简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

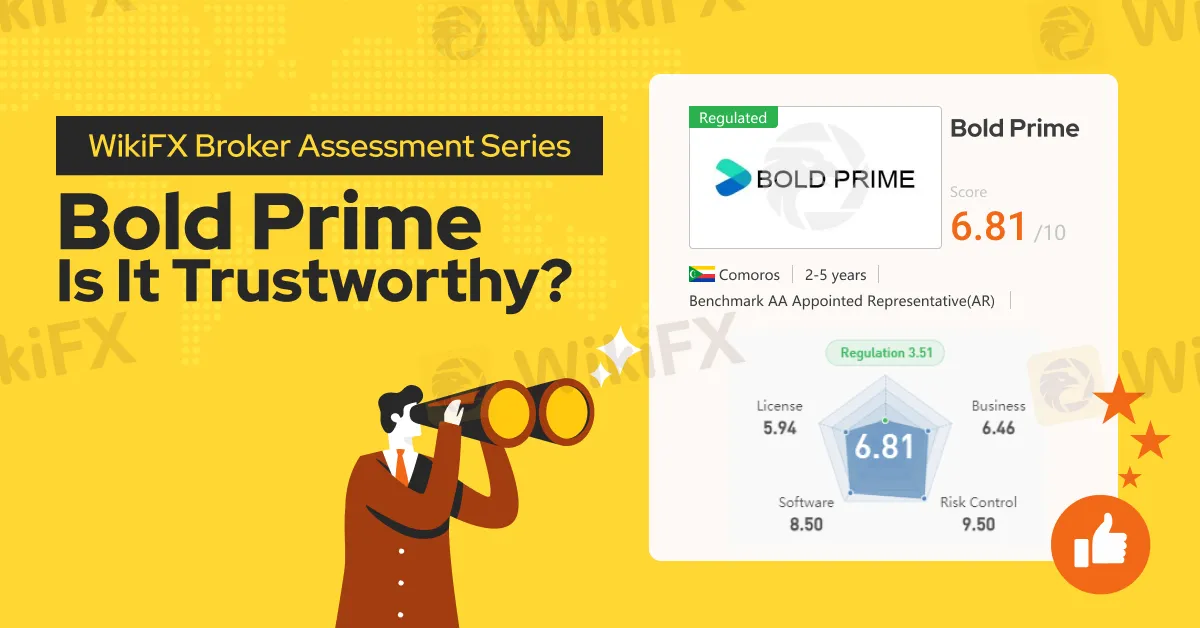

WikiFX Broker Assessment Series | Bold Prime: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Bold Prime, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2020, Bold Prime operates as an online brokerage specializing in the trading of CFDs, distinguishing itself through a commitment to offering competitive spreads as low as 0.0 pips and fast execution speeds.

Bold Prime provides a diverse range of over 27 tradeable assets, covering currency pairs, options, indices, shares, and commodities.

Additionally, Bold Prime offers a copy-trading service, enabling money managers and traders to enhance efficiency, increase profitability, and generate passive income.

Moreover, Bold Prime features an introducing broker (IB) program, allowing individuals and businesses to earn multi-tiered commissions by referring new clients to the company.

It is important to note that, at present, Bold Prime does not extend its services to the United States, Cuba, Iraq, Myanmar, North Korea, and Sudan.

Types of Accounts:

Bold Prime offers four account options, two of which are available on the MetaTrader 4 platform and two on the MetaTrader 5 platform. These are the MT4 Prime ECN Account, the MT4 Prime Standard Account, the MT5 Prime ECN Account, and the MT5 Prime Standard Account. Please refer to the attached images below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Bold Prime does not explicitly list its deposit and withdrawal methods on its official website. According to Bold Prime's live chat support, these methods can be found in the client portal after logging in.

Trading Platforms:

Bold Prime provides two trading platforms:

- The MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 offers market-leading spreads, zero commissions, leverage up to 1:1000, a minimum lot size of 0.01, flexible funding and withdrawal options, no trading restrictions, and lightning-fast order execution.

- The MetaTrader 5 (MT5) trading platform, also available on PC, mobile, and web, is renowned for its technological sophistication and provides access to a depth of market and various advanced solutions. It offers market-leading spreads, low commissions, leverage up to 1:1000, a minimum lot size of 0.01, cutting-edge technology, no trading restrictions, and access to an expanded range of CFD instruments.

Research and Education:

Bold Prime provides an educational platform called Bold Prime Trading School, which is designed to support traders at various levels of experience. The platform offers a range of resources that cover topics from basic concepts, such as Support and Resistance, to more advanced subjects like Fundamental Analysis. Each course includes a quiz to help traders assess their understanding. Additionally, completing these quizzes allows traders to earn Loyalty Points, which can be used to obtain Bold Prime merchandise. Bold Prime Trading School aims to offer practical learning opportunities for traders seeking to enhance their skills.

Customer Service:

Bold Prime's business hours are from 9:00 AM to 5:00 PM (GMT+2). They can be contacted via email at support@boldprime.com for any inquiries. Additionally, their support chat is available 24 hours a day, 7 days a week. The broker can also be reached by phone at +97145589443.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Bold Prime a WikiScore of 6.81 out of 10.

Upon examining Bold Primes license, WikiFX found that the broker is regulated by the Australian Securities and Investment Commission (ASIC). WikiFX has also validated the legitimacy of the said license.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Is IVY Markets Reliable?

IVY Markets, established in 2018, positions itself as a global brokerage offering a diverse range of trading instruments, including Forex, Commodities, Cryptocurrencies, and Stocks. The platform provides two primary account types—Standard and PRO—with a minimum deposit requirement of $50 and leverage up to 1:400.

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

Germany is set to hold a crucial general election on 23 February 2025, with voter frustration over migration emerging as a dominant issue.

ED Exposed US Warned Crypto Scam ”Bit Connect”

The Indian Enforcement Directorate (ED) recently exposed a crypto Scam from a firm called Bitconnect. During the investigation, which took place on February 11th and 15th, 2025. The authority recovered bitcoin worth approximately Rs 1,646 crore & Rs 13.50 Lakh in cash, a Lexus car, and digital devices. This investigation was conducted under the provisions of the Prevention of Money Laundering Act (PMLA) of 2002.

B2BROKER Launches PrimeXM XCore Support for Brokers

B2BROKER launches PrimeXM XCore support and maintenance services, enhancing trading efficiency for brokers with expert management and optimization.

WikiFX Broker

Latest News

Pi Network Mainnet Launch: Game-Changer or Crypto Controversy?

GlobTFX Users Report Same Issue! But Why?

Rate Cut or Not? It Depends on Trump’s Policies

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

WikiFX Community Creator Growth Camp

Effect of Tariffs on Gold and Oil Prices

Currency Calculator