简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is TRADE NATION reliable?

Abstract:In today's article, WikiFX will explore Trade Nation in depth, examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service to help you decide whether to use this platform. Keep reading to find out more!

Trade Nation is a brokerage headquartered in the United Kingdom, formerly known as Core Spreads, which was founded in 2014. It officially changed its name to Trade Nation in 2020.

One of the main features of Trade Nation is that it offers commission-free accounts, meaning traders do not have to worry about hidden fees. In addition, the company also offers fixed spreads to reduce trading costs. This means that no matter how volatile the market is, traders will always be able to accurately predict the cost of trading.

Trade Nation has physical offices in the UK, Australia, South Africa and the Bahamas.

Trade Nation offers various trading instruments, including foreign exchange, indices, stocks and commodities.

Account & Charges:

Trade Nation offers only standard accounts and does not charge any commissions. The company's earnings are realized only through spreads.

Fixed spread pricing is only available for the Cloud Trade application and platform while floating spreads are available on the MT4 platform. Trade Nation's spreads start at 0.02.

In terms of leverage, Trade Nation offers leverage of up to 200x.

Deposit and Withdrawal Methods:

Trade Nation offers its clients a variety of deposit and withdrawal options, including bank wire, debit or credit cards (Visa and MasterCard), Bitcoin, Skrill, GrabPay and more.

The currencies accepted by Trade Nation include GBP, USD, EUR, AUD, ZAR, DKK, NOK and SEK.

The minimum deposit amount starts from $0; the minimum withdrawal amount is $50, depending on the currency of the user's account.

Trade Nation does not charge any handling fees when depositing or withdrawing funds. However, the bank may charge fees where the funds are transferred and received, which are to be borne by the client.

Trading Platforms:

Trade Nation offers 2 types of trading platforms:

MT4 platform: MT4 is a platform developed by MetaQuotes, which has a high reputation in the industry. Many brokers use MT4 to provide trading services, providing the best choice for traders who value a powerful, intuitive and comprehensive trading experience. Users can choose to use the computer, mobile or web version of MT4.

Cloud Trade application: Trade Nation's own application and trading platform offers a wider range of market options combined with competitive fixed spread pricing (Trade Nation's fixed spread pricing is unavailable on MT4).

Customer Support:

Trade Nation's customer service is open 24/5, from Sunday at 10 pm (GMT) to Friday at 10 pm (GMT).

Users can contact Trade Nation through the customer service helper provided on the official website, by phone (+18449078776) and by email (support@tradenation.com).

WikiFX's Verdict:

Trade Nation currently claims that it is regulated by 3 main regulators, namely:

The UK Financial Conduct Authority (FCA)

Australian Securities and Investments Commission (ASIC)

The Securities Commission of the Bahamas (SCB)

Client funds are held separately from the company's funds in segregated trust accounts with Barclays Bank in London and Westpac Bank in Australia.

In addition, Trade Nation also offers negative balance protection to help clients manage their trading risk.

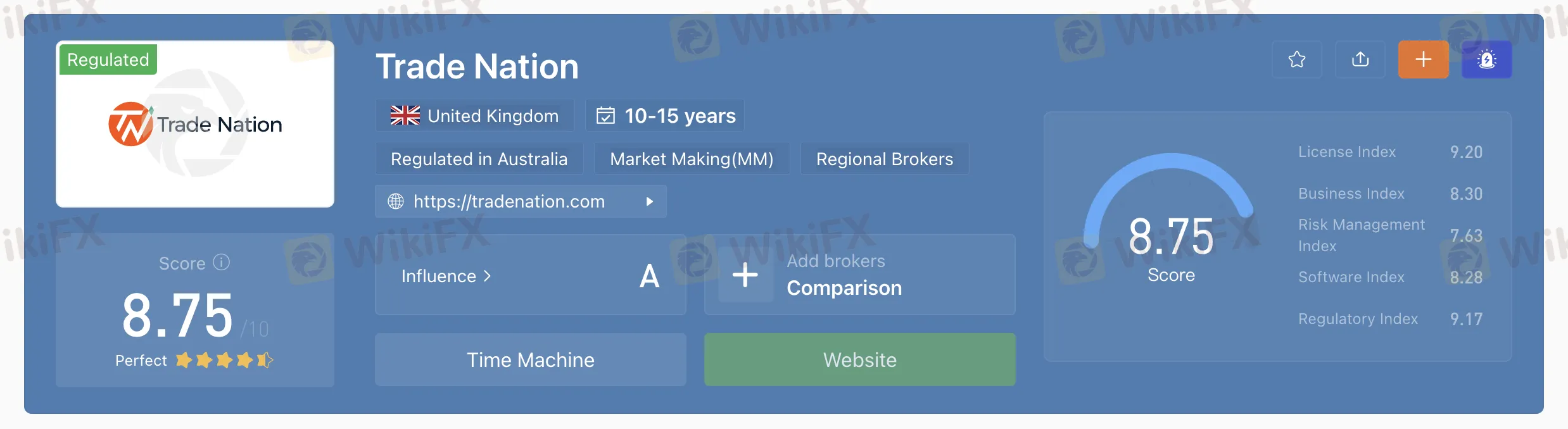

WikiFX is a global forex broker regulatory query platform that houses verified information of over 45,000 forex brokers. We research, review and rate forex brokers from various aspects to prove their credibility.

From here, it is stated that Trade Nation has a WikiScore of 8.75 out of 10.

WikiFX has verified the 3 licenses that Trade Nation claims to possess.

While doing so, WikiFX found that Trade Nation was previously under the regulation of The Financial Sector Conduct Authority in South Africa but now, the FSCA license has exceeded its validity.

Nevertheless, overall, Trade Nation is a reasonably reliable broker that users can trust.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Fidelity Investments tests a stablecoin, joining major financial firms in the booming crypto sector. Discover how this impacts digital payments and blockchain adoption.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator