简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | CA Markets: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of CA Markets, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2015 and headquartered in Sydney, CA Markets Limited, operating as CA Markets Global (also known as CA Markets), is an online brokerage specializing in the trading of exchange CFDs.

CA Markets offers a diverse range of over 1000 tradable assets, including currency pairs, agricultural contracts, cryptocurrencies, commodities, government bonds, interest-rate instruments, and global indices.

In addition, CA Markets provides a social trading service called CA Markets Copy Trading, which enables money managers and traders to enhance efficiency, increase profitability, and generate passive income through copy trading.

CA Markets also supports Algo Trading via the renowned MetaTrader 5 trading platform.

CA Markets offers several partnership programs, including an Introducing Broker (IB) program with a competitive rebate structure and high trading standards, an affiliate program with scheduled and attractive payouts for driving traffic, and a white label program designed for individuals or companies aiming to establish their own Forex brokerage. Additionally, CA Markets provides advanced technology to seamlessly connect businesses with a wide range of liquidity providers, offering tailored solutions to meet specific business needs.

It is important to note that, at present, CA Markets does not offer its services to residents of Vanuatu, the USA, or countries listed as NCCT by the FATF (as of 2024, these include Iran, North Korea, and Myanmar).

Types of Accounts:

CA Markets offers three account options: the Standard Account, the Pro Account and the Ace Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

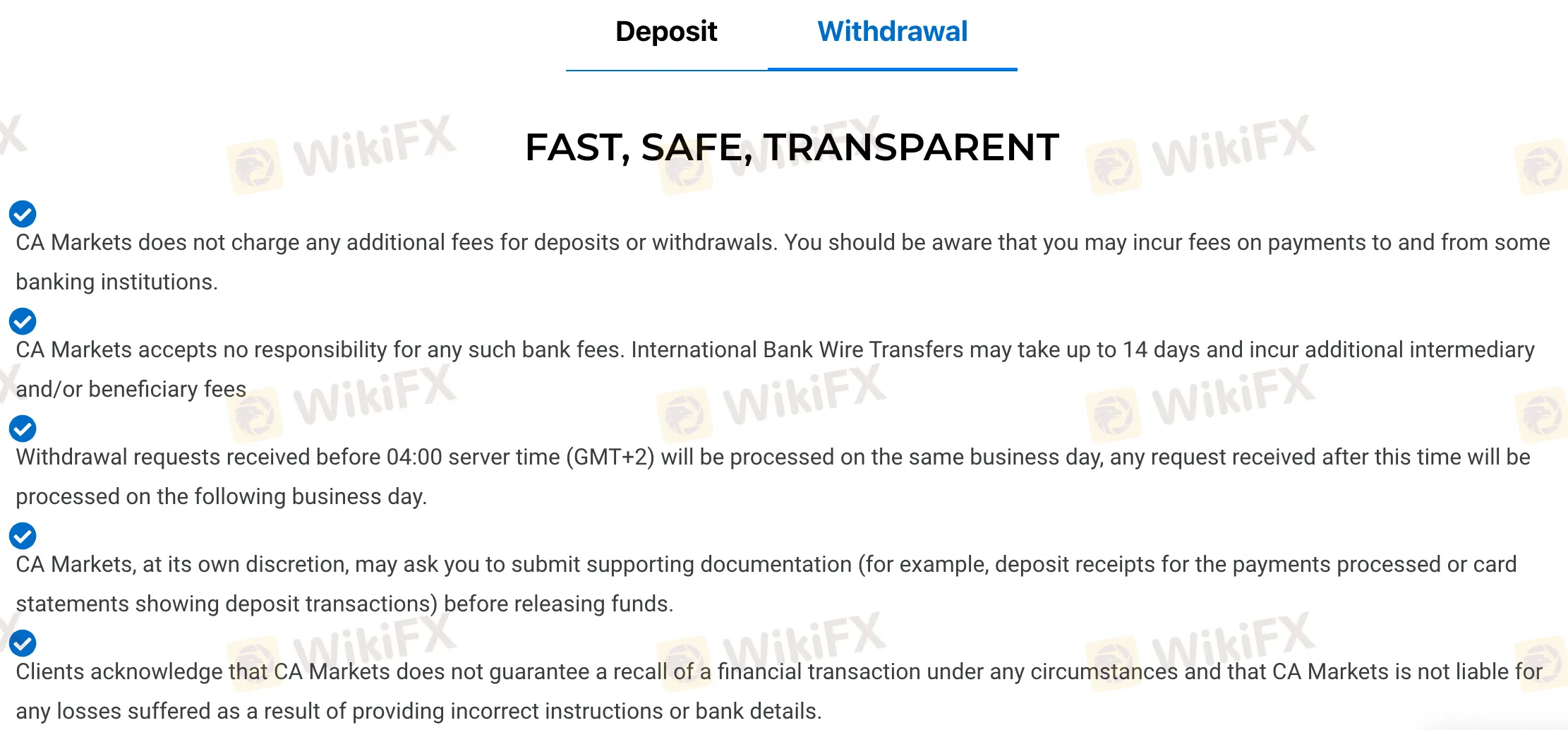

CA Markets offers a range of deposit methods, including UnionPay, ChipPay, 9Pay, Help2Pay, Crypto Wallet, bank transfers, and additional methods. While CA Markets asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client. In conjunction with this, CA Markets claims that it will waive fees charged by the merchant service provider if clients meet the minimum trading requirement of 0.2% of the deposit amount in round lots. Otherwise, a funding fee of 3% will be charged during client withdrawals.

Trading Platforms:

CA Markets only offers the MetaTrader 5 (MT5) as its trading platform. The MT5 platform, available on PC, mobile, and web, is known for its technological sophistication, providing access to a depth of market and various advanced solutions.

MT5 features technical analysis tools, customizable charts, automated trading through Expert Advisors (EAs), and a wide array of indicators to assist traders in making decisions. Its multi-asset capabilities and execution speed make it suitable for both novice and experienced traders. MT5s versatility, user-friendly interface, and access to real-time market data provide a platform for engaging in online trading across multiple financial instruments.

Research and Education:

No research or educational resources could be found on CA Markets official website. Compared to its industry peers, CA Markets is lacking in this department, as it is common for brokers to provide an extensive array of free resources for the benefit of their trading clients.

Customer Service:

CA Markets has four offices located in Sydney (Australia), Melbourne (Australia), Toronto (Canada), and Auckland (New Zealand). Clients can contact the broker at any of these offices using the contact information provided below.

Additionally, trading clients can contact the broker through its live chat service on its official website or via email at info@camarkets.com. Notably, CA Markets' website is currently available only in English, suggesting that its customer service support may be limited to English-savvy clients.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned CA Markets a WikiScore of 5.23 out of 10.

Upon examining CA Markets' licenses, WikiFX found that the broker is regulated by the Vanuatu Financial Services Commission (VFSC) with license number 700714, classifying it as an offshore-regulated broker.

However, the broker exceeds the business scope regulated by New Zealand's Financial Service Providers Register (FSPR) with the non-Forex license number 1002179, rendering this license invalid.

Additionally, CA Markets' license number 523351, which is purported to be issued by the Australian Securities and Investments Commission (ASIC), is suspected to be a clone.

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator