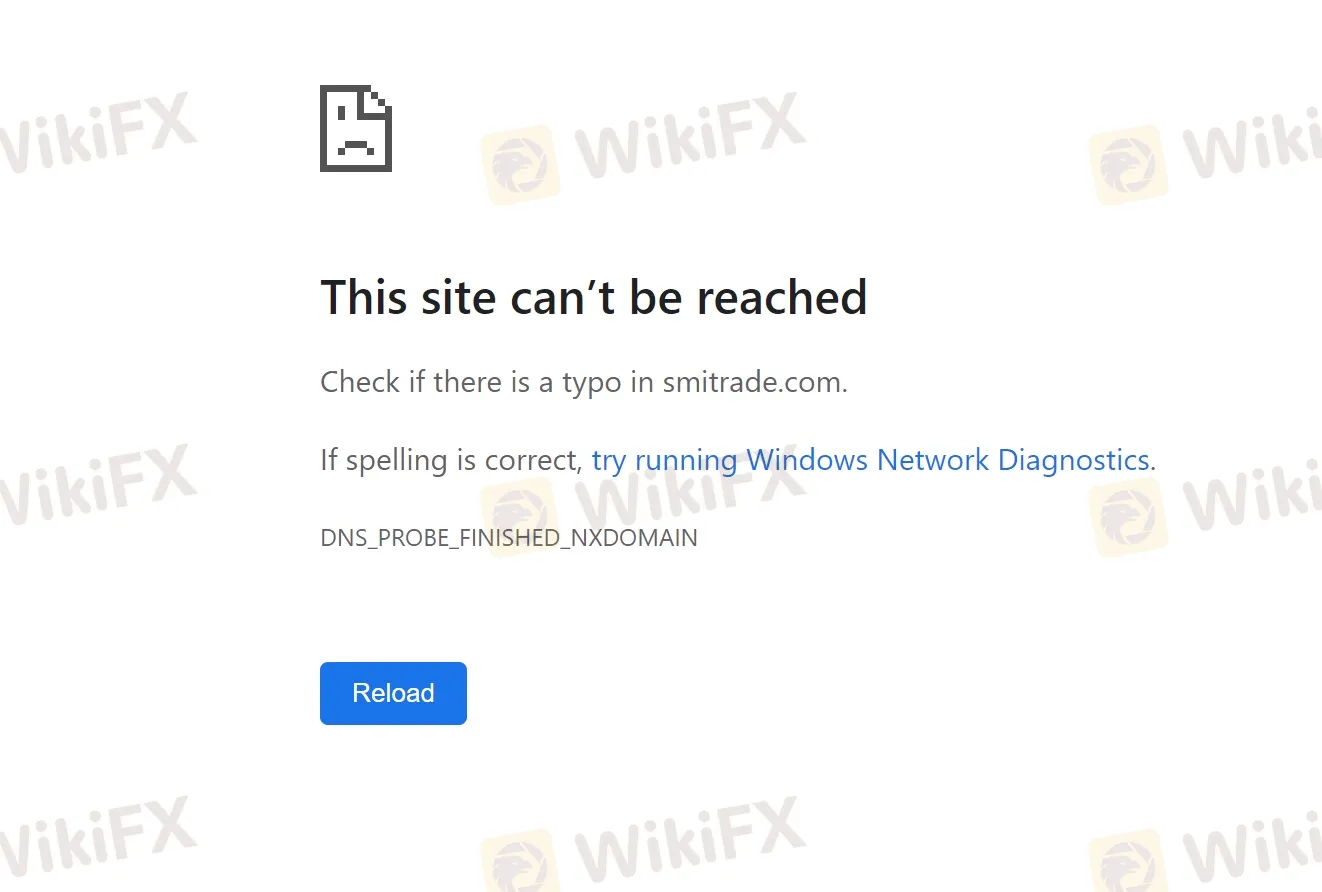

WikiFX also paid a visit to the brokers official website to learn more. However, the outcome was disappointed,the official website can‘t be reached and smitrade.com’s server IP address could not be found.

Without access to the website, we cannot see for ourselves if it holds up to something like industry. As a broker who claims to be a professional trader, but does not show even the most basic information to users. Obviously, it's covering up something shady.

Another concern is that searching Google's entire site turns up only one email address for SMI TRADE. That's not what legitimate brokers do. As a matter of fact, most scammer companies will not provide more contact information, just like a phone number is impossible. Because the email is hidden, you don't know who you're contacting, and you can't trace it back.

Whats more, WikiFX made an attempt to access the domain tool to learn about the domain information. It can be found by tracking its website information that its official website domain name is up to date -- it was registered on May 18th, 2022, just six months ago. Besides, the domain is only valid for one year - until May 18th, 2023. It's easy to see that when SMI TRADE was registered, it didn't intend to stay in business for long. It expected to get money and then switch to a new domain name and continue scamming.

When faced with the little information on Internet, we can totally trust and use WikiFX to learn more about forex broker. It is certainly the most convenient and quick inquiry mode for investors. Now let's search “SMI TRADE” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/2156809932.html), SMI TRADE currently has no valid regulatory license and the score is rather negative - only 1.00/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Please note that WikiFX is also reminding the majority of users: low scores, please stay away!

From all the above information we can know that trusting a broker like SMI TRADE is simply not worth it – you will certainly end up robbed. The so-called brokerage is nothing more than an outright scam, which is in the spotlight of a recent investigation by the British financial authorities, who have already blacklisted the website for targeting UK customers without proper authorization.

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing.You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed. In addition, scam victims are advised to seek help directly from the local police or a lawyer.

If you want to know more information about the reliability of certain brokers, you can click the information you want on this page Or you can download the WikiFX APP (https://wikifx1.onelink.me/QUVu/fiona) to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator