简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

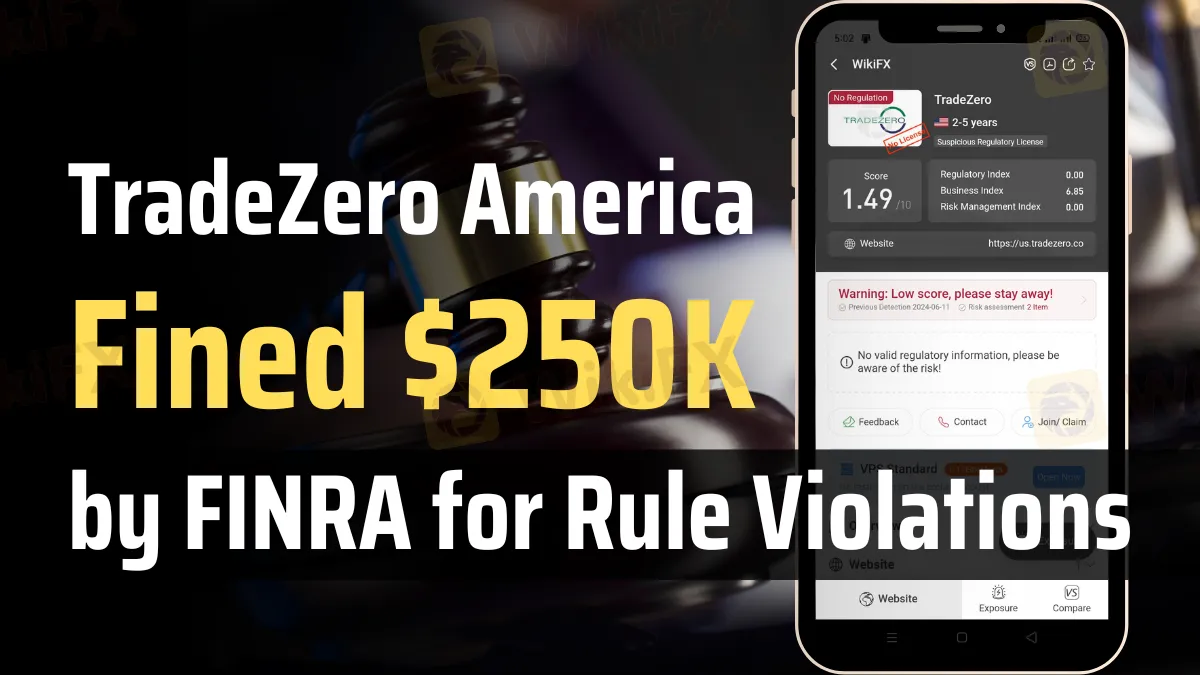

TradeZero America Fined $250K by FINRA for Rule Violations

Abstract:TradeZero America faces a $250K fine from FINRA for improper social media promotions, inadequate supervision, and misleading privacy notices.

The Financial Industry Regulatory Authority (FINRA) fined TradeZero America, Inc. $250,000 for many regulatory violations. Infractions involving the company's use of social media influencers to market its services occurred between July 2020 and October 2022.

At the time, TradeZero America was paying popular people on social media to promote their business. Nevertheless, these advertisements often included inflated claims and lacked objectivity. Not following FINRA Rules 2210(d)(1) and 2010 brought attention to major supervision issues at the company.

Worse still, neither did TradeZero America evaluate nor save the influencers' films prior to their online release, and neither did it keep tabs on nor save any posts made in participatory online forums. This oversight violated the firm's responsibilities as outlined in Section 17(a) of the Securities Exchange Act of 1934, Exchange Act Rule 17a-4(b)(4), and many FINRA rules, such as 2210(b), 4511, 3110, and 2010.

In addition, tradeZero America sent out misleading privacy alerts to clients in 2020 and 2022 about the use of nonpublic personal information. The Securities Exchange Act of 1934's Regulation S-P, Rule 4 (17 CFR § 248.4) and FINRA Rule 2010 were also violated by this misstatement.

These infractions occurred because the company failed to properly design and enforce supervisory procedures for retail communications. These compliance failures were so serious that FINRA censured the company and fined them $250,000.

Without accepting or rejecting the conclusions, TradeZero America has agreed to the censure and penalties as components of the settlement. This resolution highlights the significance of strict regulation and compliance in the financial services industry, especially with regard to contemporary advertising platforms such as social media.

The regulatory body's decision to take action against TradeZero America should serve as a strong warning to other companies about the significance of following the laws in order to keep public communications fair and open.

About FINRA

A non-governmental agency known as the Financial Industry Regulatory Authority (FINRA) is responsible for overseeing broker-dealers in the United States. Under the auspices of the SEC, FINRA has been in operation since 2007 with the goals of safeguarding investors and maintaining honest markets. Registration and education of industry participants, compliance examinations of businesses, enforcement of rules and securities laws, and monitoring of trading activity are FINRA's primary tasks. The goal of FINRA's rule enforcement and transparency initiatives is to increase public confidence in the financial markets. Investors and brokers may take use of the organization's arbitration and mediation services to settle issues.

You may also access the latest news in the financial market here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

Rising WhatsApp Scams Highlight Need for Stronger User Protections

UK consumers lose £2,437 on average to WhatsApp scams. Revolut demands stricter verification and AI monitoring to combat rising fraud on Meta platforms.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator