简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam Alert Issued By FCA Regarding Hantec Funds

Abstract:The UK Financial Conduct Authority has issued a warning about HANTEC FUNDS, a phony clone portraying as a UK-based foreign exchange (FX) trading company.

The UK Financial Conduct Authority has issued a warning about HANTEC FUNDS, a phony clone portraying as a UK-based foreign exchange (FX) trading company. The Financial Conduct Authority (FCA) earlier warned the public about Easy FX Trade's dubious activity, which was discovered to be deceiving investors by using the reference number of FCA-regulated Hantec Markets. HANTEC FUNDS INVESTMENT does not openly claim to be licensed by the FCA, but it uses the details of regulated firms to persuade investors that it is a legitimate company.

About HANTEC FUNDS

HANTEC FUNDS offers contact information, which the FCA says might be fraudulent or combined with information from a regulated firm. The financial authority, however, has said unequivocally that HANTEC FUNDS is not permitted to advertise financial services in the United Kingdom and has no affiliation with the approved business. The company's website advertises investment programs with 30-day returns ranging from 50% to 120 percent, which is a significant red flag for investors.

Websites like HANTEC FUNDS, as predicted, function as a high-yield investment program (HYIP) scam, with returns that are always doubtful and likely to dry up long before the initial investment amount is recovered. There is no real documentation of payments provided by the firm, and it is doubtful that anybody will ever receive any money.

About HANTEC MARKETS

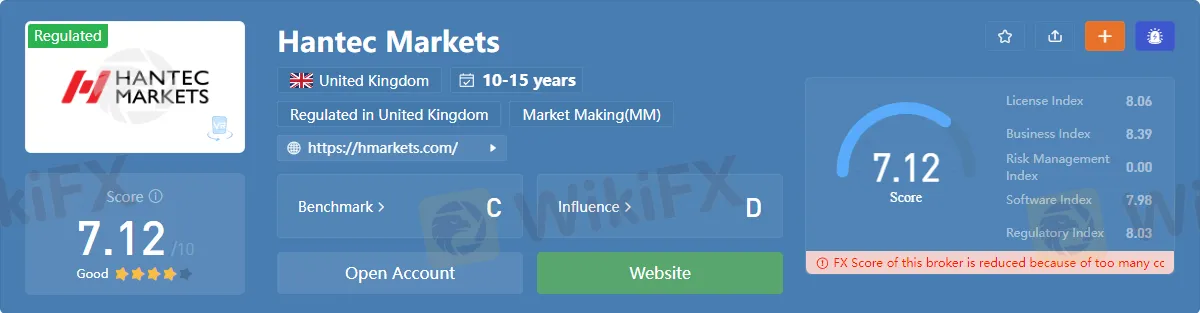

Hantec Markets, on the other hand, is a subsidiary of the Hantec Group and has been providing forex trading services for over two decades, with offices in London, Sydney, Tokyo, Hong Kong, Auckland, Dubai, Mauritius, and Lagos. The firm has acquired IKON Finance's retail customer base and inked a three-year arrangement as the official FX partner of Premier League football club West Ham United.

Awareness

It is crucial to highlight that there are various methods for detecting fraudulent financial schemes, and investors should proceed with care before depositing their money in such high-risk programs. The claims of HANTEC FUNDS of significant returns in a short time are a huge red signal in this situation since such gains are unlikely to be sustained. Additionally, scammers may utilize the details of a real organization to acquire trust with naive investors.

Before parting with their money, investors should perform extensive research on any firm or investment opportunity. Consumers should also check to see whether the firm is licensed through WikiFX app to offer financial services in their area. Moreover, investors should be cautious of unsolicited investment proposals and avoid investing in anything they do not completely comprehend.

Finally, the FCA's warning concerning HANTEC FUNDS emphasizes the need for investors to be watchful and exercise prudence when investing their money. Although the promise of big returns is appealing, it is important to realize that there are no certainties in the world of investing. Before making any investment choices, investors should always complete their due research and seek expert guidance.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Announcement: Suspension of Weekly Simulated Trading Competition

Since its launch in early 2023, the WikiFX Weekly Simulated Trading Competition has successfully hosted 99 consecutive rounds, attracting enthusiastic participation from traders worldwide and creating countless thrilling trading moments.

What Can Forex Traders Learn from Ne Zha?

The animated blockbuster Ne Zha: Birth of the Demon Child tells the story of Ne Zha’s journey to defy fate and take control of his own destiny. Beyond being an inspiring tale filled with action and character growth, the film conveys profound life lessons - many of which resonate deeply with the world of forex trading.

Retirement Savings Wiped Out: RM500,000 Lost to a Scammer named Richard Ong

A retiree was deceived into parting with more than RM500,000 after falling victim to an elaborate investment scam that promised substantial returns.

The Dark Side of Social Media Investments: How a Manager Lost RM2.08 Million

A Malaysian company manager suffered financial losses amounting to RM2.08 million after becoming the victim of an investment scam promoted through Facebook.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator