简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EightCap Has Integrated The New AI-Powered Acuity's Economic Calendar For Trade Ideas on MT4 And MT5

Abstract:Eightcap has announced a partnership with Acuity to give customers an AI-powered economic calendar that provides daily trade ideas based on over 1000 macroeconomic events, sorted in order of market impact, helping traders to more successfully manage event-driven market volatility.

“By adding Acuity's cutting-edge AI technology into our platform, we are able to give our customers a strong new tool that will help them remain ahead of the competition. We are dedicated to delivering a wide variety of tools and instructional materials that will improve our customers' trading experiences and enable them to trade smarter.”

Eightcap has announced a partnership with Acuity to give customers an AI-powered economic calendar that provides daily trade ideas based on over 1000 macroeconomic events, sorted in order of market impact, helping traders to more successfully manage event-driven market volatility.

Alex Howard, the newly appointed CEO of the Melbourne-based FX and CFD broker, is off to a good start by introducing Acuity's popular products to its customer base.

“In the MT4 or MT5 research terminal, run the economic calendar as an EA tab.”

All Eightcap customers will have access to the new economic calendar, which can be viewed immediately via the Eightcap client site. Traders will also be able to run the economic calendar as an EA tab on their MT4 or MT5 research terminal, giving them access to news, sentiment data, and other features all inside the same window.

The calendar distinguishes itself from conventional economic calendars by providing useful insights into why an economic event is impacting the market, how the market is expected to respond, the amount of the market response, and the speed with which the effect is seen. Traders will also obtain useful insights into each macroeconomic event's historical market performance.

Clients will be able to uncover trade opportunities across 100+ nations and 1000+ macroeconomic events by instantly highlighting trading ideas using AI-enhanced filtering.

AI filtering employs bold, vivid components to the trader's advantage in order to display high, medium, and low-impact occurrences. With price, emotion, and possible range charts, traders will also be able to assess probable market movement before, during, and after occurrences.

“A potent new instrument that will assist them in staying ahead of the marketplace.”

“By adding Acuity's cutting-edge AI technology into our platform, we are able to give our customers a strong new tool that will help them remain ahead of the markets,” said Alex Howard, Chief Executive Officer of Eightcap. “We are dedicated to delivering a wide variety of tools and instructional materials that will improve our customers' trading experiences and enable them to trade smarter.”

“We are thrilled to be collaborating with Eightcap, a prominent online broker in the sector,” said Andrew Lane, CEO of Acuity Trading. “Our collaboration will enable us to reach a larger audience and provide more traders access to our advanced AI-based products.”

Eightcap offers trading in a variety of financial markets, including Forex, Indices, Shares, Commodities, and Cryptocurrency CFDs.

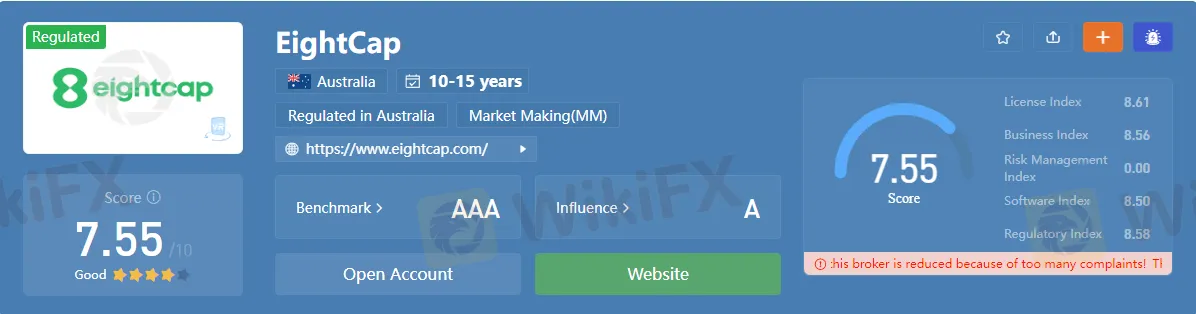

The Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Securities Commission of The Bahamas all regulate the FX and CFD broker (SCB).

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fluctuate: What Really Determines Their Value?

Gold prices have been fluctuating recently, influenced by multiple factors. Since the beginning of 2025, gold has risen by 11%, hitting new historic highs multiple times in the first quarter.

Investors Beware! A Trillion Naira Wiped Out in a Week

Market takes a hit: a trillion naira wiped out—what happened?

Dollar Under Fire—Is More Decline Ahead?

The dollar faces its biggest decline of the year, strong-dollar logic challenged.

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator