简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

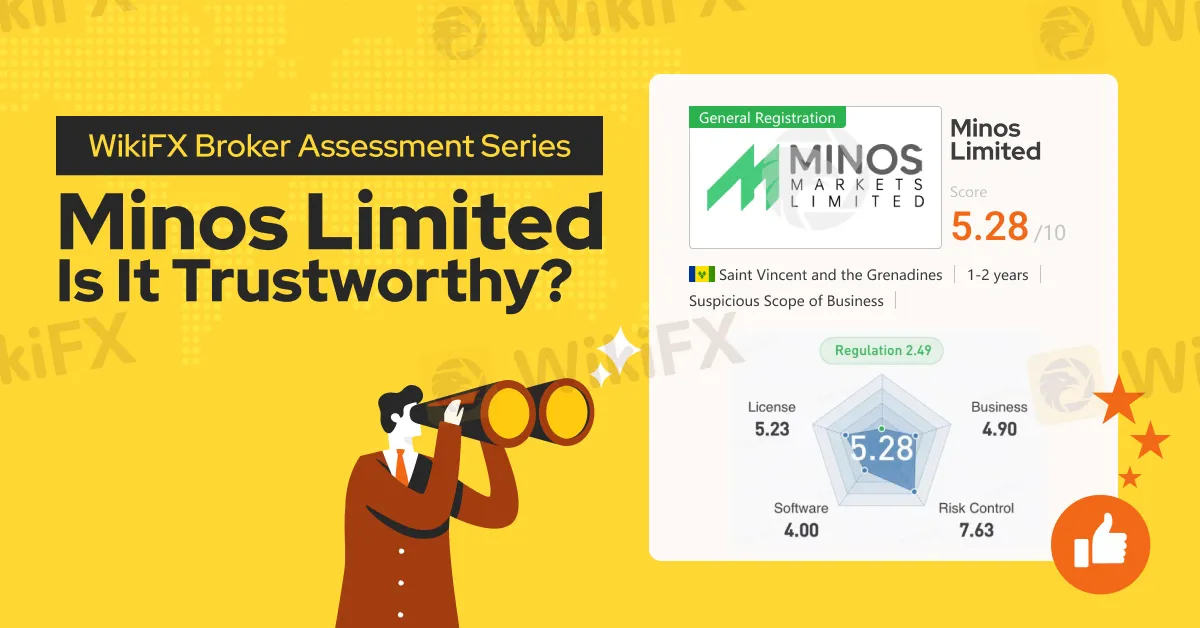

WikiFX Broker Assessment Series | Minos Limited: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Minos Limited, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2015, Minos Limited operates with a global presence through its main office located at Suites 305, Griffith Corporate Centre, Kingstown, Saint Vincent and the Grenadines, and its branch office on the 116th floor of Burj Khalifa, Corporate Suites, Downtown Dubai, United Arab Emirates.

Minos Limited offers a range of trading instruments, including commodities, grains, precious metals, and energies, but does not provide currency pairs. Investors can trade agricultural products, energy resources, and metals, with opportunities to speculate on price movements influenced by market factors and global events.

Types of Accounts:

Minos Limited offers three account options: the Standard Account, the Premium Account, and the Platinum Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Minos Limited offers a range of payment options, including bank transfers, 9Pay, cryptocurrency (Tether), 9Pay, Boost, and additional methods.

The specifications for each deposit and withdrawal method can be referred to from the images below:

Trading Platforms:

Minos Limited offers a streamlined trading experience through its exclusive use of the cTrader platform, accessible on PC, mobile, and web. With a single cTrader ID (cTID) login, users can manage all linked accounts seamlessly, with synchronized settings across devices. The cTrader platform boasts over 55 pre-installed technical indicators, 6 chart types, and 28 timeframes, along with advanced features like Level 2 Depth of Market, no restrictions on stop/limit levels, and additional pending order types. Traders benefit from detachable and linked charts, one-click trading, advanced order protection, and customizable interfaces. Additional tools include a news feed, integrated economic calendar, market sentiment, and custom cBots and indicators, providing a comprehensive suite for effective trading.

Research and Education:

Minos Limited offers free educational resources in text format to support traders at different levels. These resources are available in the form of both texts and videos. Meanwhile, Minos Limited also provides several trading tool to improve trading efficiency, such as pip calculator, profit calculator, economic calendar, market news and more.

Customer Service:

Minos Limited provides 24/5 customer service support in several languages, including English, Chinese, Vietnamese, Malay, and Thai.

Clients can reach out to Minos Limited through email at support@minosbrokers.com Additionally, trading clients have the option to contact Minos Limited by phone at +9714 362 2222.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Minos Limited a WikiScore of 5.28 out of 10.

Upon examining Minos Limited‘s license, WikiFX found that the broker is regulated by the United States’ National Futures Association. WikiFX has also validated the legitimacy of the said license.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

President of Liberland Vít Jedlička Confirms Attendance at WikiEXPO Hong Kong 2025

Vít Jedlička, President and Founder of the Free Republic of Liberland, has confirmed his participation in WikiEXPO Hong Kong 2025, one of the most influential Fintech summits in the industry. The event will bring together global leaders, innovators, and policymakers to delve into the future convergence of technology and society.

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

The worlds of social media and decentralized finance (DeFi) have converged under a new banner—SocialFi. Short for “Social Finance,” SocialFi leverages blockchain technology to reward user engagement, giving individuals direct control over their data and interactions. While SocialFi has primarily emerged in the context of content creation and crypto communities, its principles could soon revolutionize the forex market by reshaping how traders share insights and monetize social influence.

Do This ONE Thing to Transform Your Trading Performance Forever

The story is all too familiar. You start trading with high hopes, make some quick profits, and feel like you've finally cracked the code. But then, just as fast as your gains came, they disappear. Your account balance dwindles, and soon you’re left wondering what went wrong. Worse still, fear and confusion creep in, making every new trade a stressful gamble rather than a calculated decision. If this cycle sounds familiar, you’re not alone.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator