简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews Giant IFC? | Is This Giant Trustworthy?!

Abstract:The article highlights a complaint against Giant IFC, a broker with a low WikiFX score, detailing its platform closure, blocking of investor withdrawals, unauthorized license claims, and emphasizes the importance of using WikiFX to filter brokers and avoid scams.

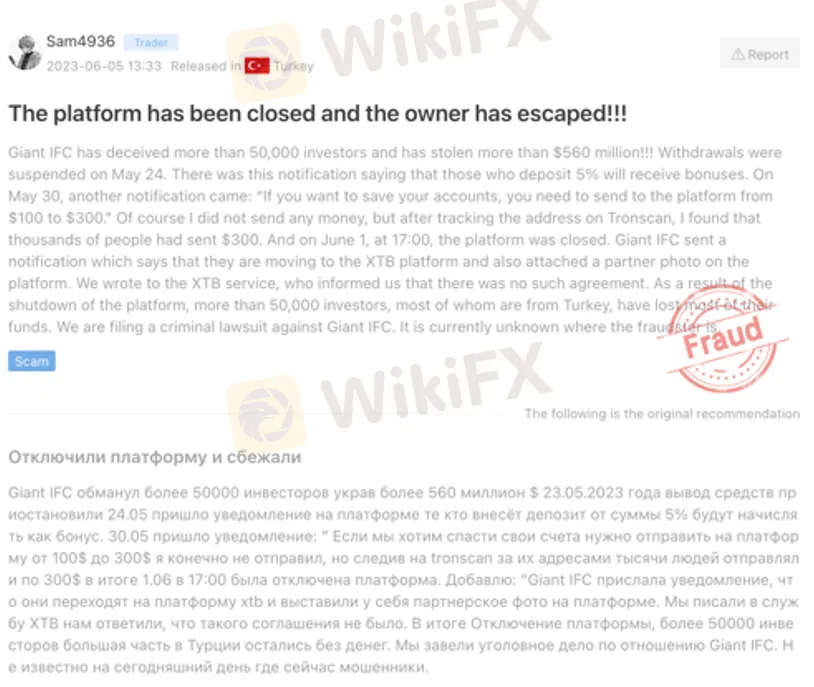

The reason why WikiFX is featuring Giant IFC today is that we have received a complaint from a Turkish trader regarding this broker. It was reported that Giant IFC had closed down its platform after blocking investors' withdrawal requests.

It is stated that Giant IFC only has a WikiScore of 1.04 out of 10.

Firstly, WikiFX found that the official website of Giant IFC is currently inaccessible. This is a significant red flag because when this happens, it is highly probable that this broker had run away with its investors' funds.

Secondly, Giant IFC previously claimed to be regulated by the National Futures Association of the United States, but WikiFX found that this license was actually unauthorized by the regulatory body. This means that the broker was previously operating without a valid license and deceiving its users.

When it comes to engaging with brokers in the financial market, it is crucial to ensure that you are dealing with a reliable and regulated entity. With the rise of online trading, the risk of encountering scam brokers has become a prevalent concern for investors.

However, there is a platform that can help you navigate through this potential minefield - WikiFX.

WikiFX is a global forex broker regulatory query platform that houses verified information on over 45,000 forex brokers. We research, review, and rate forex brokers from various aspects to establish their credibility. By utilizing this platform, users can effectively filter out unreliable and unregulated brokers, minimizing the risk of falling victim to scams or fraudulent activities.

The process of filtering brokers on WikiFX is straightforward. Users can search for a specific broker or browse through the extensive database to find the desired information. The platform offers various criteria for assessment, including regulation, license validity, investor protection, and market reputation.

One essential feature of WikiFX is its rating system. Each broker listed on the platform receives a WikiFX score based on several factors, such as regulatory compliance, customer feedback, and operational history. A low WikiFX score indicates that the broker is unreliable, and users are strongly advised to avoid engaging with such brokers at all costs.

By using WikiFX, investors can access crucial information about brokers, such as their regulatory status, licenses, contact details, and user reviews. This allows users to make informed decisions and choose brokers that meet their requirements while ensuring a safer trading experience.

It is important to note that WikiFX does not guarantee absolute safety or endorse specific brokers. Rather, it serves as a powerful tool for users to conduct due diligence and evaluate the credibility of brokers before engaging with them. It provides an additional layer of protection for investors in an industry where trust is paramount.

Remember that when it comes to trading in the financial market, it is essential to be cautious and vigilant. Utilizing the WikiFX platform empowers users to filter brokers effectively, identify potential scams, and avoid unregulated entities. Remember, a low WikiFX score serves as a warning sign, signaling that a broker may not be trustworthy. By leveraging the resources and information provided by WikiFX, investors can make more informed decisions and protect themselves from fraudulent activities in the ever-evolving world of online trading.

If you have been unfortunately scammed by Giant IFC or any other brokers, please feel free to contact WikiFX through the mediums below to seek further assistance and guidance:

Alternatively, you can submit an Exposure through the WikiFX mobile application, which is available for free download on both Google Play and the App Store. Follow the instructions below to file your complaint:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Deutsche Bank Facing Record Fine from German Watchdog – What’s the Price

Germany's watchdog imposed a EUR 23.05 million penalty to Deutsche Bank AG for violating several regulatory requirements under German law. According to the Authority, the company breached organisational requirements under the German Securities Trading Act in connection with the sale of derivatives. In addition, its Postbank branch disregarded the obligation to record investment advice and repeatedly failed to comply with the requirements of the German Payment Accounts Act regarding the account switching service.

The Hidden Tactics Brokers Use to Block Your Withdrawals

In the fast-paced world of online trading, liquidity is everything. Traders and investors must have unrestricted access to their funds at all times. Any broker that imposes unnecessary conditions or delays when it comes to withdrawals is raising a glaring red flag.

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

Hong Kong SFC warns against Linkbex for virtual asset fraud. Learn about false claims, locked accounts, and how to stay safe from investment scams.

Is $CORONA Memecoin a Legit Crypto Investment?

Explore if "$CORONA" memecoin is legit as Italy’s CONSOB bans its offer and blocks 11 crypto sites under MiCAR, targeting unauthorized services.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Donald Trump’s Pro-Crypto Push Boosts PH Markets

Japan’s Shift in Crypto Policy and What It Means for Investors

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Currency Calculator