简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PH SEC Issues Warning Against ZTOCK and HEDGE BIT TRADING INC for Unauthorized Activities

Abstract:SEC Philippines warns against ZTOCK and HEDGE BIT TRADING INC. for unauthorized investment activities. These entities, unregistered and without proper licenses, are enticing investors with high returns. The public is advised to exercise caution and avoid investing in these schemes, identified as potential Ponzi schemes.

In a recent development, the Securities and Exchange Commission (SEC) of the Philippines has issued a stern warning against two entities, ZTOCK and HEDGE BIT TRADING INC., for engaging in unauthorized investment activities. This advisory aims to raise public awareness about the risks associated with investing in unregistered securities and to protect potential investors from falling prey to such schemes.

ZTOCK Overview

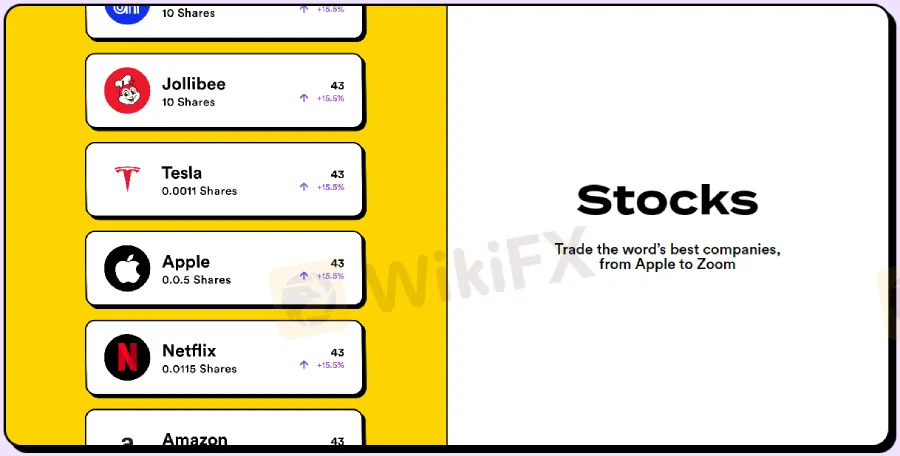

ZTOCK, operated by WETRADE TECHNOLOGIES PTE LTD., has been actively enticing the public to invest in securities through its website and various social media platforms, including Facebook, LinkedIn, Instagram, and TikTok. Portraying itself as an “all-in-one investment app for stocks and Exchange-Traded Funds (ETFs),” ZTOCK targets the younger generation, particularly Gen-Z investors. It offers the trading of over 8,000 US shares and ETFs for as low as 1 USD for fractional shares.

However, the SEC has clarified that ZTOCK/WETRADE TECHNOLOGIES PTE LTD. is not registered as a corporation or partnership in the Philippines. It operates without the necessary license or authority to solicit investments from the public or to issue securities as defined under the Securities Regulation Code (SRC).

HEDGE BIT TRADING INC Overview

Similarly, HEDGE BIT TRADING INC., reportedly led by MYLEEN VILLANUEVA, has been found to lure the public into investing with promises of high returns. Advertised on social media, the scheme offers a guaranteed return ranging from 18% to 144% in just two months for a minimum investment of Five Hundred Pesos. Additionally, it promises an extra 20% earnings from the investments of recruited individuals.

The SEC has identified that the investment offering by HEDGE BIT TRADING INC. violates several sections of the Securities Regulation Code and the Financial Product and Services Consumer Protection Act. Like ZTOCK, HEDGE BIT TRADING INC. is not registered and lacks the necessary authority to solicit investments or issue securities.

The Dangers of Ponzi Schemes

The investment scheme employed by HEDGE BIT TRADING INC. has been identified as having characteristics of a “Ponzi Scheme.” In such schemes, returns to earlier investors are paid using the capital from new investors, creating an unsustainable cycle that heavily favors early participants. The SEC emphasizes that such schemes are fraudulent and not registrable securities.

Legal Implications and Penalties

The SEC warns that involvement in these unauthorized activities can lead to severe legal consequences. Individuals acting as salesmen, brokers, dealers, or agents for these entities may face criminal charges with penalties including fines of up to Five Million Pesos (Php5,000,000.00) imprisonment of up to twenty-one years, or both.

Public Advisory

The public is advised not to invest or stop investing in any unregistered securities offered by ZTOCK/WETRADE TECHNOLOGIES PTE LTD. and HEDGE BIT TRADING INC. The Commission urges vigilance and caution in dealing with individuals or groups soliciting investments for these entities.

ZTOCK/WETRADE TECHNOLOGIES PTE LTD

HEDGE BIT TRADING INC.

Reporting and Cooperation

The SEC calls upon anyone with knowledge or information about the business transactions of these entities to come forward and assist in the investigation. The names of those involved will be reported to the Bureau of Internal Revenue for appropriate action.

Bottom Line

The warning issued by the SEC against ZTOCK and HEDGE BIT TRADING INC. serves as a crucial reminder of the risks associated with unregistered securities. It underscores the importance of verifying the legitimacy of investment opportunities and the entities behind them. The public must remain vigilant and informed to safeguard their hard-earned money against such unauthorized and potentially fraudulent investment schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

Rising WhatsApp Scams Highlight Need for Stronger User Protections

UK consumers lose £2,437 on average to WhatsApp scams. Revolut demands stricter verification and AI monitoring to combat rising fraud on Meta platforms.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator