简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

You Should Know: Forex Brokers & Their License

Abstract:As most forex traders are aware, it is always preferable to trade with a forex broker that is authorised and governed by a reputable national organisation, such as the Financial Conduct Authority (FCA), European Securities and Markets Authority (ESMA), Cyprus Securities Exchange Commission (CySEC), or a similar organisation. But it's common for a broker to have a licence and then lose it for not upholding the criteria of the licencing organisation.

Depending on what went wrong, different measures can be followed when a broker loses their license. The brokerage firm could be promptly dissolved if the broker is charged with fraud or guilty of scamming its clients. Depending on the country where the broker is located, the government may offer insurance to protect the cash stored by the brokerage and enable reimbursement for harmed clients. In certain situations, another financial institution might occasionally agree to purchase those assets and move customer accounts to the new business without much disruption.

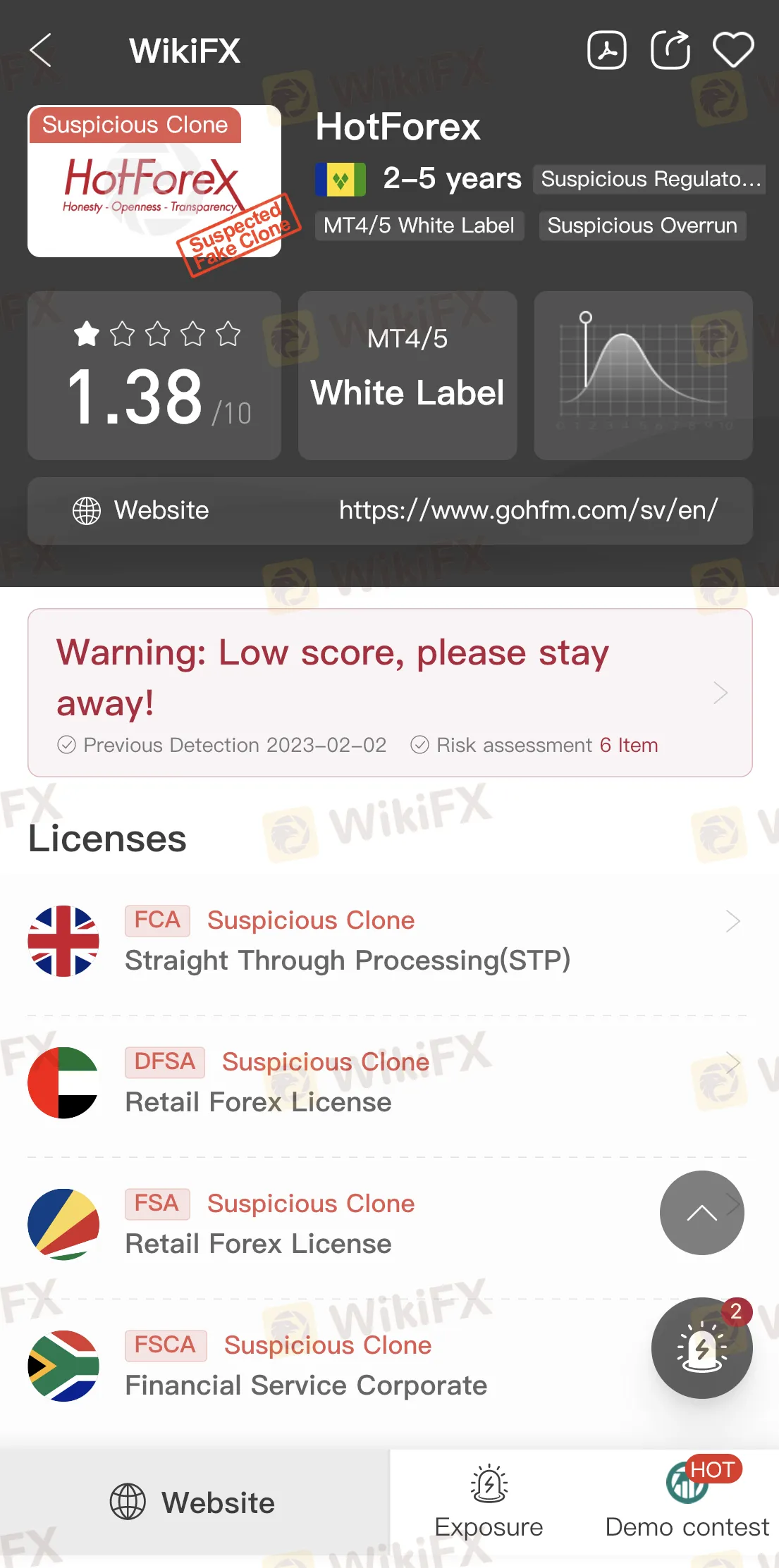

While a brokerage may stop operating after losing its licence, this is not the sole option. If a broker loses its licence in one jurisdiction, it can continue to operate as an unlicensed offshore firm or apply for a new licence in another. In 2022, Union Standard International lost its FCA licence but continued to operate from a St. Vincent and the Grenadines-registered office under the terms of an offshore licence.

You might only be aware if an online broker chooses to continue operating under an offshore licence after losing its licence. Keep an eye on WikiFX as we timely update the profiles of forex brokers. We also regularly reveal brokers that claim licenses which they do not have anymore.

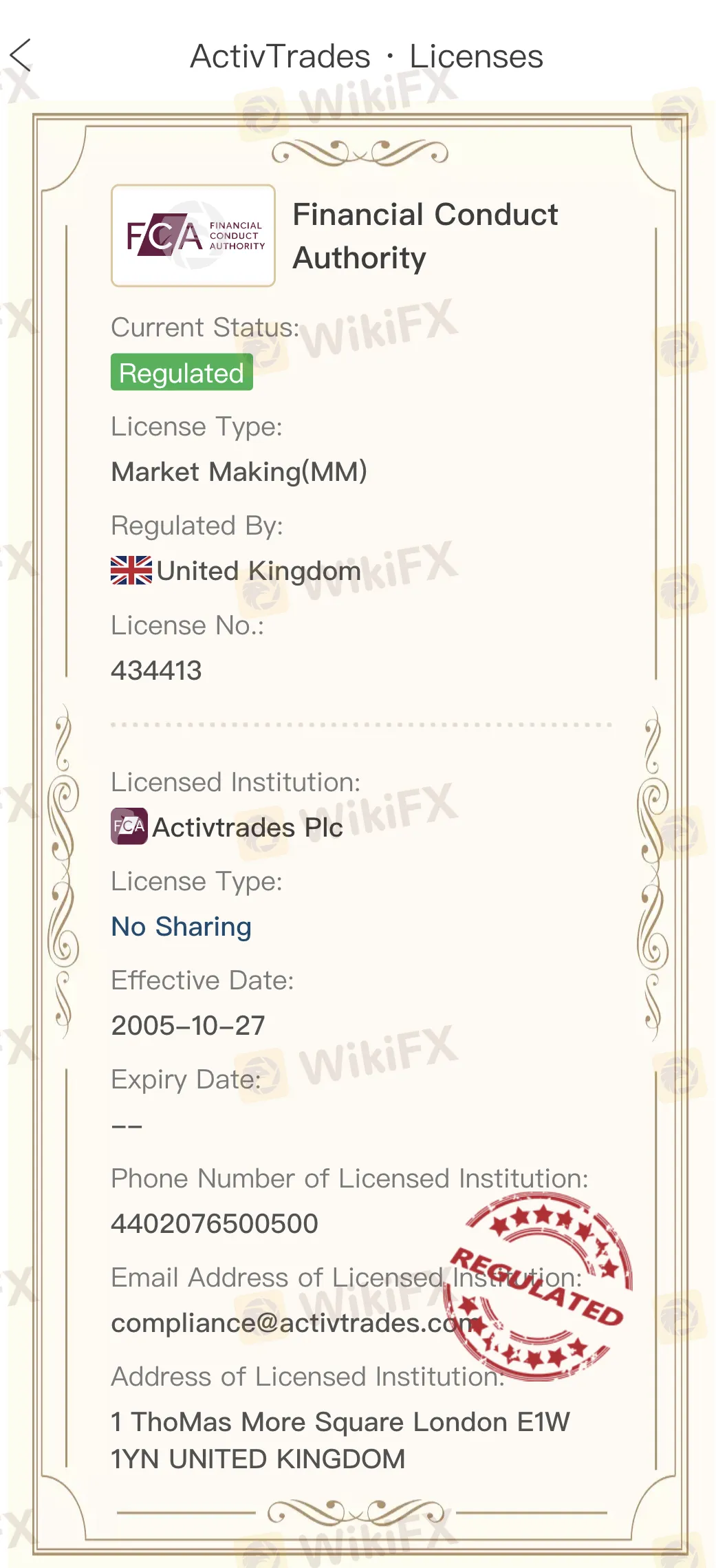

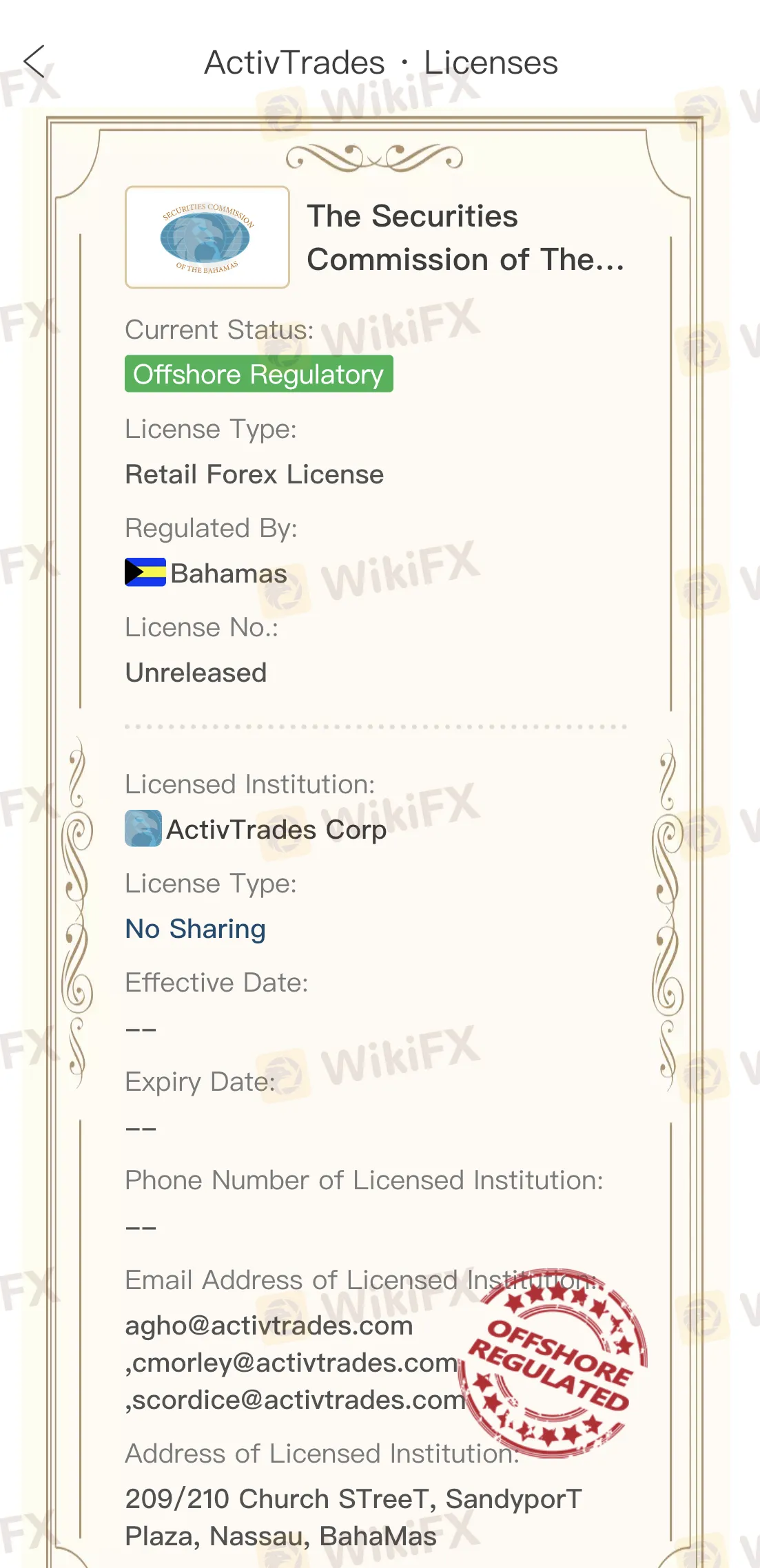

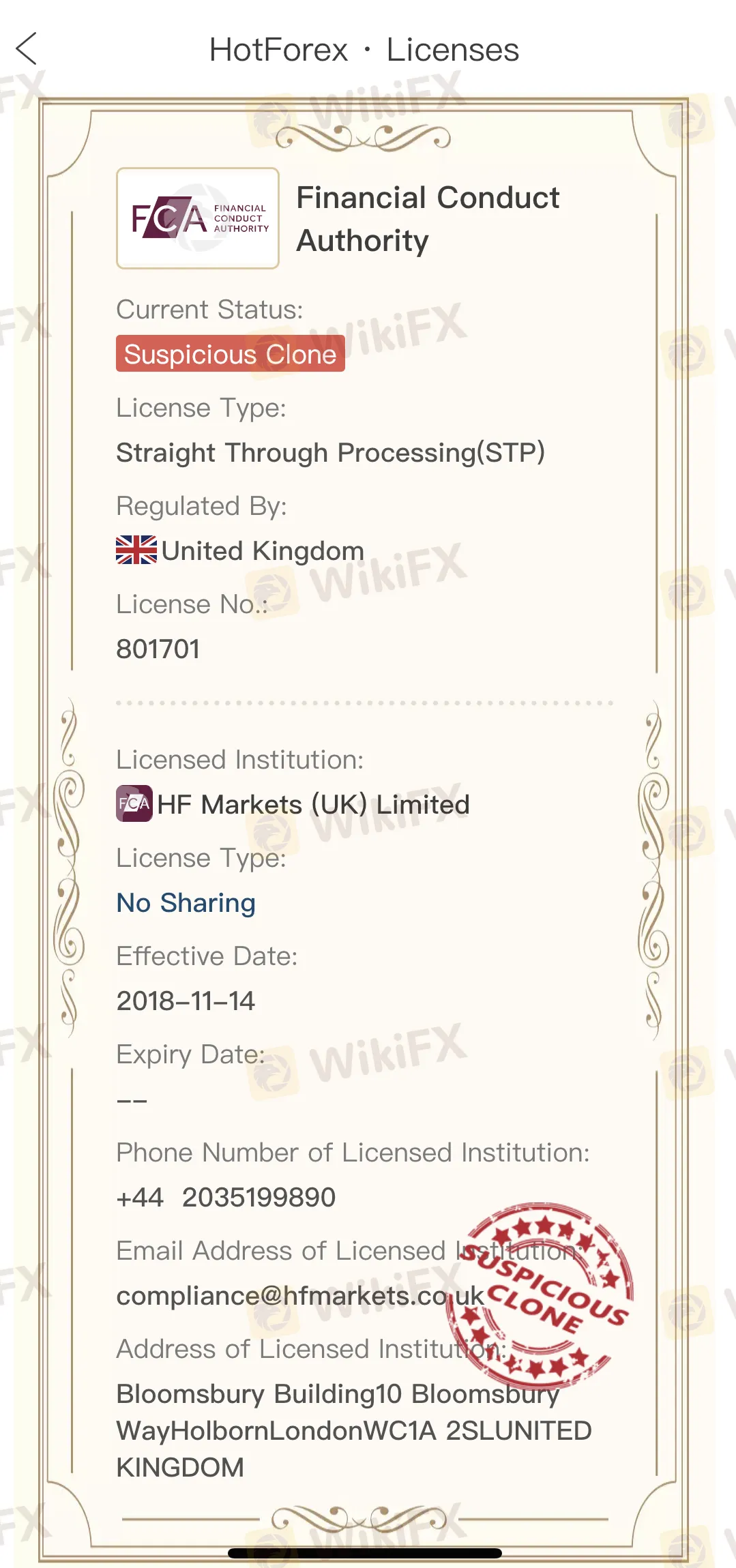

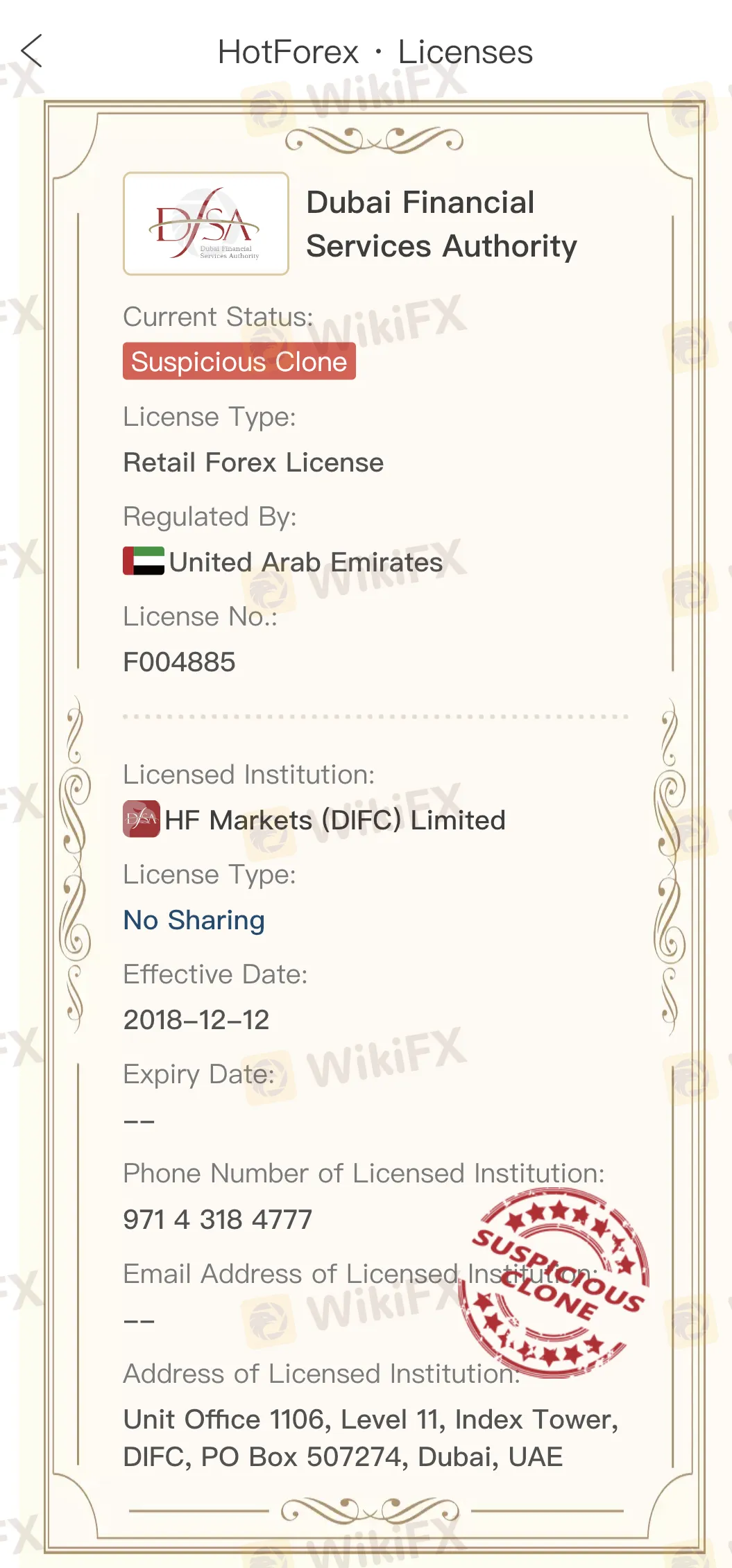

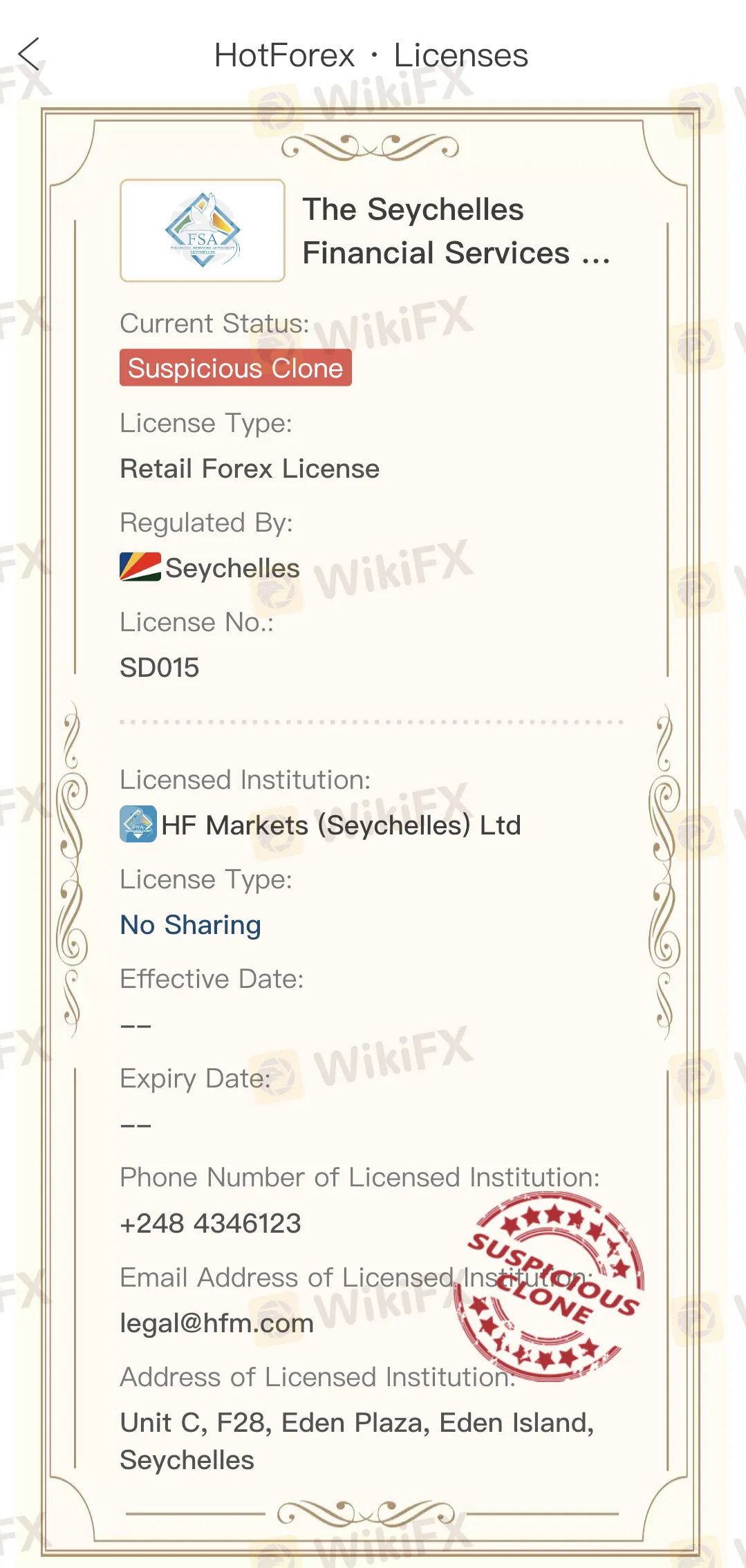

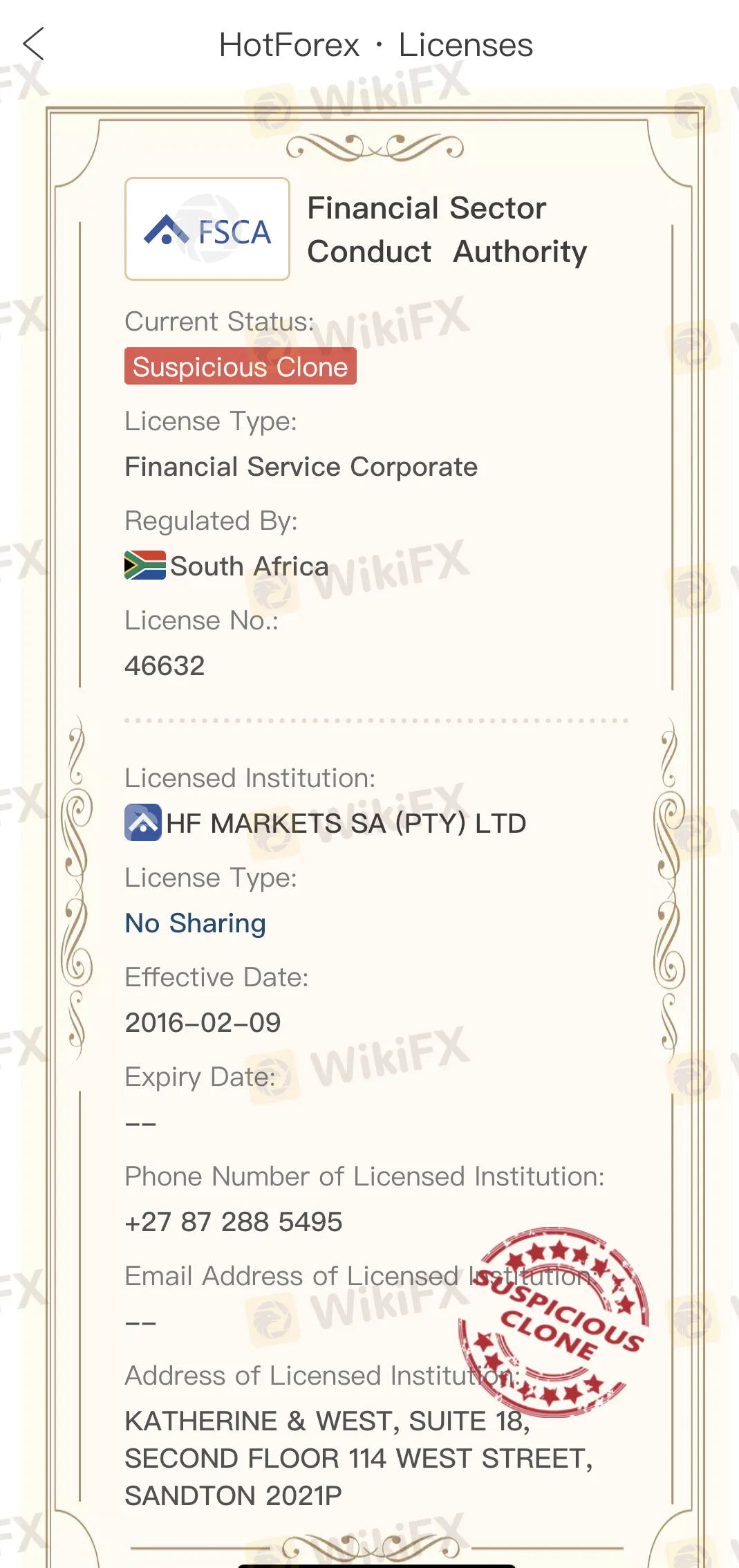

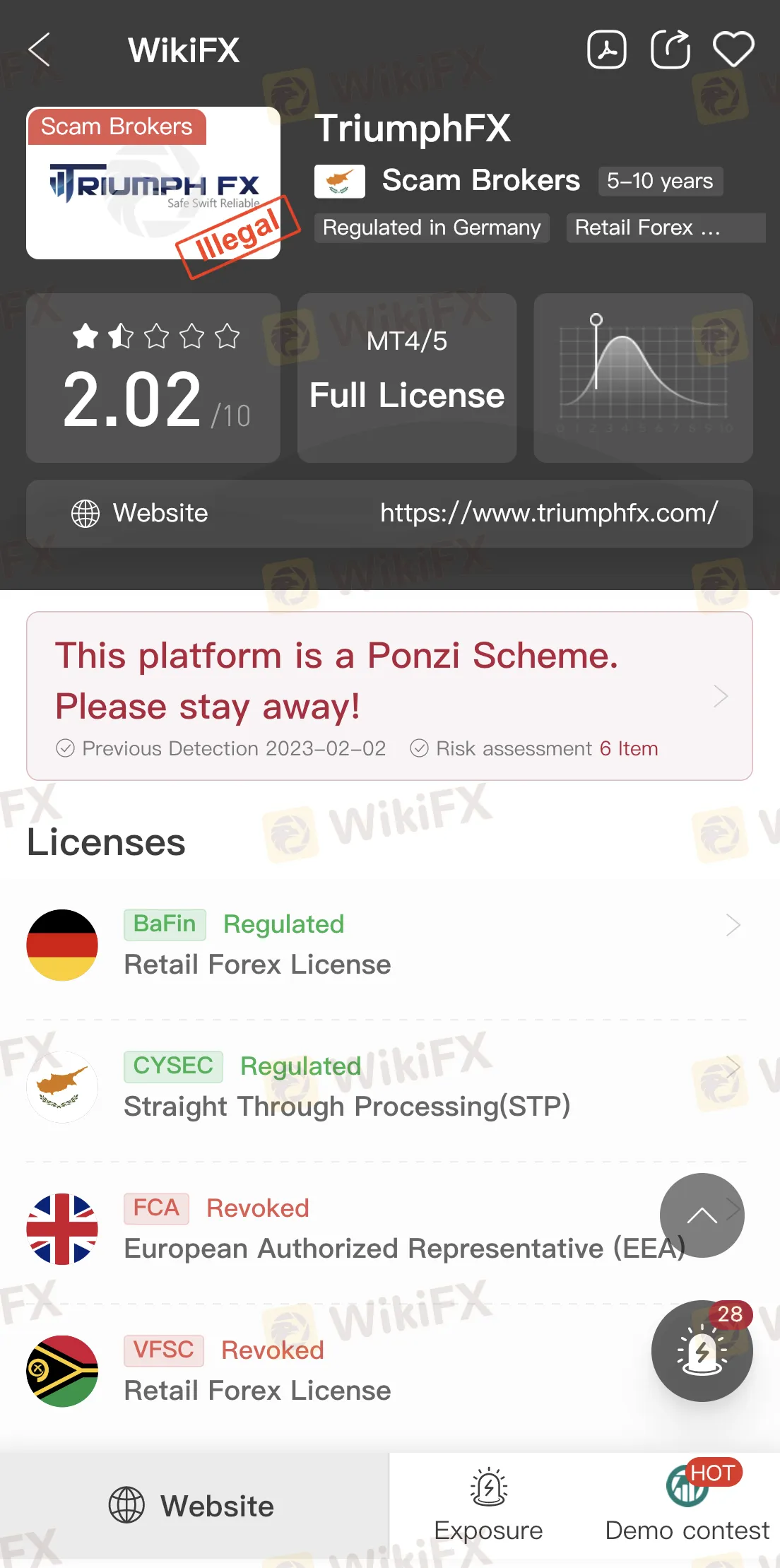

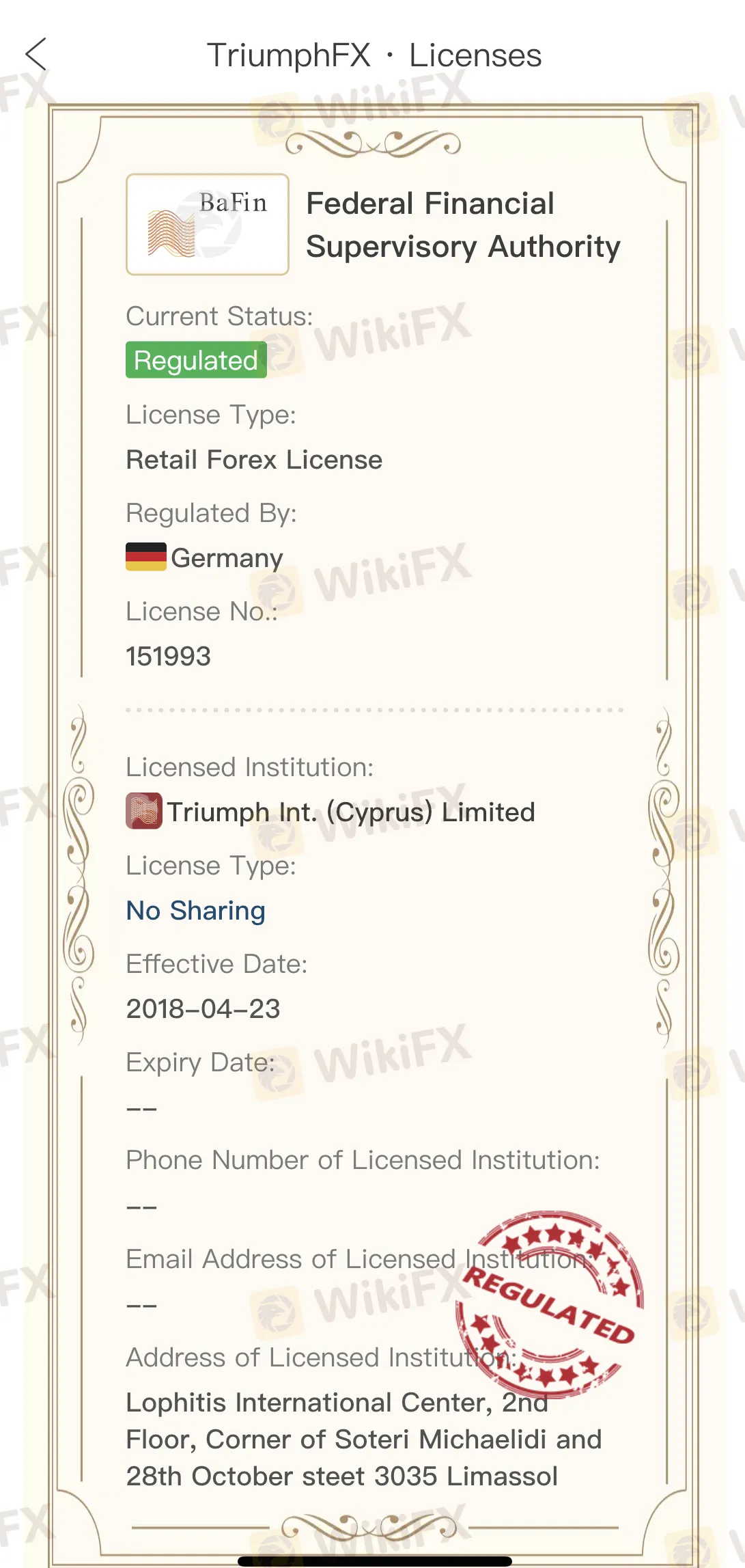

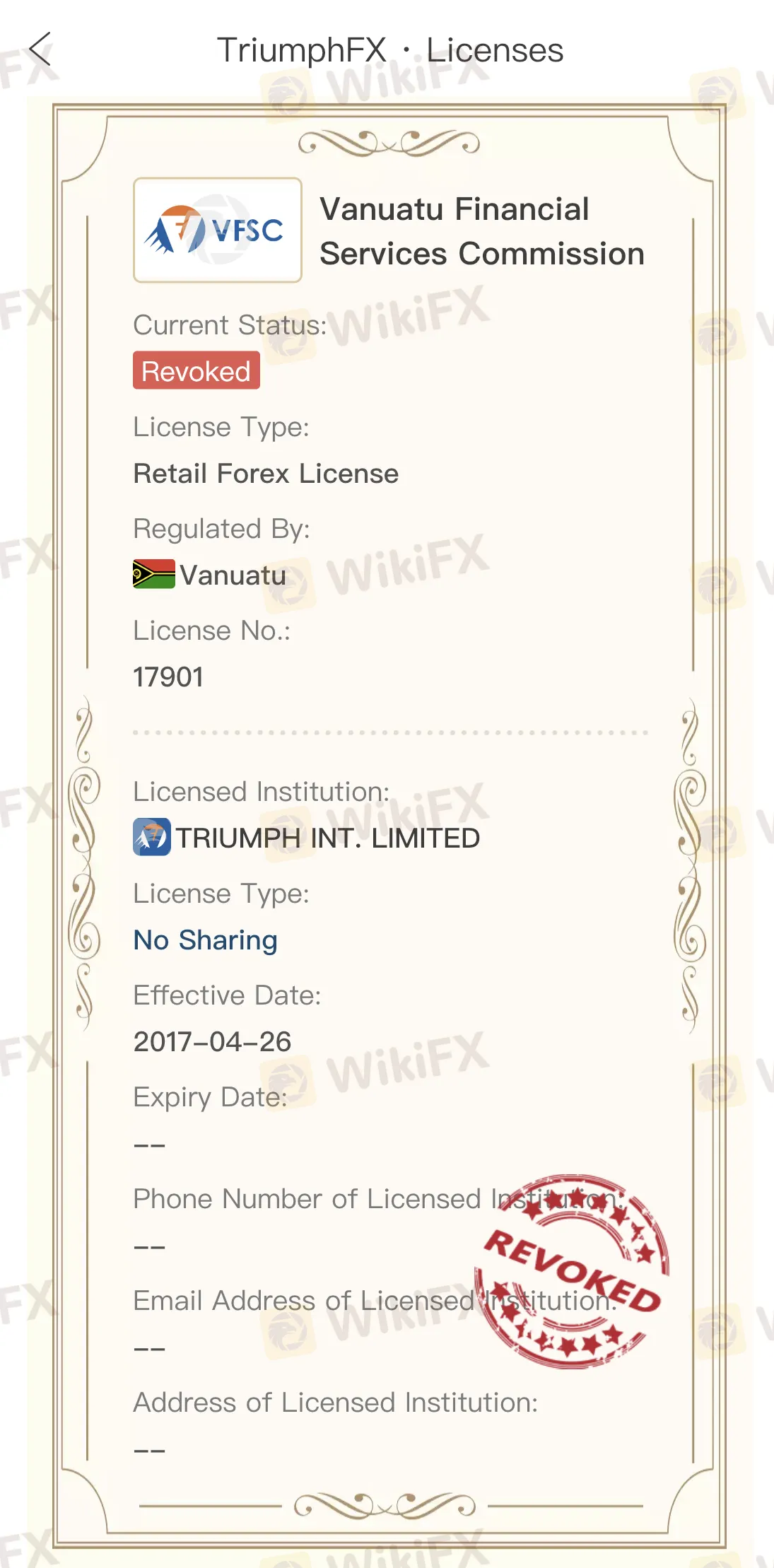

To illustrate how self-explanatory the WikiFX app is, here are 3 forex broker profiles and their respective licenses:

Broker 1:

Broker 2:

Broker 3:

Why Are Brokers' Licenses Taken Away?

Each regulated forex broker must abide by a set of rules set by its regulatory body. Additionally, they must consent to yearly evaluations and audits of their business practices to ensure continued compliance with all applicable laws and standards. As part of their onboarding procedures, forex brokers must abide by the contracts they enter into with each trading client. The revocation of a licence is possible if any rules or regulations are broken.

Brokers must abide by the laws and regulations of the nation in which they are based and the guidelines established by the national regulator issuing a licence. Even if a broker initially establishes itself as adhering to all applicable laws, if it later ceases to do so, its licence may be cancelled. Therefore, to ensure that the businesses to whom they issue licences are still compliant, national authorities should regularly monitor them.

Laws have certain similarities, even though they differ from nation to nation. Forex brokers' requirement to maintain sufficient liquidity to cover client investments is a fundamental aspect of forex regulation in several jurisdictions. In accordance with fair representation laws, all forex brokers must disclose all potential risks associated with forex trading. They cannot promise or guarantee that traders will make a profit or receive a specific rate of return on their investment.

Due to safety reasons, it is imperative that you only deal with authorised brokers. Always confirm the regulatory status of the broker you're using before signing up with them, and keep an eye on the situation to ensure nothing changes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator