简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Jetvix A Reliable Forex Broker?

Abstract:Is Jetvix a Forex scam? The unregulated status of SVGFSA and the lack of specific forex regulation cast doubt on its trustworthiness. Are traders at risk?

Understanding Jetvix in the World of Forex Trading

When it comes to the world of Forex trading, picking the right broker is crucial. A question that often comes up among traders is: Is Jetvix a dependable choice? This review delves deep into Jetvix's operations, focusing on its regulatory status and legitimacy, especially in the context of Saint Vincent and the Grenadines' laws on regulating Forex brokers.

What Is Jetvix?

Jetvix operates under Jet Corp LLC, headquartered in Ginger Village, Belmont, Kingstown, St. Vincent and the Grenadines. It boasts over 140 trading assets, aiming to cater to a wide range of traders. But, the big question is about its reliability.

Regulatory Landscape in Saint Vincent and the Grenadines

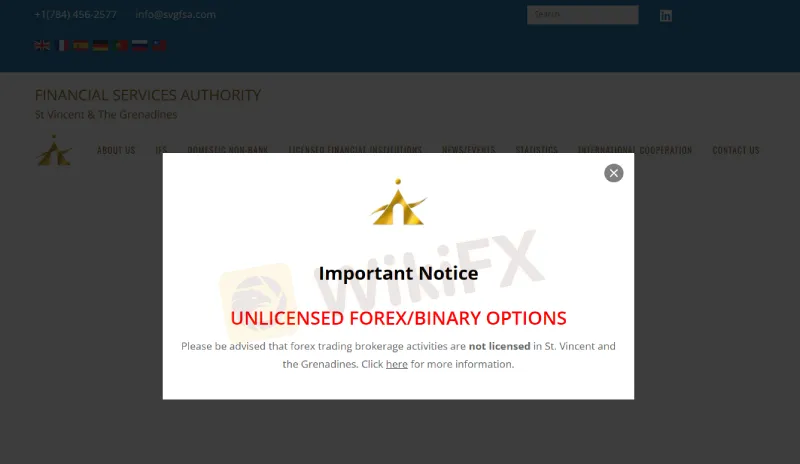

Understanding the regulatory environment is key. In Saint Vincent and the Grenadines, Forex brokers fall under a unique regulatory framework. Although Jetvix, as part of Jet Corp LLC, is a registered entity in the SVGFSA, this doesn't automatically translate to being a regulated Forex broker. According to a 2021 announcement, Saint Vincent and the Grenadines do not specifically regulate financial trading businesses, including Forex, binary options, and cryptocurrency trading.

Limited Liability Companies (LLCs) and Forex Trading

In Saint Vincent and the Grenadines, LLCs like Jet Corp LLC can be set up quickly (within 24 hours) and are allowed to conduct legal business activities. They need to have a Registered Agent in SVG and declare the nature of their intended business. However, being an LLC doesn't grant them the license to operate a regulated Forex trading business.

Is Jetvix Trustworthy or Not?

The big dilemma: can Jetvix be trusted? The answer isn't straightforward. While it's a legally registered company, its unregulated status in the realm of Forex trading raises questions. This means that while they can conduct other financial businesses, they aren't authorized for Forex trading under SVGFSA law. This gap in regulation may concern traders looking for a secure and regulated trading environment.

Conclusion: Making an Informed Decision

Choosing a Forex broker is a significant decision. While Jetvix operates legally as an LLC, its lack of specific regulation in Forex trading under SVG law is a crucial factor to consider. Traders should weigh the importance of regulatory oversight in their decision-making process and consider the potential risks associated with trading with an unregulated broker. Always remember, being informed is your first defense against potential scams in the complex world of Forex trading.

To know more about Jetvix and make an informed decision, click the following CTA: https://www.wikifx.com/en/dealer/3143950073.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

SEC Ends Crypto.com Probe, No Action Taken by Regulator

The SEC has closed its investigation into Crypto.com with no action taken. Crypto.com celebrates regulatory clarity and renewed momentum for the crypto industry.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

Gold Surges to New Highs – Is It Time to Buy?

Recently, gold prices have once again set new records, surpassing $3,077 per ounce and continuing a four-week winning streak. Is It the Right Time to Invest?

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Currency Calculator