简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

V5 Forex Global: Concerns Arise Over Withdrawal Issues and Lack of Regulation

Abstract:In the ever-expanding world of online trading, forex firms play a significant role in facilitating transactions for global institutional and retail customers. However, recent complaints regarding withdrawal problems and regulatory concerns have brought V5 Forex Global, a newly-established broker, into the spotlight. This article aims to shed light on the issues faced by investors and delve into the regulatory status of V5 Forex Global.

Introduction

In the ever-expanding world of online trading, forex and CFD brokerage firms play a significant role in facilitating transactions for global institutional and retail customers. However, recent complaints regarding withdrawal problems and regulatory concerns have brought V5 Forex Global, a newly-established broker, into the spotlight. This article aims to shed light on the issues faced by investors and delve into the regulatory status of V5 Forex Global.

Complaints

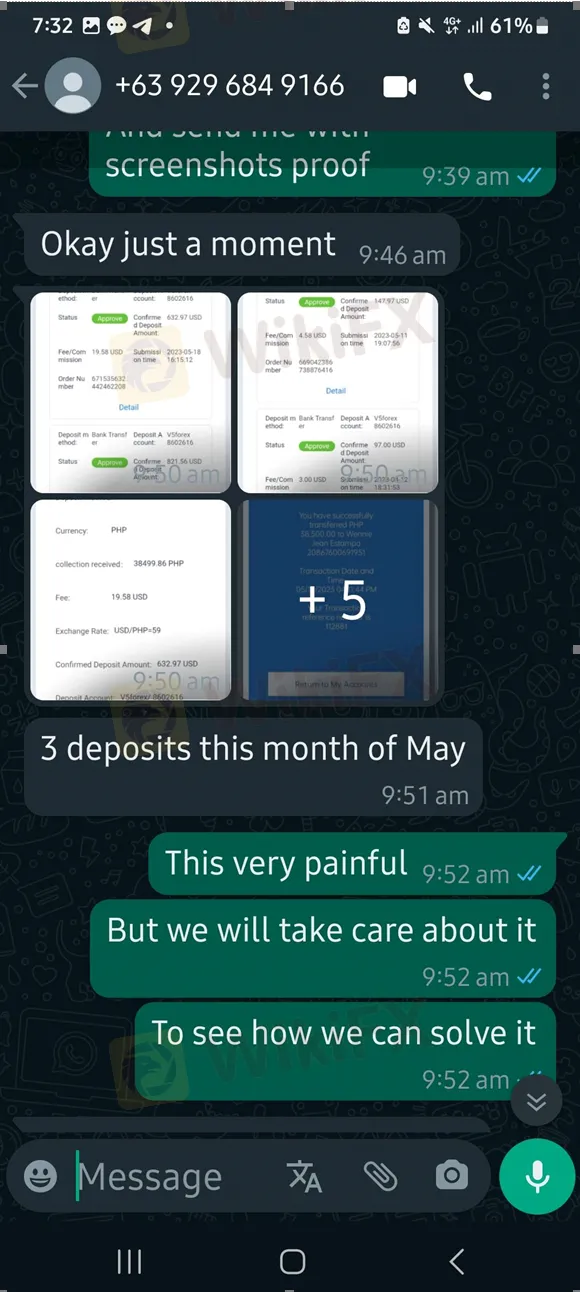

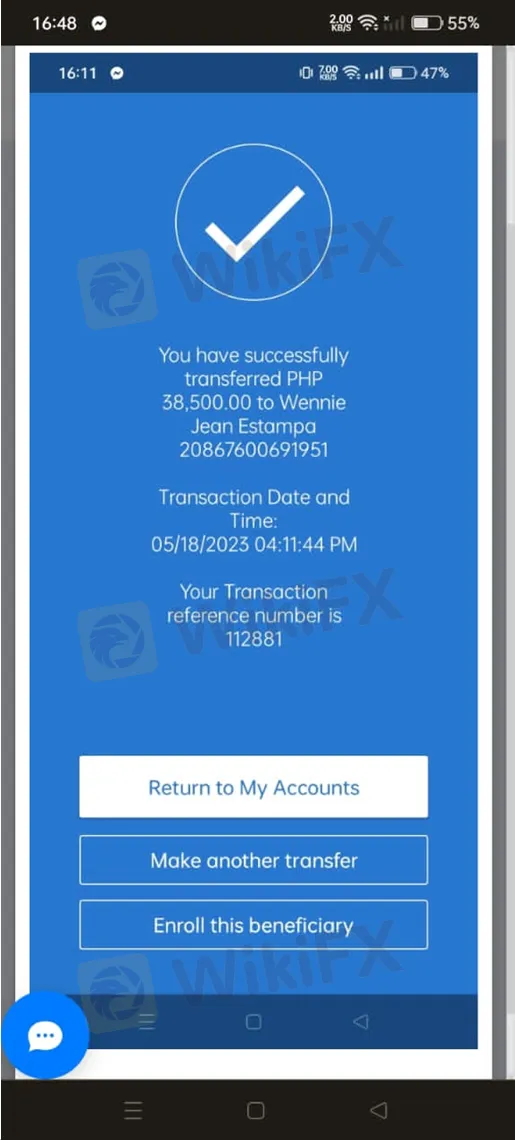

Several investors have reported difficulties in withdrawing their funds from V5 Forex Global. Among these cases, one victim has come forward, claiming to have lost his entire balance due to the actions of this broker. Such incidents raise serious questions about the company's commitment to serving its customers and ensuring the safety of its investments.

Regulatory Status and Verification

According to reputable financial services watchdog WikiFX, V5 Forex Global has been assigned a low score of 1.12/10, indicating concerns and potential risks associated with the broker. A significant factor contributing to this low score is the absence of valid regulation. While V5 Forex Global has asserted that it is regulated by the NFA (National Futures Association) with license number 0554281, further investigation reveals an abnormal regulatory status, rendering the claim unauthorized.

The Implications of Unregulated Trading

The absence of proper regulation raises alarm bells for potential investors, as it signifies a lack of oversight and safeguards. Regulatory bodies play a vital role in ensuring fair practices, transparency, and accountability within the forex and CFD industry. An unregulated broker may operate without adhering to established industry standards, potentially exposing investors to increased risks.

Investor Testimony

One individual who fell victim to V5 Forex Global alleges that the broker “ate his balance,” resulting in a complete loss of his investment. Such firsthand accounts highlight the urgency of examining the broker's practices and reinforce the need for stricter regulation within the industry to protect investors from potential misconduct.

Conclusion

V5 Forex Global, a newly-established forex and CFD brokerage company has recently faced a barrage of complaints regarding withdrawal issues. These concerns, coupled with the revelation of the broker's lack of valid regulation, raise serious questions about the company's operations and commitment to investor protection. It is imperative that individuals considering investing with V5 Forex Global exercise caution and carefully assess the risks involved in trading with an unregulated broker. As the industry evolves, regulatory bodies and investors must work together to promote transparency, accountability, and the overall integrity of online trading platforms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Dark Side of Trading Gurus: Are You Following a Fraud?

Across social media, YouTube, and countless online forums, self-proclaimed trading ‘gurus’ promise to share their winning strategies for a price. These so-called experts claim to have cracked the code, offering courses, investment tips, and mentorship schemes that guarantee success. However, in reality, many of them are little more than sophisticated scammers, preying on the financial aspirations of their followers.

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

Rising WhatsApp Scams Highlight Need for Stronger User Protections

UK consumers lose £2,437 on average to WhatsApp scams. Revolut demands stricter verification and AI monitoring to combat rising fraud on Meta platforms.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

How a Housewife Lost RM288,235 in a Facebook Investment Scam

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

The Daily Habits of a Profitable Trader

Currency Calculator