简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

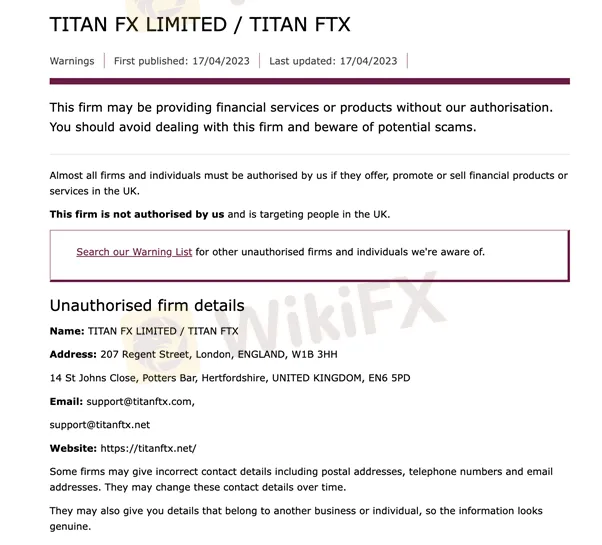

FCA: Beware of Titan Ltd!!

Abstract:Recently, the United Kingdom’s Financial Conduct Authority (FCA) issued a circular report on alerting potential investors about Titan Limited.

According to the FCA, Titan Ltd company was providing financial services and goods to customers in the UK without having proper consent from the regulator.

Additionally, the business keeps a presence in other countries, and it advertises to potential customers on its website, titanftx.net. Despite prior warnings from the FCA criticising this broker, the website still appears to be accessible to potential customers based in the UK.

WikiFX cross-chceked our database and found that Titan is indeed an unreliable broker with a fairly low WikiScore, indicating a potential high level of risk.

The UKs financial watchdog cautioned investors against doing business with financial firms it has not authorised, reiterating earlier warnings.

This is not the first time Titan Ltd has raised concerns of the regulatory bodies. Previously, Ontario Securities Commission (OSC) warned its residents that the broker in question was never authorised to conduct business within the region. Not only that, but France's financial watchdog also highlighted that Titan was never an approved investment service provider.

The Financial Conduct Authority (FCA) is a regulatory body in the UK that keeps an eye on financial markets and financial services companies to make sure they operate honestly, fairly, and in a transparent manner. Since its establishment in April 2013 and the subsequent replacement of the Financial Services Authority (FSA), the FCA has been in charge of overseeing close to 60,000 financial firms and markets in the UK.

The FCA seeks to preserve the market's integrity, foster healthy competition within the industry peers, and safeguard consumers from financial risk. The FCA establishes and enforces guidelines and standards for financial institutions, monitors their compliance with laws, and takes enforcement action against institutions that flout the law. The FCA also works to educate the public about financial services and products and offers consumers advice and direction.

The FCA urged customers to steer clear of engaging with any company or unregulated business. Simultaneously, they were encouraged to report companies they believed were operating illegally in Britain. The regulator also reminded investors to check both the Interim Permission Register, which lists businesses that have yet to receive approval, and its Financial Services Register, which displays a complete list of authorised businesses.

The FCA has warned the public to be on guard against the growing danger of unregulated businesses preying on UK citizens. This appeal is made in light of recent reports that investors have lost millions to dishonest brokers and an increase of more than 50% in complaints to the FCA consumer helpline.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Discover the top 5 currency pairs to trade for profit this week, March 31, 2025—USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF—with simple strategies and best times.

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

In February, Nigeria's stock market trading volume dropped by 97.58 billion naira, with foreign investors pulling back. Can domestic investors sustain the market?

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator