简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Which Economic Event Should I Trade?

Abstract:"Which news releases should I trade" is a golden question that you, as a retail trader, would want to be able to respond to.

We trade the news because it can raise volatility in the short term, so it only makes sense that we would only trade the news with the greatest potential to move the currency market. The news that typically influences price movement and creates volatility includes modifications to central bank monetary policy, government policy changes (fiscal policy), unexpected outcomes in the release of economic data, Tweets at random from a prominent figure, and more.

Being on the wrong side of the market can be avoided by being aware of impending key event risks. This could be efficiently dealt with with the free economic calendar provider in the WikiFX mobile app, which is also free for download in Google Play or App Store.

Economic Calendar highlights the significant occasions and economic data published by the nations with the most active currency markets. On any given week, there may be several scheduled events. Though not all of them share the same level of importance, keeping up with them is tedious. Thankfully, our Economic Calendar also makes it simple to determine the relative significance of each event. All you need is to judge it by the stars!

The most significant events typically involve changes in interest rates, inflation, and economic growth, such as retail sales, manufacturing, and consumer sentiment, as you'll start to notice if you spend some time looking through the Economic Calendar.

Here are a few instances where retail traders should be well-prepared ahead of the huge volatility, which includes interest rate decisions by central banks, inflation-related data (CPI, PCE, PPI), employment-related data (unemployment report, wage growth), economic growth (GDP), retail sales, etc.

While the markets react to the majority of economic news from different nations, the U.S. is the biggest mover and the news that is most closely followed in terms of military affairs, geopolitics, industry, energy, science, culture, and technology. The world's largest economy is still that of the United States, and the dollar serves as the reserve currency. Therefore, the geopolitical news centred around America should not be neglected.

Simultaneously, events that could bring ripple effects on a global basis also play an essential role. For example, looking back at the Covid-19 pandemic and the Russia-Ukraine war, it is evident that they drove all the financial markets wild during their outbreaks.

News can bring increased volatility in the forex market (and more trading opportunities). When news breaks, the price often jumps in one direction or reacts slowly to the information as traders assess the result compared to market expectations. It is crucial that we, as retail traders, trade currencies that are fairly liquid to ensure smooth and timely execution – these are usually the main currency pairs: EUR/USD, GBP/USD, AUD/USD, USD/JPY, EUR/USD, and CAD/USD. Also, notice how they usually involve USD proving the point mentioned above about its importance.

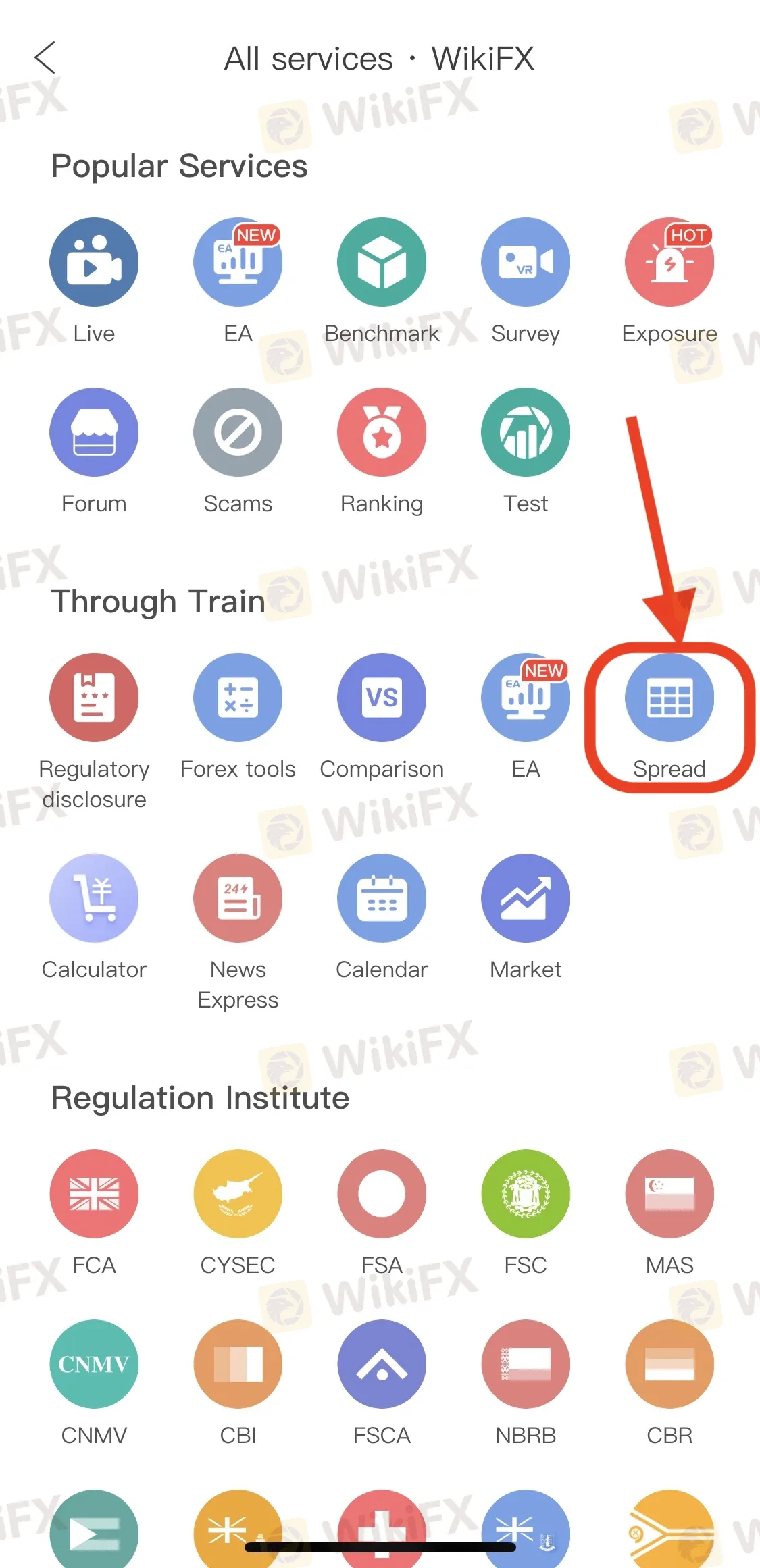

In conjunction with this, follow these steps to find brokers that offer the best spreads to keep your trading costs under control.

There are two primary ways to trade the news:

1) Having a bias in one direction

As soon as the news report is made public, you anticipate the market to move in a specific direction. Knowing what news stories will drive the market is important when looking for a trade opportunity in one particular direction.

2) Not having a bias

This approach ignores directional bias and simply takes advantage of the fact that a significant news event will precipitate a significant move. The direction of the forex market's movement is irrelevant.

No matter which strategy you are using, being equipped with the appropriate trading knowledge and skills is the prerequisite condition to be able to make profits during such volatile market conditions.

Visit the WikiFX education site (https://www.wikifx.com/en/education/education.html) and utilize the free trading-related resources to level up yourself. Have fun trading in 2023!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Impact on the Forex Market as Former Philippine President Rodrigo Duterte is Arrested.

The sudden arrest of former Philippine President Rodrigo Duterte on an International Criminal Court (ICC) warrant has sent shockwaves through global markets and regional investors alike. While Duterte’s arrest is being hailed by human rights groups as a decisive step toward accountability for his controversial “war on drugs,” it also raises significant questions about factors that can strongly influence the forex market.

How Can Fintech Help You Make Money?

Fintech – short for financial technology – is rapidly transforming the way people manage, invest, and even earn money. In this article, we’ll explore various ways fintech can help you make money, from smarter investing to launching a side hustle, while also reducing costs and boosting your financial health.

What’s the Secret in Trading Chart Behind 90% Winning Trades?

Discover the secret to 90% winning trades with chart patterns, indicators, and pro strategies. Master trading charts for consistent wins!

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Currency Calculator