简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Forex Rights Protection Day:Top 5 Most Complained Brokers

Abstract:As WikiFX Forex Rights Protection Day concludes, the staggering numbers unveil a stark reality in the world of forex trading.

As WikiFX Forex Rights Protection Day concludes, the staggering numbers unveil a stark reality in the world of forex trading. With over 2,000 evidence chains collected and a total recovery amounting to $764,365, the campaign sheds light on the plight of victims from more than 80 countries ensnared by fraudulent practices. Among the plethora of exposed black platforms, the voice of over 200,000 traders resonates, seeking justice and awareness.

As WikiFX Forex Rights Protection Day concludes, the staggering numbers unveil a stark reality in the world of forex trading. With over 2,000 evidence chains collected and a total recovery amounting to $764,365, the campaign sheds light on the plight of victims from more than 80 countries ensnared by fraudulent practices. Among the plethora of exposed black platforms, the voice of over 200,000 traders resonates, seeking justice and awareness.

To empower traders with knowledge and vigilance, WikiFX has meticulously curated a list of the top five most complained brokers from the campaign. These brokers, adorned with deceptive facades, have left a trail of disillusionment and financial loss in their wake. Let us delve into their disheartening profiles:

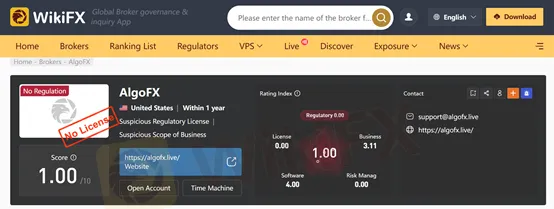

Top 5: AlgoFX

WikiFX Rating: 1/10

Number of Complaints: 1

Money Involved: $6,510

AlgoFX, adorned with a dismal rating of 1/10, stands as a testament to deceit. Despite a single complaint, the involvement of $6,510 reflects the magnitude of damage inflicted upon unsuspecting traders.

Top 4: Paxful Financials

WikiFX Rating: 1.36/10

Number of Complaints: 2

Money Involved: $167

Paxful Financials, with a meager rating of 1.36/10, exhibits a lack of integrity mirrored by two complaints and a modest sum of $167 implicated in dubious dealings.

Top 3: MOGAFX

WikiFX Rating: 5.87/10

Number of Complaints: 2

Money Involved: $258

Despite a comparatively higher rating of 5.87/10, MOGAFX's inclusion in this list underscores the prevalence of malpractice. With two complaints and $258 entangled in fraudulent activities, vigilance remains paramount.

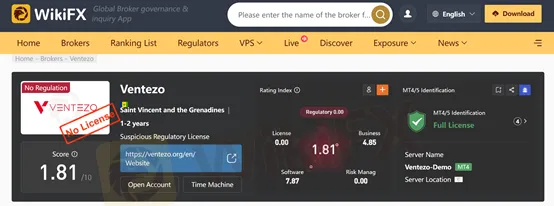

Top 2: Ventezo

WikiFX Rating: 1.81/10

Number of Complaints: 4

Money Involved: $21,180

Ventezo's dismal rating of 1.81/10 echoes the harrowing experiences of four traders, grappling with losses totaling $21,180. The prevalence of complaints serves as a cautionary tale against succumbing to deceptive allure.

Top 1: FXOpulence

WikiFX Rating: 1.86/10

Number of Complaints: 8

Money Involved: $7,634

Earning the ignominious title of the most complained broker, FXOpulence's rating of 1.86/10 underscores its egregious practices. With eight grievances and $7,634 embroiled in deceit, the magnitude of its deception cannot be understated.

Conclusion

As the curtains draw on WikiFX Forex Rights Protection Day, the testimonies of victims reverberate as a clarion call for awareness and diligence. Let these five brokers serve as cautionary tales, urging traders to exercise prudence in navigating the treacherous waters of forex trading. In the pursuit of financial prosperity, let not ignorance be our downfall.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

IG Group acquires Freetrade for £160M, boosting its UK investment offerings. Freetrade to operate independently, with plans for growth and innovation.

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

In its latest report for March 2025, WikiFX has released a cautionary ranking of brokers that have raised significant red flags within the trading community. These five platforms, marked by alarmingly low scores, serve as stark reminders of the importance of due diligence when selecting a broker. Below is an in-depth look at each one.

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator