简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold & Silver Rocket (more) on War & Economy Double

Abstract:The combination of deteriorating economic conditions and the specter of a global war saw gold and silver prices jump the most since the banking crisis on Friday

The combination of deteriorating economic conditions and the specter of a global war saw gold and silver prices jump the most since the banking crisis on Friday – Gold was up $108 (3.6%) and Silver $1.54 (4.5%) in Aussie dollar terms and $64 & 93c in US dollars with gold spot price now $1930 (up over 5% for the week) and silver spot price $22.70 (at time of writing). Conversely the S&P500 was down and the NASDAQ down heavily.

To get the gravity of the situation from a financial markets point of view, the head of the world‘s biggest bank, J P Morgan had this to say in a statement accompanying the bank’s quarterly earnings:

“This may be the most dangerous time the world has seen in decades…….far-reaching impacts on energy and food markets, global trade and geopolitical relationships.”

At a time when increasing signs of stickier than expected inflation grew, along comes a war in the middle east adding weight to price pressures on oil and commodities (oil too rocketed Friday night), particularly as Iran weighs in warning of dire consequences.

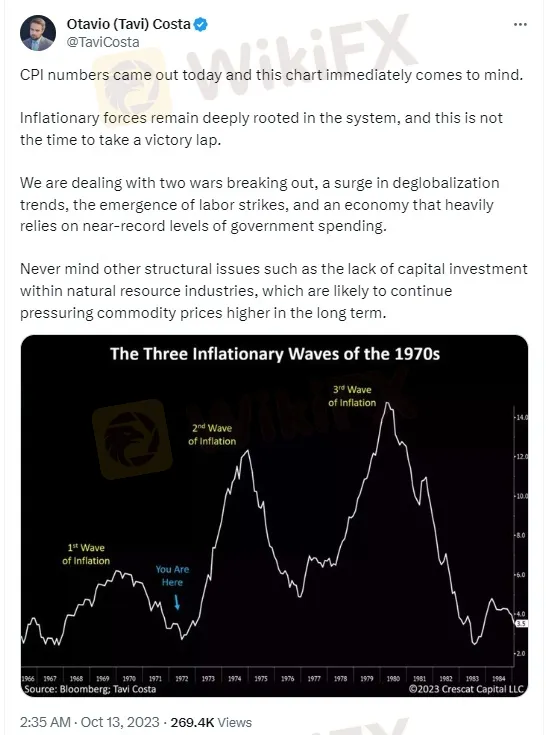

The implications for metals are profound. At a time when the US struggles to sell bonds to finance its deficits, big licks of debt are maturing in a 5% environment, and inflation stays stronger than expected putting further pressure on the situation; the pressure on the Fed to step in to buy the bonds to monetise the debt and respond to the now seemingly inevitable recession increases. The prospect then of that perversely increasing inflation again looms large. That is stagflation, negative real rates (as inflation is high and nominal rates low) – gold‘s sweet spot - and it’s happened before as Crescat‘s Tavi Costa tweeted last week (before Friday’s jump):

This spike in price aligns perfectly with that brilliant interview our Chief Economist, Chris Tipper, did last week calling the bottom in for gold.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The president of @Liberland, @Vít Jedlička come on stage, dialogue on trading security.

The 2025 WikiEXPO Hong Kong Station is about to grandly open. the president of @Liberland, @Vít Jedlička come on stage, dialogue on trading security.

Countdown: 1 day.WikiEXPO2025's first stop, Hong Kong, is about to open.

⏰ Countdown: 1 day. WikiEXPO2025's first stop, Hong Kong, is just tomorrow. Focus on transaction security and explore new investment opportunities. ???? Get ready to start now. See you tomorrow.

JustMarkets Review 2025: Live & Demo Accounts, Withdrawal to Explore

Established in 2012, JustMarkets (Formerly JustForex) is an online forex broker based in Cyprus and serves clients in over 160 countries. Featuring a low entry barrier, a 50% deposit bonus, and robust trading platforms -MT4 and MT5, JustMarkets has gained great popularity among retail investors in recent years. JustMarkets allows traders to trade over 260 CFD-based instruments, which is not an extensive range, yet on leverage up to 3000:1 to increase trading flexibility. To enhance the trading experience, both MT4 and MT5 are provided, along with JustMarkets Trading App, MetaTrader Mobile App, and MetaTrader WebTerminal. JustMarkets offers a 50% deposit bonus to boost traders' confidence. Opening an account is a fully online process, typically completed within one day.

WikiEXPO Becomes Partner of the Liberland Government

Wiki Finance EXPO is honored to announce a partnership with the Free Republic of Liberland. This collaboration will further advance global dialogue on financial innovation and decentralized technology, bringing cutting-edge insights and industry opportunities to participants.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Currency Calculator