简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Tape Reading: What It Is, Strategies, Potentials and Challenges

Abstract:Tape reading is an old stock trading technique that involves analyzing the "tape," which was originally a telegraph ticker tape used to transmit stock price information in real time.

What Is Tape Reading?

Tape reading is an old stock trading technique that involves analyzing the “tape,” which was originally a telegraph ticker tape used to transmit stock price information in real time. Historically, traders would watch the ticker tape to discern market trends, price action, and volumes as they happened, making trading decisions based on the flow and velocity of orders. The term has evolved over time and now refers to the practice of observing and interpreting real-time data such as price and volume, but through modern electronic trading platforms rather than physical ticker tape.

Tape reading involves a detailed analysis of how trades are executed and how their prices move to predict short-term market direction. It is a skill that emphasizes understanding market sentiment, supply and demand dynamics, and identifying potential price movements before they become obvious to the market at large. Tape readers look for patterns, such as large buy or sell orders, to gauge the strength or weakness of a stock and the likely direction of its next move.

Despite its name, modern tape reading does not involve a physical tape but rather focuses on Level II market data, time and sales data, and other real-time indicators that provide insights into the market's immediate direction. Instead, this method requires a high level of skill, focus, and the ability to make quick decisions, as it relies on subtle cues within the flow of market data. Tape reading is less about technical indicators and more about intuition, experience, and the ability to read the underlying market psychology and actions of large institutional traders.

History of Tape Reading

Tape reading originated in the late 19th century with the invention of the stock ticker by Edward A. Calahan in 1867. This device printed stock prices on paper tape in almost real-time, revolutionizing trading by making market information widely accessible. Tape readers emerged as traders who specialized in interpreting this flow of data to predict market movements, relying on keen observation and quick decision-making without modern analytical tools.

Legendary traders like Jesse Livermore exemplified the art of tape reading, using it to build and lose fortunes by gauging market sentiment and predicting price movements based on the volume and pace of price changes. As the financial markets evolved and electronic trading replaced physical tickers, tape reading adapted into modern order flow analysis. Today, it involves analyzing electronic data on order flows and market depth, maintaining its core aim of anticipating market moves by understanding the behavior of other participants. This practice underscores the enduring relevance of tape reading principles in assessing market dynamics, despite technological advancements.

| Period | Technology | Key Features | Impact on Trading |

| Late 19th Century | Stock Ticker | Introduction of telegraph machine that prints stock prices on tape. | Enabled traders to follow stock prices in almost real-time. |

| Early 20th Century | Stock Ticker (Enhanced) | Widespread use of ticker; emergence of tape readers like Jesse Livermore. | Specialized traders used tape to gauge market sentiment and predict movements. |

| Mid 20th Century | Early Computers & Electronic Trading | Transition to electronic data processing, reducing reliance on physical tape. | Beginnings of computerized trading, changing the way market data was analyzed. |

| Late 20th Century onwards | Advanced Electronic Trading Platforms | Use of Level II quotes, time and sales data for modern tape reading (order flow analysis). | Traders can analyze market depth and order flow with sophisticated tools, enhancing decision-making. |

What Does Tape Reading Involve?

Tape reading's efficacy lies in its focus on volume and price action. High volume signals strong interest in a stock, while price action indicates the direction of this interest. Together, these elements offer a real-time snapshot of market sentiment, allowing traders to anticipate moves before they fully manifest.

Let's consider this example:

The stock, Apple Inc. (AAPL), has been steadily increasing in price throughout the morning. Around midday, you notice a sudden spike in trading volume without a significant change in the stock price. This is a critical moment for a tape reader. The high volume indicates a strong interest in AAPL, but the stable price suggests a tug-of-war between buyers and sellers.

Now, as a tape reader, you're closely watching for the next sign. Suddenly, there's a breakout: the stock price begins to climb rapidly on continued high volume. This pattern suggests that buyers are winning the battle, willing to pay higher prices to secure shares, indicating a strong bullish sentiment.

Based on this analysis, a tape reader might interpret these signals as the right moment to buy AAPL, expecting the upward trend to continue as more traders recognize the bullish sentiment and jump in, pushing the price even higher. This decision is based on real-time observations of price and volume dynamics, showcasing the essence of tape reading in capturing the momentum before the majority of the market reacts.

Tape Reading in Modern Trading

In modern trading, tape reading plays a crucial role by enabling traders to interpret real-time market data beyond basic price and volume metrics. This technique focuses on the nuanced analysis of order flow and transaction speeds, offering insights into the immediate sentiment and momentum within the market. By assessing the strength behind price movements and identifying patterns in buying or selling pressure, tape readers can make informed predictions about future price directions. This practice is particularly valuable in fast-moving markets, where understanding the underlying dynamics of supply and demand at a granular level can provide a competitive edge. Tape reading's relevance has evolved with technology, now incorporating sophisticated electronic data analysis, yet its core principle remains: deciphering the story told by the market's immediate actions to anticipate short-term movements. This approach is indispensable for traders seeking to leverage market psychology and liquidity signals to execute timely and strategic trades.

Significance in Electronic Markets

The advent of electronic trading platforms has led to an exponential increase in market data velocity and volume. In this environment, tape reading offers traders a means to cut through the noise, identifying actionable information amid the chaos. This capability is crucial in markets where microseconds can mean the difference between profit and loss.

Tape Reading in Algorithmic Trading

As algorithmic trading strategies become increasingly prevalent, tape reading has adapted, offering insights that can enhance these strategies. Algorithms, capable of processing vast quantities of data with precision, benefit from the depth of analysis tape reading provides. This synergy between human insight and algorithmic efficiency is shaping the future of trading.

Tape Reading in Various Markets

Tape reading is a versatile technique that can be applied across a wide range of markets, from stocks and forex to futures and cryptocurrencies. Each market presents unique challenges and opportunities, requiring tape readers to adapt their strategies accordingly.

Stock Market

In the stock market, tape reading involves analyzing transaction volumes and price movements to gauge supply and demand. Traders look for patterns in the data that indicate potential price movements, using this insight to predict short-term market direction and make buy or sell decisions. This requires a keen understanding of how different stocks behave and how they respond to market-wide and sector-specific news.

Forex Market

The foreign exchange (Forex) market, with its vast volume and 24-hour trading, offers a unique environment for tape reading. Traders monitor the flow of buying and selling orders in real-time, assessing currency pair movements to identify trends or reversals. Given the impact of geopolitical events, economic indicators, and central bank policies on Forex markets, tape reading here also involves a nuanced understanding of these factors.

Futures Market

Tape reading in the futures market focuses on contracts for commodities, indices, and other financial instruments, tracking how future expectations of supply and demand affect prices. Traders analyze order flows and price action to predict movements in commodities like oil, gold, or agricultural products, as well as financial futures. This market's leverage and contract expiry dates add layers of complexity to tape reading strategies.

Cryptocurrency Market

The relatively new cryptocurrency market presents a frontier for tape reading, characterized by high volatility and 24/7 trading. Crypto traders apply tape reading to spot trends and reversals in digital currencies, observing transaction volumes and price changes across different exchanges. The decentralized nature of this market and the influence of social media on trading behavior require tape readers to adapt their strategies accordingly.

Options Market

Options traders use tape reading to analyze the flow of options contracts, looking for clues about future stock movements. By observing the volume of option buys or sells and the prices at which they occur, traders can infer market sentiment towards the underlying asset. This requires an understanding of options pricing models and the Greeks.

In all these markets, the essence of tape reading remains the analysis of price action and volume to infer market direction. However, the specific strategies and data sources vary, reflecting the unique characteristics of each market. Successful tape reading in any market demands a deep understanding of that market's dynamics, a keen eye for detail, and the ability to make quick and smart decisions.

Trading Strategies for Effective Tape Reading

Effective tape reading involves a blend of observational skills, market knowledge, and strategic application. While the technique has its roots in scrutinizing the “tape” for stock prices and volumes, today's traders use advanced technologies to interpret market data in real-time across various asset classes. Here are several trading strategies that can enhance the effectiveness of tape reading:

Identifying Breakouts and Breakdowns

Tape readers closely monitor price and volume data to spot potential breakouts or breakdowns before they occur. A sudden increase in volume, accompanied by a price movement out of a consolidation range, can signal the start of a new trend. Acting on these signals promptly can allow traders to capitalize on the momentum early in its development.

Momentum Trading

This strategy involves following the direction of the market's momentum, entering trades based on signals of strong buying or selling activity. Tape readers look for high volume transactions and rapid price movements as indicators of momentum. The key here is to “ride the wave” of market sentiment, entering and exiting positions to capture the phases of strong movement before they taper off.

Scalping

Scalping is a strategy well-suited for adept tape readers, focusing on making numerous small trades to capture minor price changes. This method requires analyzing the flow of orders and executing trades quickly to profit from small price movements, often magnified by high volume. Scalpers rely on tape reading to make fast, informed decisions, capitalizing on the liquidity and volatility present at specific moments.

Level II Quotes Analysis

Level II quotes provide detailed information about the price levels of buy and sell orders, including the market depth. Tape readers use this data to assess the strength of support and resistance levels, gauging the balance between supply and demand. Analyzing these quotes helps in identifying potential price movement directions based on the accumulation of orders at certain price points.

Order Flow Analysis

Order flow analysis involves scrutinizing the buying and selling pressure as it happens, providing insights into potential price movements. Tape readers look for imbalances in order flow, indicative of a shift in market sentiment. This strategy requires interpreting the nuances of trade sizes, the pace of transactions, and the overall volume to predict short-term price movements accurately.

Sentiment Analysis

Understanding the sentiment behind the movements can give tape readers an edge. This involves correlating real-time data with market news, social media trends, and economic indicators to gauge the mood of the market. Sentiment analysis can confirm the signals seen on the tape, providing a more comprehensive view of potential market directions.

Effective tape reading is not just about observing data; it's about interpreting it in the context of the broader market. Combining these strategies with a thorough understanding of market mechanics and individual asset characteristics can significantly enhance trading decisions. As with any trading method, risk management is crucial—tape reading should be used in conjunction with stop-loss orders and a clear plan for each trade to mitigate potential losses.

Tools and Technology for Tape Readers

For modern tape readers, a wide array of tools and technology has replaced the traditional ticker tape, enabling them to analyze market data with greater speed, efficiency, and depth. These tools not only provide real-time data but also offer analytical capabilities to dissect and interpret market movements intricately. Here are key tools and examples of technology that are indispensable for contemporary tape reading:

Direct Market Access (DMA) Platforms

DMA platforms offer traders direct access to the stock exchanges, bypassing traditional brokers. This access allows for faster execution of trades, which is crucial for strategies that rely on quick reactions to market movements. For example, Interactive Brokers provides a robust DMA platform that allows for real-time order execution and access to market data across multiple exchanges.

Level II Quotes Systems

Level II systems display the full order book for a security, showing all buy and sell orders in the market. This gives tape readers insight into market depth and the potential direction of price movements based on the volume and price of orders at different levels. Thinkorswim by TD Ameritrade (now Charles Schwsls) offers detailed Level II quotes, providing visibility into the market depth for stocks and options.

Time and Sales Data Feeds

Time and sales streams provide a real-time list of all transactions for a particular stock, including price, volume, and time. This information is critical for understanding the flow of orders and identifying patterns in market activity.

Order Flow Analysis Software

Software that specializes in order flow analysis can help traders visualize the buying and selling pressure in the market, identifying potential reversals or continuations in price trends.

Charting and Technical Analysis Software

While tape reading focuses on the raw data of price and volume, charting software can complement this analysis by providing a visual representation of market trends and patterns. For instance, TradingView offers advanced charting tools along with real-time data and technical analysis features, enabling traders to overlay their tape reading insights with technical indicators and patterns.

Customizable Trading Algorithms

For traders who wish to automate part of their strategy, customizable trading algorithms can execute trades based on specific criteria related to price, volume, and time—factors that are key to tape reading.

High-Speed Internet and Multiple Monitors

A high-speed internet connection is essential for receiving real-time data without lag, and using multiple monitors allows traders to set up a comprehensive trading station where they can monitor various data streams and execute trades simultaneously.

These tools and technologies enhance the ability of tape readers to analyze the market efficiently and make quick, informed trading decisions. It's important to note that the effectiveness of these tools can vary based on the trader's strategy, market conditions, and the specific assets being traded.

How Tape Reading Differs from Technical and Fundamental Analysis

Unlike technical analysis, which leans on historical data to forecast future price movements, tape reading thrives on the immediacy of live data. It is less concerned with patterns of the past and more with the here and now. Similarly, it diverges from fundamental analysis by focusing on market dynamics rather than company fundamentals. This real-time focus grants tape readers agility, allowing them to pivot swiftly in response to emerging trends.

Potentials and Challenges in Tape Reading

Tape reading, the analysis of price and volume data on charts, holds a unique position in the trading world. Here's a look at its potential benefits and inherent challenges:

Potentials of Tape Reading:

Enhanced Market Insight: Tape reading allows for a real-time interpretation of market sentiment. By deciphering the interplay between price movements and volume fluctuations, traders can gauge buying and selling pressure, potentially identifying entry and exit points.

Opportunities for Short-Term Gains: Tape reading is particularly well-suited to short-term trading strategies, such as day trading or scalping, where traders can capitalize on small, rapid price movements.

Improved Order Timing: Tape reading allows for a more nuanced understanding of order flow. Traders can potentially react to imbalances between supply and demand quicker, potentially leading to better trade timing and execution.

Developing Intuition: Through experience, tape reading can cultivate a trader's intuition. By recognizing recurring price-volume patterns, traders can potentially anticipate future market movements with greater confidence.

Challenges of Tape Reading:

Subjectivity: Interpretations of price and volume data can be subjective. Without proper experience and discipline, tape reading can lead to misreading market signals and costly trading decisions.

High Skill Requirement: Effective tape reading requires a significant amount of skill and experience. Traders must be able to interpret complex data quickly and accurately, which typically comes with time and practice.

Market Noise: The vast amount of data generated in modern electronic markets can be overwhelming, making it challenging to distinguish meaningful signals from market “noise.”

Evolving Market Dynamics: Tape reading techniques that worked in the past may not be as effective in today's electronically dominated markets. Traders need to adapt their approach to stay relevant.

Conclusion

In conclude, tape reading is a timeless trading technique that offers deep insights into market dynamics through the analysis of real-time price and volume data. Despite its potential for significant gains, mastering it requires considerable skill, experience, and access to advanced technology. As trading evolves with technological advancements, tape reading remains a challenging yet rewarding strategy for those committed to understanding the nuances of market behavior.

FAQs

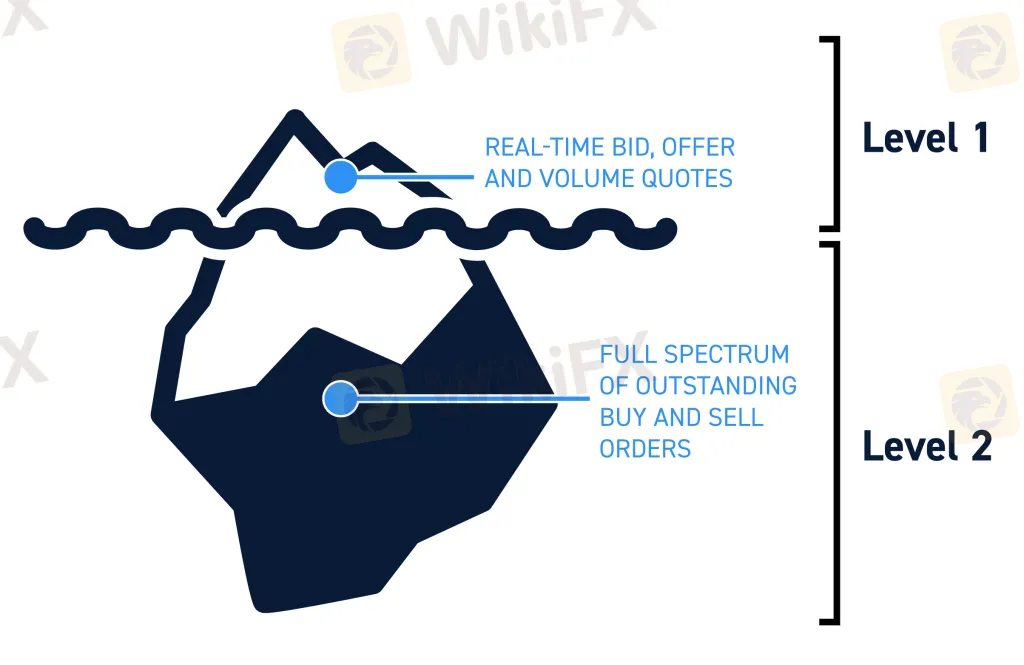

What is Level 2 tape reading?

Level 2 tape reading takes analysis a step beyond traditional tape reading by incorporating the order book, revealing the depth of the market, displaying the limit orders (bids and asks) at various price levels along with their respective share sizes. By analyzing this data, traders can gauge potential buying and selling pressure, assess liquidity, and potentially identify opportunities for entering or exiting trades with greater precision.

What is tape reading volume at price?

In tape reading, volume at price refers to the specific amount of shares traded at a particular price point. By analyzing these spikes in volume at specific price levels, traders can potentially identify areas of support and resistance. High volume at a support level might suggest strong buying interest, while high volume at a resistance level could indicate selling pressure that may impede further price increases.

How important is tape reading?

The importance of tape reading can be debated. In today's electronic markets, some consider it a niche skill. However, for certain trading styles, particularly short-term and day trading, tape reading offers a valuable real-time pulse on market sentiment. By deciphering price and volume fluctuations, skilled practitioners can potentially gain an edge in order timing and trade execution. However, its effectiveness hinges on experience and discipline to avoid misinterpretations.

Do I need Level 2 to day trade?

Level 2 data isn't mandatory for day trading, but it can be a significant advantage. It provides a deeper look into market sentiment by revealing order book details. This can help you gauge buying and selling pressure, potentially leading to better entry and exit timing. However, success in day trading relies more on a robust strategy, sound risk management, and experience than solely on Level 2 access.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

Rising WhatsApp Scams Highlight Need for Stronger User Protections

UK consumers lose £2,437 on average to WhatsApp scams. Revolut demands stricter verification and AI monitoring to combat rising fraud on Meta platforms.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator