简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Is Accumarkets Reliable?

Abstract:Accumarkets is an online forex broker offering a bunch of financial instruments. Recently this broker has come to our eyes. In this article, we want to show you the reliability of Accumarkets by analyzing different aspects.

About Accumarkets

Registered in South Africa, Accumarkets, owned by Elite Financial Services(Pty) Ltd, is an online forex broker offering traders various financial instruments, including Forex, Shares, Indices, Metals, and so on. This broker is newly established and the target market is South Africa. According to WikiFX, this broker has multiple business addresses.

Lack of Information on The Website

The website of this broker looks pretty shabby. There is a lot of information we cannot find on its website. We dont know what the leverage is and what trading platform Accumarkets use.

Is It Legit?

Accumarkets claimed to be regulated by FSCA. However, we found out that this broker exceeds the business scope regulated by FSCA with license number: 52677. Therefore, we cannot consider Accumarkets a regulated broker. Investing in an unlicensed broker is extremely dangerous as your money can not be protected under the regulation. WikiFX has given this broker a low score of 3.12/10. Investors need to think carefully before making a decision.

Account Types & Minimum Deposit

Accumarkets offers traders three different types of accounts. They are Cent Account, 100% Bonus Account, and Standard Account. The minimum deposit of this broker is $5.

Accumarkets on Social Media

Although Accumarkets does not have a long history in the industry, it has made a lot of efforts on social media platforms in order to promote itself. It has established official accounts on both Facebook and Instagram.

Withdrawal & Deposit

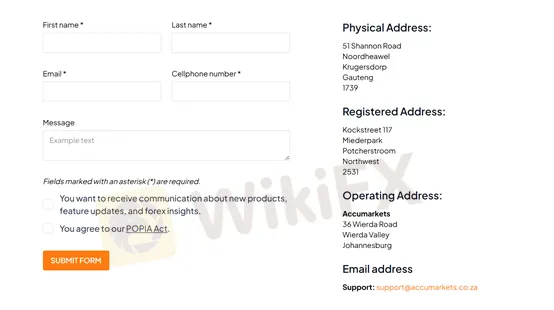

Contact Information

Accumarkets offers multiple choices for investors to contact them. Investors can contact Accumarkets via phone calls and sending emails.

Conclusion: Should We Trust Accumarkets?

As an unregulated broker, Accumarkets cannot protect traders funds if something goes wrong. You may lose all your fund if you invest in an unregulated broker. Besides, this broker has been given a low score by WikiFX, which is another red flag you should be aware of. WikiFX. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

President of Liberland Vít Jedlička Confirms Attendance at WikiEXPO Hong Kong 2025

Vít Jedlička, President and Founder of the Free Republic of Liberland, has confirmed his participation in WikiEXPO Hong Kong 2025, one of the most influential Fintech summits in the industry. The event will bring together global leaders, innovators, and policymakers to delve into the future convergence of technology and society.

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

The worlds of social media and decentralized finance (DeFi) have converged under a new banner—SocialFi. Short for “Social Finance,” SocialFi leverages blockchain technology to reward user engagement, giving individuals direct control over their data and interactions. While SocialFi has primarily emerged in the context of content creation and crypto communities, its principles could soon revolutionize the forex market by reshaping how traders share insights and monetize social influence.

Could Japan Move Away from Ultra-Low Rates?

Japan's Interest Rate Hike: Is the Era of Ultra-Low Rates Over?

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator