简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Beware! Novopus Blocks Withdrawals

Abstract:In this article, WikiFX would like to alert our users about the online broker, Novopus, as it has come under scrutiny due to withdrawal issues faced by investors.

Investing in financial markets can be an exciting opportunity to grow one's wealth, but it also comes with its fair share of risks, particularly when dealing with online brokers. Novopus has come under scrutiny due to withdrawal issues faced by investors like the victim we will highlight in this article.

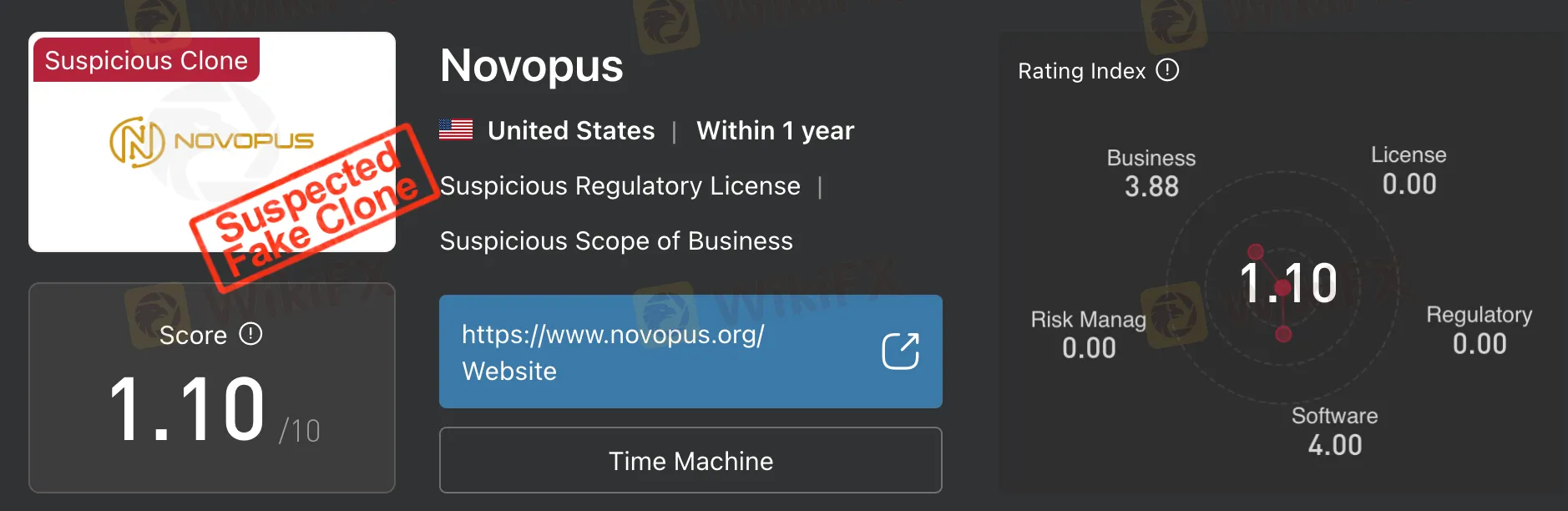

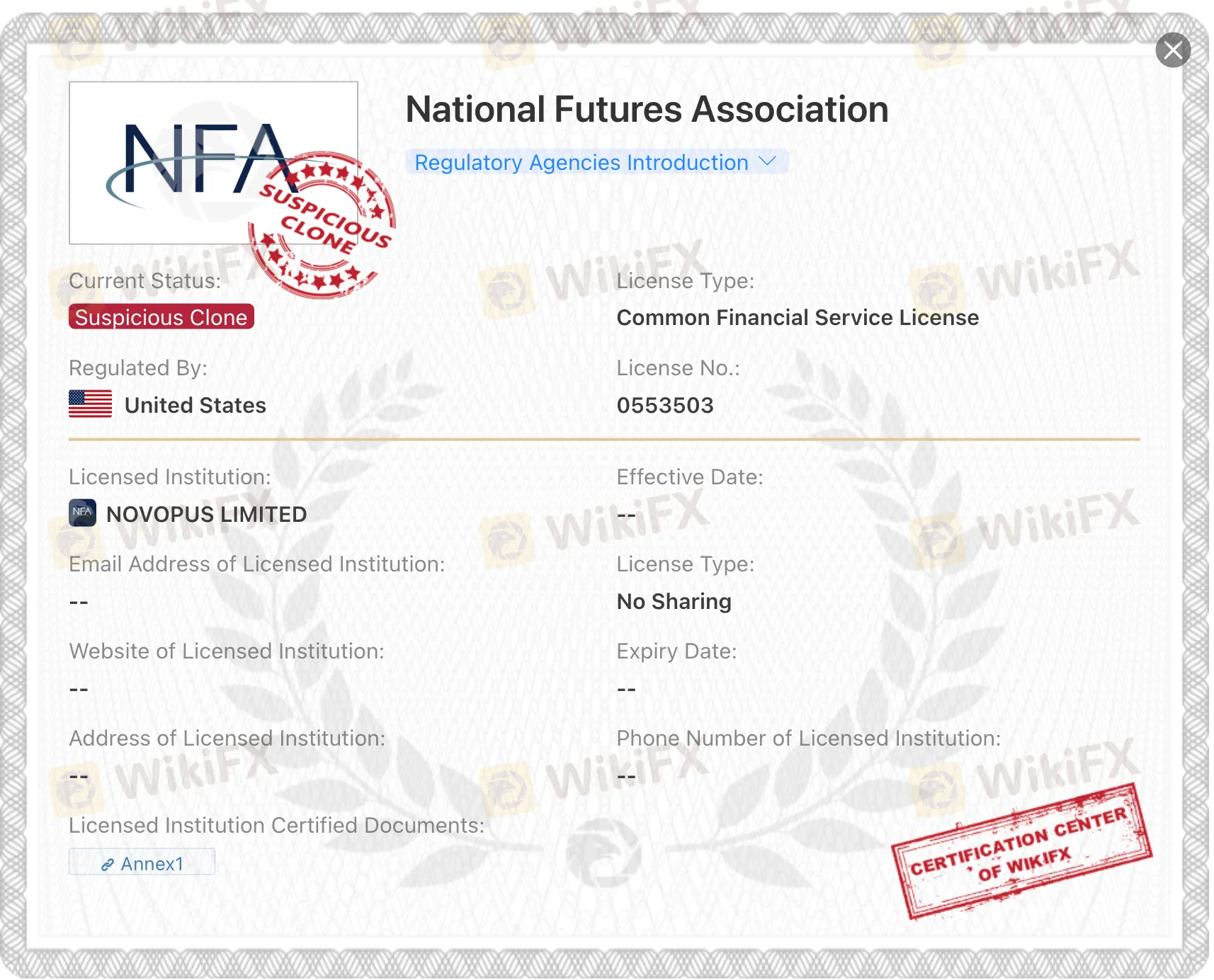

Novopus is an online cryptocurrency trading company founded in 2018 and based in the United States. Although the company claims to operate under the National Futures Association (NFA) regulation, WikiFX discovered that this license is potentially a clone. Therefore, Novopus has a low rating on WikiFX, with a score of 1.10 out of 10. This is due to several factors, including a lack of user reviews and a lack of transparency about the company's ownership and financial status, and the invalid license claim.

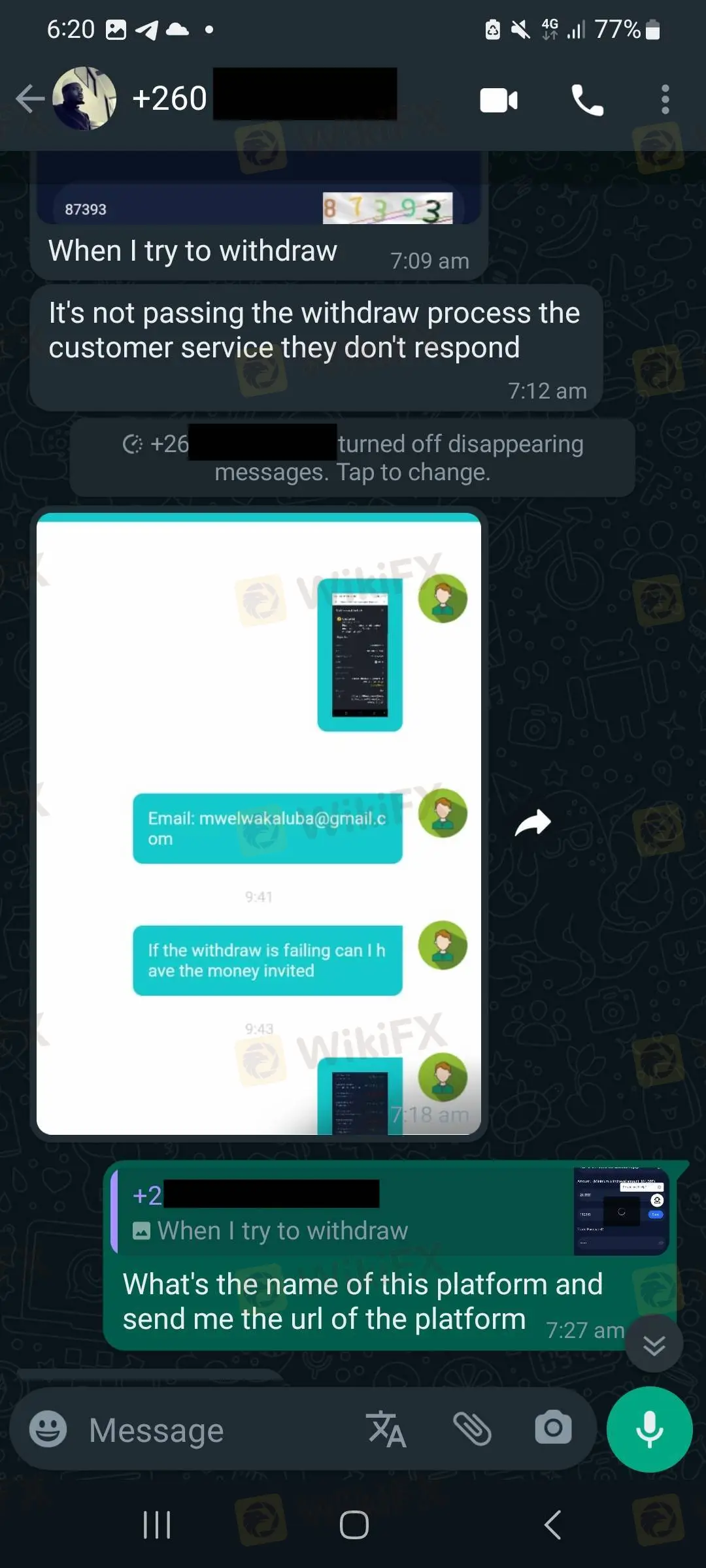

One particular investor, who wishes to remain anonymous, shared their harrowing experience with Novopus Investment. They deposited funds with high hopes of growing their investment portfolio. However, what followed was a nightmare as they struggled to withdraw even a single dollar from their account.

In the victim's words, “Hello, I made a deposit in Novopus Investment, but I have never been able to withdraw a single dollar. Now, they hold my money hostage, and I can't withdraw it. I've reached out to their customer service, but they are not willing to help me retrieve my funds.”

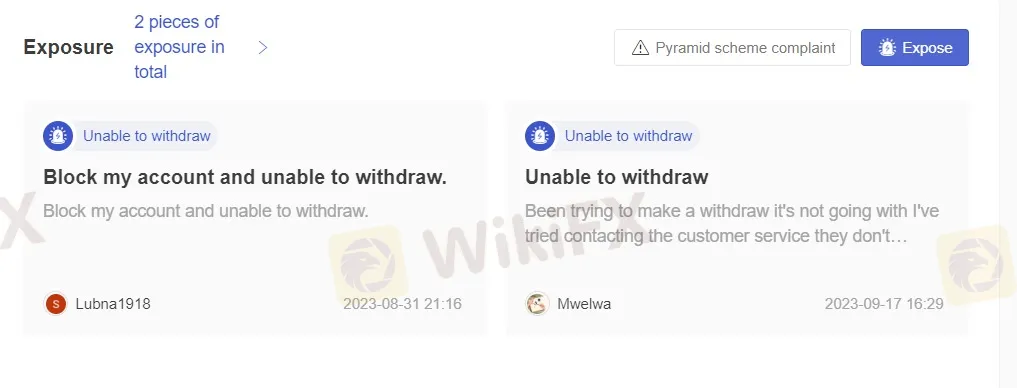

This is also not the first time Novopus has received complaints about withdrawal issues.

The victim's predicament highlights a common problem faced by many investors dealing with online brokers. While it's important to note that not all brokers engage in unethical practices, there have been instances where investors have encountered withdrawal difficulties. Some of the common withdrawal issues include:

Unresponsive Customer Service: As seen in the victim's case, unresponsive customer service can leave investors feeling helpless and frustrated. Lack of communication can exacerbate the problem, leaving investors in the dark about the status of their withdrawal requests.

Complex Terms and Conditions: Some brokers have complex terms and conditions that make it difficult for investors to understand the withdrawal process. This lack of transparency can lead to delays or refusals when attempting to withdraw funds.

Verification Hurdles: Brokers often require investors to complete a verification process to ensure compliance with anti-money laundering regulations. Delays in this process can impede withdrawals.

Hidden Fees: Investors may be subject to unexpected fees or charges when trying to withdraw their funds, reducing the amount they ultimately receive.

Refusal to Process Withdrawals: In some cases, brokers may outright refuse to process withdrawal requests, providing vague or non-existent reasons.

Investors can take several precautionary measures to safeguard against the distressing experience of encountering withdrawal issues. Firstly, conducting extensive research on the chosen broker is paramount. This involves reviewing reviews, verifying regulatory compliance, and scrutinizing the broker's history for red flags. This could be easily done via the free WikiFX mobile application. WikiFX is a global forex regulatory query platform that houses verified information of over 49,000 online brokers throughout the globe in collaboration with more than 30 national regulators.

Secondly, investors should thoroughly grasp the broker's terms and conditions, specifically regarding withdrawal procedures and associated fees. Additionally, expediting the verification process is essential to minimize withdrawal delays. Keeping meticulous records of all communications with the broker, such as emails, chat logs, and phone calls, is another crucial step to provide evidence in case of disputes.

Lastly, if faced with withdrawal problems and unfair treatment, investors should not hesitate to escalate the issue by reporting it to the relevant financial regulators, ensuring their rights and investments are safeguarded.

The victim's experience with Novopus Investment is a stark reminder of the potential risks of online trading. While many brokers operate transparently and ethically, investors must exercise caution and due diligence before entrusting their funds to any financial institution. In cases of withdrawal issues or suspected wrongdoing, investors should not hesitate to seek assistance from regulatory authorities and legal experts to ensure their rights are protected and their hard-earned money is safeguarded.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

TradingView Brings Live Market Charts to Telegram Users with New Mini App

TradingView has launched a mini app on Telegram, making it easier for users to track market trends, check price movements, and share charts.

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Georgia man James Schwab charged in Danbury kidnapping tied to $230M crypto heist. Plot targeted couple for ransom after Miami altercation with son.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator