简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

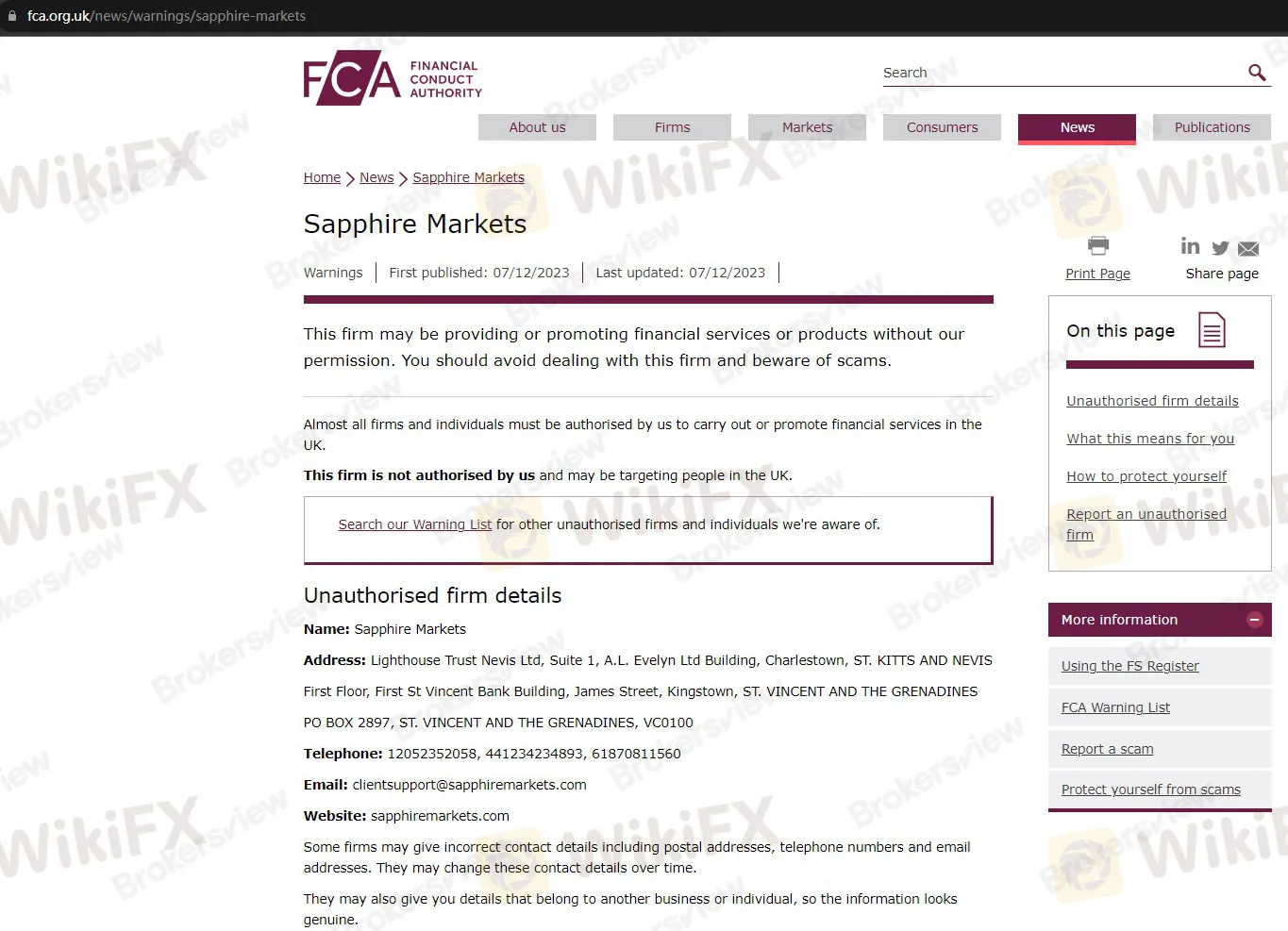

FCA Warns an Unauthorized Broker Named 'Sapphire Markets'

Abstract:On December 7, the UK's Financial Conduct Authority (FCA) regulator warned against an unauthorized broker called Sapphire Markets, reminding the public to be aware of financial safety.

On December 7, the UK's Financial Conduct Authority (FCA) regulator warned against an unauthorized broker called Sapphire Markets, reminding the public to be aware of financial safety.

Sapphire Markets operats a website to promote financial services, including currency trading services. According to the website, it purportedly offers various financial instruments such as foreign exchange, indices, metals, oil, and cryptocurrencies. This company also claims to offer investors fixed spreads and competitive commission rates.

From the bottom of its homepage, we find that this broker claims to be a company registered in St. Kitts and Nevis, an island nation located in the Caribbean. Besides, this company provides visitors with three contact numbers attributed to the United States, the United Kingdom, and Australia.

Other than that, we could not find any valid regulatory information.

Please note that business registration is not the same as financial authorization. Not all registered businesses are qualified to offer financial products and services. Only entities and individuals authorized by financial regulators can legally offer financial services, with the types of offerings limited by strict regulations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

SEC Ends Crypto.com Probe, No Action Taken by Regulator

The SEC has closed its investigation into Crypto.com with no action taken. Crypto.com celebrates regulatory clarity and renewed momentum for the crypto industry.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Broker Comparison: FXTM vs XM

Currency Calculator